The politics of oil are complicated, to say the least. There’s any number of important players, from OPEC to North American shale to sanctions. Relating to that last one, the US government has sought to impose serious restrictions upon the Iranian regime. Choking off a major piece of that country’s revenue, and source for dollars, has been a stated US goal. In May, the Trump administration formally withdrew from the...

Read More »Wasting the Middle: Obsessing Over Exits

What was the difference between Bear Stearns and Lehman Brothers? Well, for one thing Lehman’s failure wasn’t a singular event. In the heady days of September 2008, authorities working for any number of initialism agencies were busy trying to put out fires seemingly everywhere. Lehman had to compete with an AIG as well as a Wachovia, already preceded by a Fannie and a Freddie. If Lehman was the personification of...

Read More »The Relevant Word Is ‘Decline’

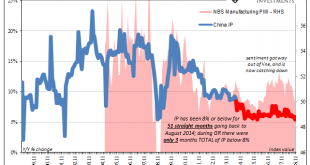

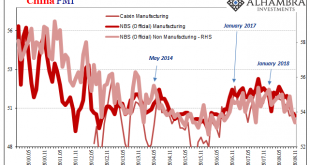

The English language headline for China’s National Bureau of Statistics’ press release on November 2018’s Big 3 was, National Economy Maintained Stable and Sound Momentum of Development in November. For those who, as noted yesterday, are wishing China’s economy bad news so as to lead to the supposed good news of a coordinated “stimulus” response this was itself a bad news/good news situation. If the Communist State...

Read More »US Banks Haven’t Behaved Like This Since 2009

If there is one thing Ben Bernanke got right, it was this. In 2009 during the worst of the worst monetary crisis in four generations, the Federal Reserve’s Chairman was asked in front of Congress if we all should be worried about zombies. Senator Bob Corker wasn’t talking about the literal undead, rather a scenario much like Japan where the financial system entered a period of sustained agony – leading to the same in...

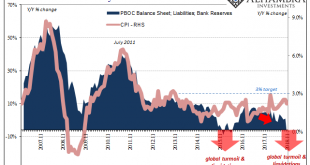

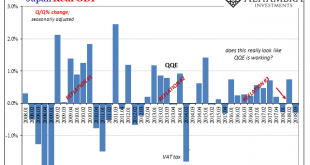

Read More »China Going Back To 2011

The enormous setback hadn’t yet been fully appreciated in March 2012 when China’s Premiere Wen Jiabao spoke to and on behalf of the country’s Communist governing State Council. Despite it having been four years since Bear Stearns had grabbed the whole world’s attention (for reasons the whole world wouldn’t fully comprehend, specifically as to why the whole world would need to care about the shadow “dollar” business of...

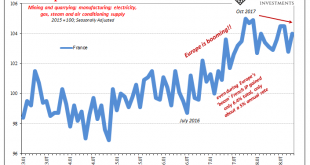

Read More »‘Paris’ Technocrats Face Another Drop

How quickly things change. Only a few days ago, a fuel tax in France was blamed for widespread rioting. Today, Emmanuel Macron’s government under siege threatens to break its fiscal budget. Having given up on gasoline and diesel, the French government now promises wage increases and tax cuts. Italy has found competition in the race to violate EU fiscal guidelines. Around the rest of Europe, the question is being asked....

Read More »Economics Is Easy When You Don’t Have To Try

The real question is why no one says anything. They can continue to make these grossly untrue, often contradictory statements without fear of having to explain themselves. Don’t even think about repercussions. Even in front of politicians ostensibly being there on behalf of the public, pedigree still matters more than results. It’s actually worse than that since all that I’m talking about means it is these guys who...

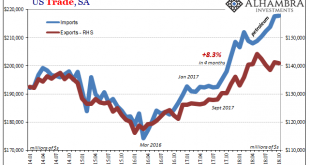

Read More »Converging Views Only Starts With Fed ‘Pause’

There’s no sign of inflation, markets are unsettled, and now new economic data keeps confirming that dark side. Forget each month, every day there is something else suggesting a slowdown. That much had been evident across much of the global economy, but this is now different. The US has apparently been infected, too, not that that is any surprise. That’s how these things go. Global synchronized growth, decoupling,...

Read More »China’s Global Slump Draws Closer

By the time things got really bad, China’s economy had already been slowing for a long time. The currency spun out of control in August 2015, and then by November the Chinese central bank was in desperation mode. The PBOC had begun to peg SHIBOR because despite so much monetary “stimulus” in rate cuts and a lower RRR banks were hoarding RMB liquidity. Late 2015 was not a fun time in China. The idea of economic...

Read More »The Direction Is (Globally) Clear

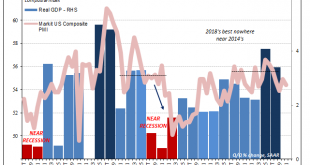

It is definitely one period that they got wrong. Still, IHS Markit’s Composite PMI for the US economy has been one of the better forward-looking indicators around. Tying to real GDP, this blend of manufacturing and services sentiment has predicted the general economic trend in the United States pretty closely. The latter half of 2015 was the big exception. For November 2015, the composite index jumped to 56.1 from 55.0...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org