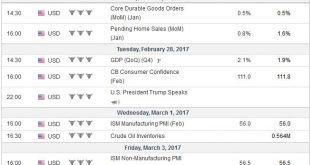

United States There is a broad consensus around the macroeconomic picture. The headwinds slowing the US economy in H1 16 have eased, and above trend growth in H2 16 appears to be carrying into 2017. Q4 16 GDP is expected to be revised to 2.1% up from 1.8%. Many economists appear to accept that a good part, though not all, of the decline in the estimated trend growth in the US, is a function of demographic...

Read More »FX Daily, February 13: Quiet Start of Busy Week

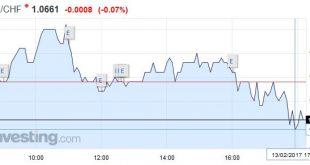

Swiss Franc EUR/CHF - Euro Swiss Franc, February 13(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Pound to Swiss Franc exchange rates provide strong beginning to the week Pound to Swiss Franc exchange rates have enjoyed a strong boost to begin the week, after what had been a disheartening end to the week for many Franc buyers. The Pound has regularly suffered on Friday’s since the Referendum, with...

Read More »FX Weekly Preview: Five Events that Will Drive the Capital Markets in the Week Ahead

Summary: Bank of Canada may be more upbeat following strong jobs and trade figures. China’s President Xi will speak at Davos and likely defend globalization and free trade, which some think the US is abandoning. UK PM May’s speech on Brexit may be blunted by few surprises, collapse of the government in Northern Ireland, and the pending Supreme Court ruling. ECB will leave rates on hold and look for Draghi to push...

Read More »FX Daily, January 03: Dollar-Bloc and Sterling Advance, while Euro and Yen Slip

Swiss Franc Switzerland SVME PMI, December 2016(see more posts on Switzerland SVME PMI, ) Source: Investing.com - Click to enlarge FX Rates The US dollar is mixed. After a soft start in Asia, where Tokyo markets were closed, the dollar recovered smartly against the euro and yen. The dollar-bloc and sterling are firmer. Sterling’s earlier losses were recouped following news that the manufacturing PMI jumped to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org