The Independent Evaluation Office of the International Monetary Fund released a critical report on IMF supported policies in Greece, Ireland and Portugal. It questions the legitimacy of certain decisions. The executive summary states that [t]he IMF’s pre-crisis surveillance mostly identified the right issues but did not foresee the magnitude of the risks … missed the build-up of banking system risks … shared the widely-held “Europe is different” mindset … Following the onset of the...

Read More »Puerto Rico may Restructure its Debt

In the FT, Eric Platt reports that US Congress has passed emergency legislation allowing Puerto Rico to restructure its debt. Unlike US cities and municipalities, Puerto Rico and other territories do not have access to protections under the US bankruptcy code. The legislation gives the island and its debt-issuing entities that right, so long as they have made “good-faith” efforts to negotiate with creditors and have received sign-off from the control board. With the deal, Puerto Rico...

Read More »Greek Debt: Now and Then

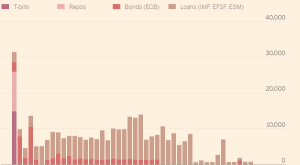

In the FT, Mehreen Khan offers a “Greek debt dilemma cheat sheet.” Face value: EUR 321 billion, thereof EUR 248 billion owed to official creditors. Official creditors: Eurozone countries (Greek loan facility), eurozone rescue funds (EFSF and ESM), IMF, ECB. Maturity profile: IMF proposal for restructuring:

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org