The Fed did, as expected, hike rates at their last meeting. And interestingly, interest rates have done nothing but fall since that day. As I predicted in the last BWER, Greenspan’s conundrum is making a comeback. The Fed can do whatever it wants with Fed funds – heck, barely anyone is using it anyway – but they can’t control what the market does with long term rates. At least not without making a commitment like the...

Read More »Global Asset Allocation Update

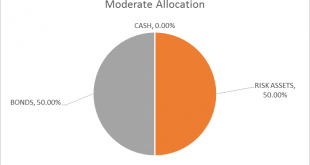

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. The Fed spent the last month forward guiding the market to the rate hike they implemented today. Interest rates, real and nominal, moved up in anticipation of a more aggressive Fed rate hiking cycle. Post meeting, a lot of the rise came out of the market. Nominal and...

Read More »Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. The Fed spent the last month forward guiding the market to the rate hike they implemented today. Interest rates, real and nominal, moved up in anticipation of a more aggressive Fed rate hiking cycle. Post meeting, a lot of the rise came out of the market. Nominal and...

Read More »Bi-Weekly Economic Review

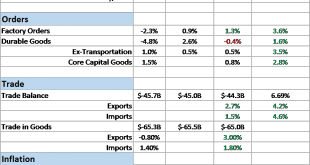

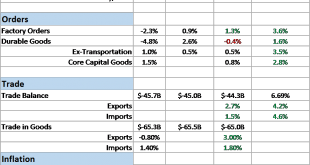

Economic Reports Scorecard The Federal Reserve is widely expected to raise interest rates again at their meeting next week. They obviously view the recent cyclical upturn as being durable and the inflation data as pointing to the need for higher rates. Our market based indicators agree somewhat but nominal and real interest rates are still below their mid-December peaks so I don’t think a lot has changed. More...

Read More »Fixed Income: looking for a place to hide

With sovereign yields rising and little room for significant spread tightening in investment grade corporate debt, conditional exposure to high yield may offer more opportunities.Last year credit posted stellar total returns, and the beginning of 2017 has also started well. Investors need to watch three main macroeconomic risk factors in 2017: Inflation, which will normalize; Monetary policy, which will continue to diverge; and Fiscal policy, which will remain accommodative in both the US...

Read More »Bi-Weekly Economic Review

Economic Reports Scorecard The economic data released since my last update has been fairly positive but future growth and inflation expectations, as measured by our market indicators, have waned considerably. There is now a distinct divergence between the current data, stocks and bonds. Bond yields, both real and nominal, have fallen recently even as stocks continue their relentless march higher. The incoming, current...

Read More »Bi-Weekly Economic Review

Economic Reports Scorecard The economic data since my last update has improved somewhat. It isn’t across the board and it isn’t huge but it must be acknowledged. As usual though there are positives and negatives, just with a slight emphasis on positive right now. Interestingly, the bond market has not responded to these slightly more positive readings with nominal and real yields almost exactly where they were in the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org