Published: 7th November 2016Download issue:In spite of large doses of policy easing, inflation and global growth remain tepid. With the effectiveness of existing monetary policy styles therefore being increasingly questioned, the November 2016 issue of Perspectives looks at three of the most plausible alternatives.One is asset-price targeting. Could central banks assume responsibility for ensuring the stability of asset prices as well as price stability? Christophe Donay, head asset of asset...

Read More »The Next Generation

[embedded content] Published: Tuesday November 01 2016The third Next Generation event took place in Geneva with 50 Next Gens in attendance from 22 different nationalities.The event was a great success, focusing both on the challenges and solutions the rising generation face in todays complex environment. Presentations offered both solid educational platforms and fostered lively workshops, providing a unique opportunity for like-minded peers to exchange opinions and advice. Among Pictet...

Read More »In Conversation With Sally Osberg

[embedded content] Published: Wednesday October 12 2016Sally Osberg, who has lead the Skoll Foundation since its creation in year 2000, spoke to an audiance of 80 entrepreneurs and investors at The Pictet Entrepreneur Summit Seminar held in Geneva in September 2016.Sally said that to be successful, a social entrepreneur has to really understand the system that creates the problem – the actors and the forces – in order to intervene at a high leverage point.In this conversation, she explains...

Read More »Gauging the economic plans of U.S. presidential candidates

Published: 11th October 2016Download issue:Both main candidates in the US presidential election have outlined their plans in numerous areas. Whoever wins, both are promising to raise government spending, especially on infrastructure. Writing in the October issue of Perspectives, Pictet Wealth Management’s chief economist Bernard Lambert outlines various scenarios. Should Hilary Clinton win the presidency but the Democrats fail to win a majority in the House of Representatives in...

Read More »Private equity, an antidote to prospect of weak returns?

Published: 13th September 2016Download issue:The summer months were good for risk assets, though things may get bumpier in the months ahead. But alongside this study in chiaroscuro, the September issue of Perspectives offers a brighter picture of investment opportunities.Pictet chief strategist Christophe Donay admits that “prospects for portfolio returns look far weaker than they did in the past” as the extraordinary measures introduced by central banks to combat low growth and inflation...

Read More »In conversation with Peter Diamandis

[embedded content] Published: Thursday August 11 2016 The world is living in exponential times, according to the Greek-American entrepreneur Peter Diamandis — an era when the pace of technological change is doubling every year or two. Speaking to an audience of 40 wealthy families at The Family Consilium which was convened in Gstaad by Pictet in June 2016, he said that the speed of innovation was making the world’s population better-off, healthier and happier. In this conversation,...

Read More »Family brands

Published: 9th August 2016Download issue:In the Summer 2016 issue of Pictet Report, Pictet managers and analysts set out the megatrends behind the success of premium brands and the financial pillars that make them attractive to investorsPremium brands have proved to be profitable long-term investments, offering strong revenue growth, superior operating margins and robust balance sheets over the long term. There are four fundamental megatrends behind their success in driving returns, whether...

Read More »Polarisation poses risks

Brexit should not lead to a repeat of the financial crisis of 2007-2008. So argue Pictet analysts and economists in the July issue of Perspectives. Central banks are better prepared and banks are less leveraged. In the last resort, the European Central Bank can be expected to step in again should financial stress noticeably increase […]

Read More »Investing in a post-Brexit world

Published: 11th July 2016Download issue:Brexit should not lead to a repeat of the financial crisis of 2007-2008. So argue Pictet analysts and economists in the July issue of Perspectives. Central banks are better prepared and banks are less leveraged. In the last resort, the European Central Bank can be expected to step in again should financial stress noticeably increase in the weeks ahead. Longer term, an ideal post-Brexit scenario for European financial markets would be a renewed push for...

Read More »Central banks face test of credibility

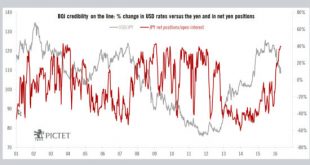

Published: 12th May 2016 Download issue: Central banks contributed to halting the financial crisis (starting with the US Federal Reserve’s first quantitative easing package, launched in late 2008), with successive rate cuts helping companies and households in the West to deleverage. The Bank of Japan (BoJ) and European Central Bank (ECB) followed with aggressive policies at a later stage, when the US recovery was already underway. Central banks’ commitment to their mandates has been...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org