Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered “fake news” within the “serious” financial community, disseminated by fringe blogs? Good times. In an interview with Swiss Sonntags Blick titled appropriately enough “A Recession Is Sometimes Necessary“, the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by...

Read More »Trumpflation Takes A Breather As Global Stocks Rise, Oil Jumps On Renewed OPEC “Deal Optimism”

With the Trumpflation euphoria easing back slightly overnight, leading to a modest paring in the USD index and US Treasury yields, Asian and European stocks rose, while US equity futures rebounded to just shy of new all time highs, as crude jumped on renewed optimism that OPEC will agree to cut output; Italian equities underperformed ahead of the Italian referendum; metals rebounded from last week’s losses as yields dropped and the dollar halted its longest winning streak versus the euro....

Read More »Former CEO Of UBS And Credit Suisse: “Central Banks Are Past The Point Of No Return, It Will All End In A Crash”

Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered "fake news" within the "serious" financial community, disseminated by fringe blogs? Good times. In an interview with Swiss Sonntags Blick titled appropriately enough "A Recession Is Sometimes Necessary", the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by criticizing the growing strength of central banks and their ‘supremacy over the...

Read More »BIS: The VIX is Dead, The Dollar is the new “Fear Indicator”

Over the past few years, one of the recurring themes on this website has been an ongoing discussion of how the VIX has lost its predictive value as a market risk indicator. This culminated recently with a note by Russel Clark who explained in clear term why the “VIX is now broken.” Today, in a fascinating note Hyun Song Shin, head of research at the Bank for International Settlements, the “central banks’ central bank”...

Read More »Did President-Elect Trump Just Inadvertently Kill The Golden Goose?

Submitted by Gordon T Long via MATASII.com, President-Elect Trump may have just unwittingly sowed the seed of an equity market draw-down which will send even more protesters into the streets of America. Donald Trump’s stated economic policies are clearly pro-growth and if he manages to implement his pro-business, anti-regulation agenda, in the longer term they have the potential to surpass the bold and successful...

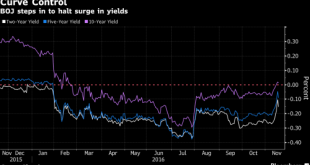

Read More »BOJ “Fires Warning At Bond Market” Sending Global Yields, Dollar Lower; All Eyes On Yellen

Yesterday morning we noted why, in light of the ongoing global bond rout, all eyes would be on the BOJ, and specifically whether Kuroda would engage his "Yield control" operation to stabilize the steepness of the JGB yield curve and implicitly support global bond yields in what DB said would be "full blown helicopter money" where the "BoJ is flying the copter over the US and may be about to become the new US government’s best friend." And sure enough that is precisely what Kuroda did last...

Read More »Dollar Illiquidity Getting Critical: A $10 Trillion Short Which The Fed Does Not Understand

In the latest report from ADM ISI’s strategy team, “Dollar Liquidity Threat is Getting Critical and Fed is M.I.A.”, Paul Mylchreest argues that mainstream economic luminaries (like Carmen Reinhart) are finally acknowledging the evolving crisis due to the dollar shortage outside the US, a topic which even the head researcher at the BIS shone a spotlight on yesterday suggesting that the strength of the dollar, not the VIX...

Read More »Are Emerging Markets Still “A Thing”?

By Chris at www.CapitalistExploits.at Last week I jumped on a call with an old friend Thomas Hugger who I hadn't spoken with in months. I recorded the call for your enjoyment but first a quick bit of background to Thomas. Thomas is a Swiss fund manager living and working in Asian frontier markets such as Vietnam, Bangladesh, and Cambodia, which is a bit like taking a Rolls Royce through the Gobi desert if you think about it. The Swiss after all are everything that frontier markets...

Read More »Which Government System Is The Best For People’s Wealth?

Via HowMuch.net, We have created a map which shows the per-capita GDP based upon the type of government in a country. The larger the country appears on the map, the higher the GDP per capita. GDP for Republics The map above shows the GDP per capita of countries with the republic form of government in red, including the United States. Among countries with this form of government, Singapore has the highest GDP per capita...

Read More »Gold Surges Post-Trump, Nears Heaviest Volume Day Ever

Gold futures had their heaviest day of trading during April 2013 when a mysterious flash crash sent the precious metal collapsing with no clear fundamental/news catalyst. In June, Brexit sparked massive volume buying in the barbarous relic, but overnight, as a Trump victory became more and more of a reality, gold futures are approaching their busiest day ever. As Bloomberg notes, that’s triple the full-day average this...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org