Plans and Consequences You are probably already getting into the holiday spirit, perhaps you are even under a little stress. But the turn of the year will soon be here – an occasion to review the past year and make plans for the new one. Many people are doing just that – and their behavior is creating the strongest seasonal rally in the precious metals markets. Anonymous industrial stackers showing off their freshly purchased silver hoard. PT Silver is seasonally...

Read More »Banana Republic Money Debasement In America

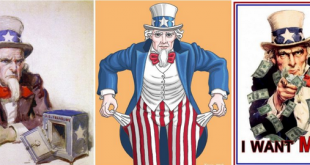

Addicted to Spending There are many falsehoods being perpetuated these days when it comes to money, financial markets, and the economy. But when you cut the chaff, three related facts remain: Uncle Sam needs your money. He needs a lot of your money. And he needs it bad! The inescapable logic of tax & spend: empty vault… empty pockets… gimme more! PT According to the Congressional Budget Office, the federal budget deficit for the first two months of fiscal year...

Read More »Riding the Type 3 Mega Market Melt Up Train

Beta-driven Fantasy The decade long bull market run, aside from making everyone ridiculously rich, has opened up a new array of competencies. The proliferation of ETFs, for instance, has precipitated a heyday for the ETF Analyst. So, too, blind faith in data has prompted the rise of Psychic Quants… who see the future by modeling the past. Gandalf, quant of Middle-Earth, dispensing sage advice. [PT] For the big financial outfits, optimizing systematic – preprogrammed...

Read More »Maurice Jackson Interviews Brien Lundin and Jayant Bhandari

Two Interesting Recent P&P Interviews Our friend Maurice Jackson of Proven and Probable has recently conducted two interviews which we believe will be of interest to our readers. The first interview is with Brien Lundin, the president of Jefferson Financial, host of the famed New Orleans Investment Conference and publisher & editor of the Gold Newsletter – an investment newsletter that has been around for almost five decades, which actually makes it the...

Read More »Incrementum 2019 Gold Chart Book

The Most Comprehensive Collection of Gold Charts Our friends at Incrementum have just published their newest Gold Chart Book, a complement to the annual “In Gold We Trust” report. A download link to the chart book is provided below. The Incrementum Gold Chart Book is easily the most comprehensive collection of charts related to or relevant to gold available anywhere. It contains everything from a wealth of economic to monetary data, to charts detailing sources of...

Read More »The Golden Autumn Season – One of the Most Reliable Seasonal Patterns Begins

The Strongest Seasonal Stock Market Trend Readers may already have guessed: when the vibrant colors of the autumn leaves are revealed in all their splendor, the strongest seasonal period of the year begins in the stock market – namely the year-end rally. Stocks typically rise in this time period. However, there are questions, such as: how often does a rally take place, how strong is it, and when is the best time for investors to enter the market? I will answer...

Read More »America’s Road Map to $40 Trillion National Debt by 2028

Planning on Your Behalf Watch out! At this very moment, professional economists of all stripes are making plans on your behalf. They are dreaming and scheming new and innovative ways to spend your money long before you have earned it. While you are busy at the gristmill, grinding away for clients and customers, claims are being laid upon your life. Your future earnings are being directed to boondoggles galore. Yet these claims are in addition to everything...

Read More »A Gain of 1,080 percent Annualized – One of the Strongest Seasonal Rallies is Starting Right Now

Bitcoin – An Exceptional Asset When I first heard about Bitcoin (BTC) in May 2011, it was trading at 8 US dollars. Today, more than eight years later, BTC trades at around 8,000 dollars. A thousandfold increase! An investment of 1,000 dollars at the time would have resulted in a gain of more than a million – a dream result. However, even an exceptional asset such as Bitcoin has its ups and downs – inter alia in terms of its seasonal patterns. And an exceptional...

Read More »US Money Supply Growth – Bouncing From a 12-Year Low

True Money Supply Growth Rebounds in September In August 2019 year-on-year growth of the broad true US money supply (TMS-2) fell to a fresh 12-year low of 1.87%. The 12-month moving average of the growth rate hit a new low for the move as well. The main driver of the slowdown in money supply growth over the past year was the Fed’s decision to decrease its holdings of MBS and treasuries purchased in previous “QE” operations. This was partly offset by bank credit...

Read More »Fed Chair Powell’s Inescapable Contradiction

Under the Influence “This feels very sustainable.” – Federal Reserve Chairman Jerome Powell, October 8, 2019 Conflict and contradiction. These were two of the main themes reverberating around the world of centralized monetary planning this week. On Tuesday, for instance, a novel and contradictory central banker parlance – “reserve management purposes” – was birthed into existence by Fed Chair Jay Powell. We will have more on this later on. But first, to best...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org