USD/CHF gained ground as FOMC left its benchmark lending rate in the range of 5.25%–5.50% on Wednesday. Powell stated, “We don’t see ourselves as having the confidence that would warrant policy loosening at this time.” Swiss Franc may see limited downside as SNB is unlikely to implement a rate cut in June. USD/CHF retraces its losses from the previous session after the hawkish hold from the US Federal Reserve (Fed). The Federal Open Market Committee (FOMC) left its...

Read More »Gold continues bearish tone on outlook for US interest rates

Gold rolls over after retesting key resistance as the outlook for US interest rates remains elevated. This keeps the opportunity cost of holding non-yielding Gold high, making it less attractive to investors. Gold (XAU/USD) trades a quarter of a percent lower on Tuesday after being rejected by key support-turned-resistance at $2,315 late Monday. Higher interest-rate expectations in the US are weighing on the precious metal. The release of better-than-expected US...

Read More »USD/CHF gains amid US labor market strength

In Friday's session, the USD/CHF recovered surging above the 0.8965 mark. Strong Nonfarm Payroll data from the US propelled the USD across the board. US Treasury yields increased while the odds of a cut in September by the Fed slightly declined. The USD/CHF pair is seeing a boost after updated Nonfarm Payroll (NFP) figures from the US were released on Friday, surpassing market expectations. As market bets on the Federal Reserve may turn more...

Read More »Gold extends decline after US Nonfarm Payrolls beats expectations

Gold price declines after the release of US Nonfarm Payrolls data for May, shows a higher-than-expected change in employment and wages. Gold was already trending lower after data unveiling PBoC reserves showed no change in May compared to April. Short-term technical picture remains volatile as Gold whipsaws higher and then lower. Gold (XAU/USD) falls all the way back to the $2,310s on Friday after the release of US Nonfarm Payrolls (NFP) data...

Read More »USD/CHF declined as the Greenback remains weak, defends the 20-day SMA

USD/CHF took a dip in Tuesday’s session and fell to 0.9110. Despite the Consumer Confidence index in the US and Housing prices exceeding expectations, the USD remains weak. The Federal Reserve maintains a cautious stance, asking the market for patience, which keeps the odds for rate cuts in June or July low. The USD/CHF pair is trading lower, despite optimistic signals from the US economy, specifically in the Housing market, and Consumer...

Read More »USD/CHF stays above 0.9100 nearing the highs since October

USD/CHF hovers below 0.9152, the highest since October reached on Monday. US Dollar strengthened as higher Retail Sales amplified expectations of the Fed prolonging higher policy rates. Swiss Franc faces challenges due to the likelihood of SNB implementing another rate cut in the June meeting. USD/CHF recovers its recent losses registered in the previous session, trading near 0.9120 during the early European hours on Tuesday. The strength of the US Dollar (USD)...

Read More »Canadian Dollar remains vulnerable after strong US Retail Sales

Canadian Dollar gives away gains as USD bounces up following strong Retail Sales data. Investors’ concern that Middle East conflict might escalate provides additional support to the safe-haven US Dollar. Oil prices have depreciated nearly 3.5% from early April highs, adding negative pressure to CAD. The Canadian Dollar (CAD) recovery attempt seen during Monday’s European session has been short-lived. The US Dollar has resumed its bullish...

Read More »Pound Sterling falls back as upbeat US Retail Sales strengthen US Dollar

The Pound Sterling faces pressure as geopolitical tensions improve the appeal for safe-haven assets. UK’s employment and inflation data will influence speculation over BoE rate cuts. The UK economy is on track to come out of a technical recession. The Pound Sterling (GBP) remains on the backfoot against the US Dollar in Monday’s early New York session. The near-term demand of the GBP/USD pair remains downbeat due to deepening Middle East...

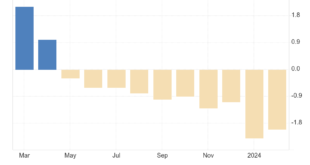

Read More »Swiss Franc at risk as inflation diverges from SNB forecasts

Swiss Franc is vulnerable as inflation data continues to undershoot official forecasts. The SNB expected inflation to average 1.9% in 2024 in its December forecast, but it currently sits at 1.2%. The latest Producer and Import Prices showed the tenth month of deflation in a row. The Swiss Franc (CHF) trades flat at the end of the trading week – off by barely a few hundredths of a percent in its most traded pairs. The overal fundamental...

Read More »EUR/CHF Price Analysis: Pullback possible amid mixed signals

EUR/CHF touches 50-week SMA and recoils RSI on daily chart indicates possibility of a pullback. Symmetrical Triangle has formed on 4-hour chart with breakout likely. EUR/CHF has rebounded from the 0.9254 December 2023 lows and rallied up to resistance from a key barrier in the form of the 50-week Simple Moving Average (SMA). The pair is probably still in a long-term downtrend despite recent strength. Euro to Swiss Franc: Weekly chart The price has respected the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org