The Federal Reserve’s Federal Open Market Committee (FOMC) on Wednesday left the target policy interest rate (the federal funds rate) unchanged at 5.5 percent. This "pause" in the target rate suggests the FOMC believes it has raised the target rate high enough to rein in price inflation which has run well above the Fed's arbitrary two-percent inflation target since mid-2021. The press release from the FOMC was largely unchanged from previous recent meetings and contained the usual language about the state of the economy and the Fed's ability to manage it: Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have slowed in recent months but remain strong, and the unemployment rate has remained low. Inflation remains

Topics:

Ryan McMaken considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

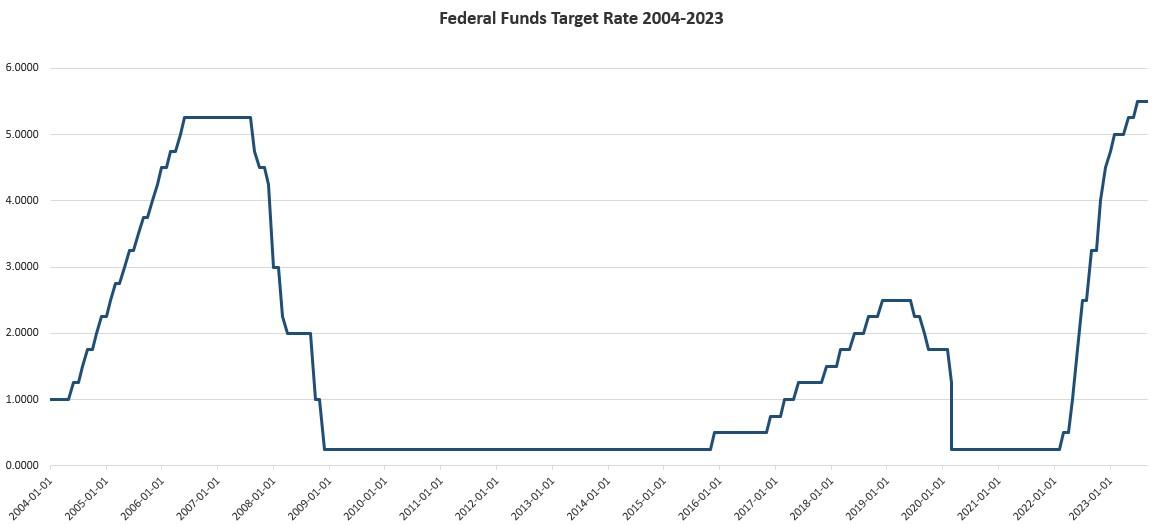

The Federal Reserve’s Federal Open Market Committee (FOMC) on Wednesday left the target policy interest rate (the federal funds rate) unchanged at 5.5 percent. This "pause" in the target rate suggests the FOMC believes it has raised the target rate high enough to rein in price inflation which has run well above the Fed's arbitrary two-percent inflation target since mid-2021.

The press release from the FOMC was largely unchanged from previous recent meetings and contained the usual language about the state of the economy and the Fed's ability to manage it:

Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have slowed in recent months but remain strong, and the unemployment rate has remained low. Inflation remains elevated. ... The U.S. banking system is sound and resilient. ... the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans.

This rosy and orderly picture of the situation relies on cherry-picking which indicators on which to base an assessment of the overall economy, and in his post-meeting press conference, Fed Chair Jerome Powell repeated the usual stock language the committee routinely provides on how present high labor demand proves there is no economic turbulence on the horizon. This reliance on current jobs data deliberately hides a larger and more accurate assessment of the economy. Nonetheless, in his comments at the press conference, Powell stated some undeniable facts:

Inflation remains well above our longer-run goal of 2 percent—4 percent over the 12 months ending in August—and that, excluding the volatile food and energy categories, core PCE prices rose 3.9 percent. Inflation has moderated somewhat since the middle of last year ... Nevertheless, the progress—the process of getting inflation sustainably down to 2 percent has a long way to go.

This meeting of the FOMC was described as "hawkish" by Wall Street observers and pundits, mainly because the FOMC's Summary of Economic Projections (SEP) suggested that the target inflation rate will remain at 5.5 percent—or even slightly higher—throughout the rest of the year. As Powell noted:

If the economy evolves as projected the median participant projects that the appropriate level of the federal-funds rate will be 5.6 percent at the end of this year, 5.1 percent at the end of 2024, and 3.9 percent at the end of 2025. Compared with our June Summary of Economic Projections, the median projection is unrevised for the end of this year but is moved up by a half percentage point at the end of the next two years.

If we read between the lines, it is apparent that the Fed is hoping that price inflation will fall to politically acceptable levels without any additional tightening, and without a recession. But "hope" is all the Fed has. The FOMC voting members have no idea what comes next. But, the members apparently still fear politically damaging price inflation isn't going away as evidenced by most members' admission that the target rate is unlikely to fall much before the end of 2024. This is notable because the FOMC members tend to strenuously avoid any predictions that rates might tighten further.

A look at the past three years of SEPs shows very little upward movement in target rates. Moreover, in 2021, Fed personnel were insisting with the utmost confidence that the target rate would not increase at all until late 2023. In reality, the Fed was forced to raise rates in 2022 as price inflation soared to 40-year highs. The Fed's misplaced confidence in 2021 that low rates would endure all relied on a false narrative that price inflation would be either nonexistent or—at most—would be transitory. Fed economists were either lying or were utterly wrong about the state of price inflation. So, if Fed personnel have failed so miserably at predicting price inflation in recent years is there reason to now believe that the Fed now has the situation in hand? No.

The Fed Forced Rates to Ultra-Low Levels for a Very Long Time

Nonetheless, the current narrative about the "hawkish" Fed is that it has slayed the price-inflation beast and that the Fed has allowed interest rates to rise to the "correct" level. Some even claim that the target rate is too high.

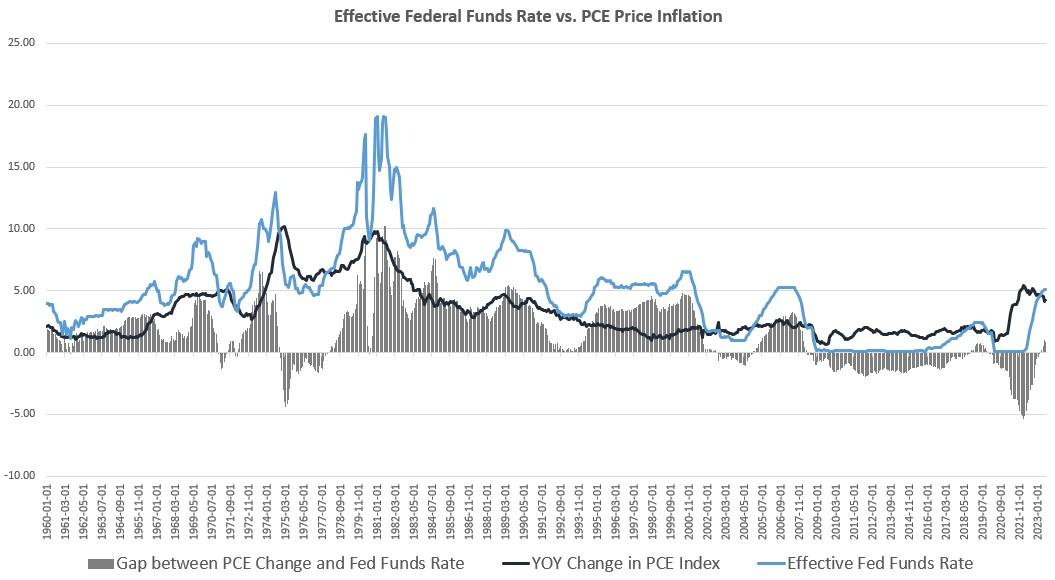

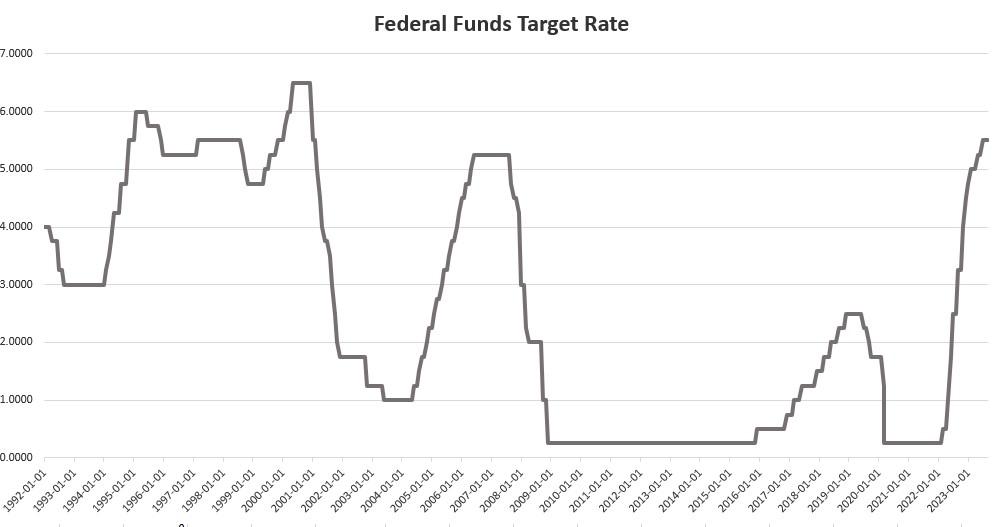

Much has been said of how the target federal funds rate is now at the highest it's been since 2001. Yet, it is important to consider the cumulative effects of ultra-low-interest rate policy that proceeded the recent rate-hiking schedule. The fact is that beginning in late 2007, the Federal Reserve began a policy of forcing down interest rates for a very prolonged period that lasted until 2018. During this period, the target policy interest rate was consistently well below the CPI inflation rate. This produced a negative-value "gap" between the target interest rate and the CPI inflation rate. Then, from 2020 to 2023, this gap was driven deep into negative territory to levels not seen since the mid-1970s.

Indeed, the only period rivaling this post-2008 easy-money policy is the period of the mid-1970s which ended in the historical periods of high inflation experienced during the late 1970s and early 1980s.

The current target rate must be interpreted in light of the long duration of the easy-money years that came before today's rate-raising trend given. During this period, easy-money fueled bubbles and malinvestments grew for fifteen years. Such immense amounts of monetary inflation cannot be "fixed" with a few months of 5-to-6 percent interest rates.

The long period of ultra-low rates we've seen over the past 15 years is a clear historical aberration and the product of a central bank seeking to force down interest rates again and again. Evidence of this can be seen in the Fed's turn toward purchasing trillions of dollars worth of government debt and mortgage-backed securities (MBS) since 2008. The effect has been to drive down interest on Treasurys and create artificial demand for MBS to prop up commercial banks. An enormous bubble in asset prices—i.e., asset-price inflation—has been one result.

After so long a period, a "cure" for such enormous imbalances in the economy will not be engineered with a "soft landing."

The claim that interest rates are "high," of course, are unsupportable so long as the central bank replaces market interest rates with artificial central-bank-manipulated interest rates. The Fed has no idea what the "natural interest rate" is or what market interest rates would be in the absence of the central bank's incessant interventions. So, it is impossible to say what the "correct" target rate is. Of course, it is safe to assume market rates would be higher than the current policy rate. If market rates would be actually lower than the current target policy rate, then there would be no "need"—"need" as perceived by central bankers—for the FOMC to manipulate rates downward as it is clearly trying to do.

At the First Sign of Trouble, Rates Will Head Down Again

The FOMC's SEP shows that the target interest rate will remain above 5 percent, even to the end of 2024. There is no telling if the polled FOMC members actually believe this, but it is extremely unlikely that the target rate will remain anywhere near five percent if the employment situation worsens to the point it becomes a political liability for the current regime.

Over the past 30-plus years, the central bank has consistently forced interest rates downward every time high unemployment and recession become evident to the public. Thus, it is likely the FOMC has already maxed out its target rate for this cycle. Yes, the FOMC has only "paused" the rate hikes, meaning it could conceivably move them higher in the near future. For cynical veteran Fed watchers, however, the pause immediately raises the question of whether or not the pause will be followed in, say, six months by a drop in the target interest rate. After all, historical experience shows that when the Fed "pauses" it rarely goes back to any sort of sustained period of monetary tightening.

Over the past thirty years, there have only been a few occasions during which the Fed paused for more than a single month, and then went back to allowing the target rate to move upward again. This occurred briefly in 2017, and in 1996 and 1997. In the quantitative tightening period between the Dot-com Bust and the Great Recession, however, the Fed never "paused" longer than a single month. If the Fed fails to allow rates to climb again next month, we'll have good reason to suspect that the Fed is done with this current round of rate hikes.

The last decade has shown us that the Fed clings to a bias very much in favor of ramming down interest rates again and again. This is what happened in the ten years of near-zero rates that followed the 2008 financial crisis. Every month, the FOMC would come out and say that the economy was "growing" and was showing "strength" yet repeatedly refused to raise rates. In our current predicament, the Fed is afraid of price inflation, but is also afraid to raise rates even further, even as the August CPI data showed rates ticked upward again. Political expedience demands that the Fed do what it can to rein in price inflation without triggering sizable increases in unemployment. The Fed is holding the current rate steady because politics demands it.

Read More: "Yes, the Fed Really Is Holding Down Interest Rates" by Joseph Salerno.

Tags: Featured,newsletter