Credit Suisse, one of the fifty largest banks in the world, has joined the long list of Western banks over the past two decades that have been rescued from the brink of failure and subsequently acquired by a larger financial institution. After comments from the chairman of the Saudi National Bank triggered the evaporation of almost a third of the megabank’s market capitalization, the Swiss National Bank (SNB) announced the creation of a new facility to preemptively strengthen Credit Suisse’s liquidity (i.e., bail the bank out in order to prevent a full-blown financial crisis). This was followed over the weekend by the announcement of UBS’s intentions to purchase the bank at a significant discount with the full support of the SNB, while over fifteen billion dollars

Topics:

L. H. considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Credit Suisse, one of the fifty largest banks in the world, has joined the long list of Western banks over the past two decades that have been rescued from the brink of failure and subsequently acquired by a larger financial institution.

After comments from the chairman of the Saudi National Bank triggered the evaporation of almost a third of the megabank’s market capitalization, the Swiss National Bank (SNB) announced the creation of a new facility to preemptively strengthen Credit Suisse’s liquidity (i.e., bail the bank out in order to prevent a full-blown financial crisis).

This was followed over the weekend by the announcement of UBS’s intentions to purchase the bank at a significant discount with the full support of the SNB, while over fifteen billion dollars in bonds will be defaulted upon.

In the midst of the panic, Credit Suisse’s CEO, Ulrich Koerner, offered an insightful public statement: “Our capital, our liquidity basis is very very strong,” Koerner said. “We fulfill and overshoot basically all regulatory requirements.”

This was perhaps one of the only factual statements uttered across global financial media during the chaos, amid a flurry of mainstream analysts begging for Credit Suisse’s rescue while conversely claiming that this rescue posed no threat to the global financial system.

Despite its reputation as a tax haven, the Swiss banking industry is one of the most regulated financial sectors on Earth, with countless stringent requirements established in the name of protecting the solvency of the financial system, all of which Credit Suisse dutifully adhered to.

Yet the bank completely imploded, proving that these regulations were at best, useless, and at worst, directly responsible for its woes.

The Usual Suspect

As with every financial crisis, the central bank sets the stage for a collapse by creating untenable economic conditions in the form of an artificial boom fueled by a drastic increase in the money supply.

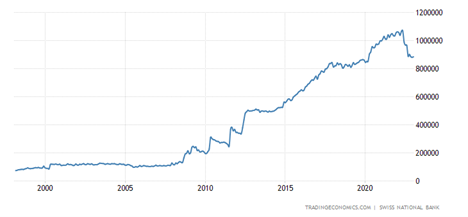

Figure 1: Swiss National Bank balance sheet (millions of CHF)

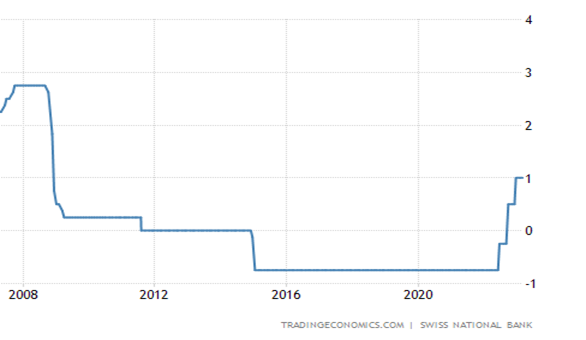

Figure 2: Swiss National Bank policy rate (percent)

The SNB’s near-fifteen-year suppression of interest rates directly lowered the returns on fixed-income assets, which form the bulk of every bank’s portfolio, dramatically diminishing profitability in the Swiss banking sector.

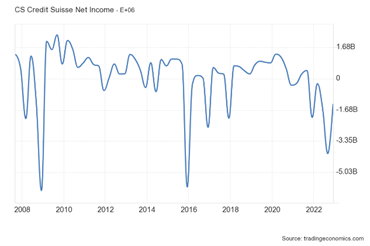

Figure 3: Credit Suisse net income ($USD)

More importantly, the SNB’s distortion of markets resulted in all kinds of financial absurdities, such as negative-yielding 50-year government bonds, 0 percent unsecured corporate bonds, and near–0 percent mortgages.

These malinvestments never would have come to life without the SNB’s intervention, but year after year of low interest rate, zero interest rate, and negative interest rate policies have resulted in Swiss markets pricing themselves upon the lowest rates seen in five thousand years, a recipe for disaster.

While the yields on Credit Suisse’s assets continually fell as the suppressed-rate environment dragged on, the vulnerability of its portfolio to a rise in interest rates increased.

Anyone with a shred of common sense questioned the sustainability of keeping rates so low for so long, but as always, state officials justified their delusion through convoluted academic dogma.

Harmful Regulations

Credit Suisse’s downfall further highlights the failure of financial regulators, whose meddling exacerbates the vulnerable position of private financial institutions as middlemen in the business cycle.

Cookie-cutter regulations seeking to stabilize the financial industry through arbitrary capital requirements invariably have the opposite effect, as investment positions are dictated by unelected bureaucrats rather than managers of financial institutions who are evaluating market signals for themselves.

Asset allocation enforced by mandate and decree rather than guided by free market prices leads to severe waste and malinvestment while forcing financial institutions to pursue their desired investments in black markets.

This phenomenon transpired in 2008, as the first Basel accords pushed banks into seemingly low-risk, mortgage-backed securities and off-balance sheet leverage.

The same effects have arisen throughout this cycle, as banks such as Credit Suisse were forced to hold large portions of low-yielding assets in the name of reducing systemic risk.

Rather than protecting the megabank, regulators virtually guaranteed its failure once interest rates rose, as they eventually did.

Boom Turns to Bust

While depressed global consumer price inflation (CPI) rates had provided cover for the SNB’s activities, the recent rise in Swiss CPI figures forced its hand, and it began hiking interest rates and trimming its balance sheet in the second quarter of 2022.

Figure 4: Switzerland consumer price inflation (year-over-year percent change)

Less than a year later, with interest rates having barely risen above 0 percent from the previous negative percent rates, economic growth is pointing toward imminent recession, and the country’s second largest bank just required a central bank–sponsored rescue. To any proponent of the Austrian school of economics, this is yet another example that can be added to the list of countless business cycles that have proven the validity of Austrian business cycle theory:

- The Swiss government and the SNB intervened in the economy in the name of fostering prosperity.

- Their intervention fueled a bubble of malinvestment in low-yielding assets.

- Their attempts to slow the resulting uncomfortable rise in prices without causing a recession were futile as the bubble popped, and the illusionary house of cards they had erected collapsed before their eyes.

Conclusion

The dissolution of Credit Suisse is far from the end of this business cycle’s financial crisis, as negative interest rate policies were not unique to Switzerland, having been implemented across Europe and in Japan.

Other “too big to fail” megabanks will likely face the same fate as Credit Suisse, pushing central banks to intervene in order to provide just enough moral hazard to ignite another artificial boom.

The Austrian school’s accurate forecasts (Many. Accurate. Forecasts.) will continue to clash with the ignorance of Keynesian economists and government officials as long as they disregard liberalization in favor of regulation and intervention.

Tags: Featured,newsletter