The Organization of the Petroleum Exporting Countries (OPEC) embargo on sales of crude oil from their member countries to the United States was a response to US support for Israel in the October 1973 Yom Kippur War against invading Egyptian and Syrian military forces. This oil embargo raised barrel prices on the open market and, when combined with US price controls, reduced the amount of oil available in the US for refining into gasoline, leading to domestic gasoline shortages and higher prices at the pump. The federal government banned oil exports in December 1975 with the intent of preserving it for domestic refiners to produce gasoline, diesel, and jet fuel. The ban did not function as intended and was lifted by President Obama in December 2015, forty years to

Topics:

Stephen Anderson considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Organization of the Petroleum Exporting Countries (OPEC) embargo on sales of crude oil from their member countries to the United States was a response to US support for Israel in the October 1973 Yom Kippur War against invading Egyptian and Syrian military forces. This oil embargo raised barrel prices on the open market and, when combined with US price controls, reduced the amount of oil available in the US for refining into gasoline, leading to domestic gasoline shortages and higher prices at the pump.

The federal government banned oil exports in December 1975 with the intent of preserving it for domestic refiners to produce gasoline, diesel, and jet fuel. The ban did not function as intended and was lifted by President Obama in December 2015, forty years to the month after its implementation.

Oil has physical properties based on its sulfur content that make it valuable. Oil with a high amount of sulfur, which is called sour crude, is less valuable than oil with a low amount, which is called sweet crude. Refineries are designed and built to refine sour or sweet oil based on available supply. Most US Gulf Coast oil refineries were made to process imported sour oil. Updating equipment to refine sweet oil is not easy: it requires government permits, engineering, economic investment, and time. But refiners like to use sweet oil because its low sulfur content makes it easy to refine. Worldwide, most oil sold today is sour, but refiners blend it with sweet oil to balance the sulfur content. In the US, most of the shale oil produced is sweet, making the repeal of the export ban particularly helpful.

The late Texan George Mitchell, founder of Mitchell Energy, is credited with initiating hydraulic fracturing (fracking) for extracting shale gas. Shale is a sedimentary rock known to hold oil and gas in a way that is less accessible to traditional vertical drilling. High-pressure pumps apply water through a drill hole to create fractures through which oil or gas can flow. Fracking was first tried on the Barnett Shale in Texas in the 1980s and yielded large volumes of natural gas and oil. The process was applied to other shale formations and soon made the US one of the top three oil producers in the world (along with Saudi Arabia and Russia), the world’s top gas producer, and a leading exporter of liquefied gas.

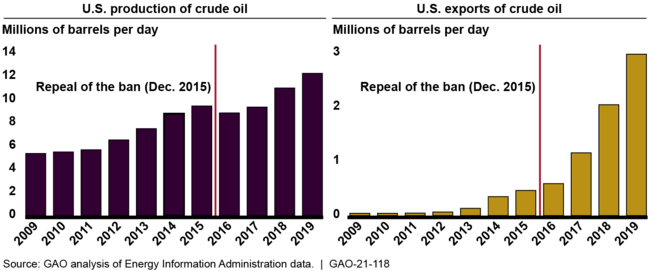

A US Government Accountability Office (GAO) report from October 2020 showed that the 2015 repeal of the ban on oil exports has made way for a slow and steady rise in exports to about three million barrels a day in 2019.

Figure 1: Annual production and exports of US crude oil, 2009–19

Source: Crude Oil Markets: Effects of the Repeal of the Crude Oil Export Ban (Washington, DC: GAO, October 2020).

The report outlines four results of the repeal: the market for oil produced in the US expanded to buyers outside the US; US producers were able to charge more for oil than producers outside the US could; the growing market and higher prices encouraged domestic production, which had already been growing since the shale oil boom began in or around 2009; and the profit margins of oil refiners decreased when they bought domestic oil due to its higher price.

The American Petroleum Institute issued a report in July 2022 on the many positive economic results of lifting the export ban, including increases in domestic oil and gas production, direct employment, employee wages, the number of operational drilling rigs, producer revenues, and global oil supply.

Domestic oil production almost doubled between 2009 and 2015 due to the new fracking technology, and US oil imports relative to daily oil consumption dropped from nearly two-thirds to one-half in the same time period.

The oil export ban offers a lesson about what happens when the federal government intervenes in the economy for the supposed good of the public. If the ban had remained in place after 2015, today’s positive economic results would not have occurred. Federal overseers should let the natural law of human creativity and innovation run its course.

Tags: Featured,newsletter