Over the years observers of Turkish politics have become somewhat inured to erratic swings in policy coming out of Ankara. Particularly since the political reforms of 2017, his high degree of control over the primary functions of the state mean President Recep Tayyip Erdoğan faces few hurdles to executing abrupt changes he views as correct or necessary. This lack of any effective institutional check to his authority is, at present, leading the country off an economic cliff. Already since 2018 the country was mired in a multifront crisis. Characterized by stagnation, unemployment, dramatic swings in the price of the lira, rising inflation, a declining balance of trade, growing borrowing costs, and an increase in corporate defaults, Erdoğan’s present interference

Topics:

Joseph Solis-Mullen considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Over the years observers of Turkish politics have become somewhat inured to erratic swings in policy coming out of Ankara. Particularly since the political reforms of 2017, his high degree of control over the primary functions of the state mean President Recep Tayyip Erdoğan faces few hurdles to executing abrupt changes he views as correct or necessary. This lack of any effective institutional check to his authority is, at present, leading the country off an economic cliff.

| Already since 2018 the country was mired in a multifront crisis. Characterized by stagnation, unemployment, dramatic swings in the price of the lira, rising inflation, a declining balance of trade, growing borrowing costs, and an increase in corporate defaults, Erdoğan’s present interference with the central bank invites blowing the whole thing up into a monumental catastrophe. While comparisons to the hyperinflation that overcame Weimar Germany are often hyperbolic, the danger in Turkey is real.

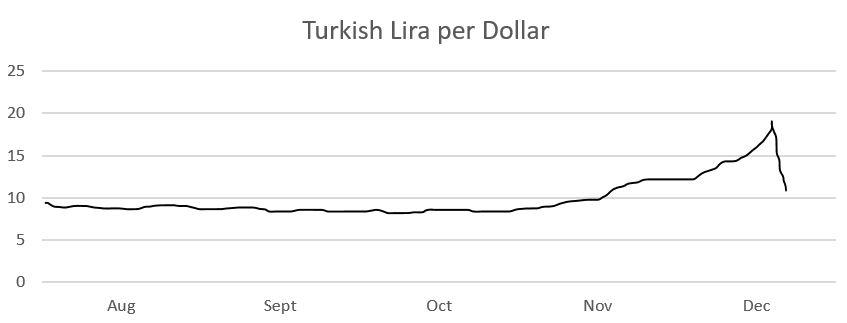

Erdoğan’s insistence that higher central bank rates lead to higher inflation, the direct opposite of economic orthodoxy, has led to Turkey’s central bank cutting rates four times in as many months, even as inflation has continued to rise. As shown in the graph below, global investors have fled the lira, as have many in Turkey, with the lira’s value declining sharply. The apparent resuscitation of the lira following Erdoğan’s mid-December announcement of a plan to protect lira deposits is a mirage. While consumers and businesses have redeposited some ₺3 billion in Turkey’s banks, the real reinvigoration of the lira came from Turkey’s central bank, which through open market activities and through state member banks engaged in purchases of over $7 billion dollars’ worth of lire in just two days. Like all currency crises, then, the central bank is emptying its foreign reserves in order to prop up the price of the lira. When this support breaks, as it eventually almost always does, where the lira will end up is anyone’s guess. To paraphrase Ernest Hemingway, the process will be gradual and then sudden. |

Domestically, Erdoğan has tried to cast the series of crises as the result of hostile foreign tariffs, such as those enacted by the United States in 2018, and the perfidy of a globalist banking cabal. Whether or not he will be able to convince Turkey’s (of yet) large and educated middle class this is the case when they cast their next ballots in 2023 remains to be seen. Early indications do not look promising. In 2019 his party, the AKP (Adalet ve Kalkınma Partisi, or Justice and Development Party), suffered its worst electoral defeats since he took the helm in 2003, losing local control over Istanbul and Ankara.

Erdoğan’s electoral coalition has changed gradually over his two decades in power; however, the AKP has always drawn its primary support from orthodox Muslims, rural communities, and the poor (in fact, he has recently cited among his arguments for lowering interest rates Qur’anic prohibition of usury). Initially serving as prime minister, Erdoğan oversaw a dramatic expansion of Turkey’s economy and welfare state. These efforts and the wider success of the economy made Erdoğan and the AKP understandably popular. However, the economy’s growth was unbalanced. Large and persistent deficits became the norm as state spending grew and reliance on global credit markets increased. Particularly during the second decade of his tenure, as his reform plans stalled and his foreign policy misadventures mounted, cronyism and corruption became more pervasive; so too did prosecution of those deemed hostile to the regime. Heavily reliant on increasingly unaffordable state subsidies, the further collapse of the lira will make the necessary imported inputs required by Turkey’s economy prohibitively expensive. Despite Erdoğan’s hopes, Turkey’s balance of trade will further decline despite the lira’s devaluation, for the paralysis of its economy by the inflation created by his continual interference will founder the productive capacity of the private and public sectors. Mass unemployment will follow.

A decade ago, many geopolitical and geoeconomics forecasters divined that Ankara would become the dominant power of the region and a player of global significance. With the leverage of its geography and North American Treaty Organization membership, it had a high degree of strategic flexibility to go with a growing economy and a relatively young and educated population. That population came to expect big things, and they have been increasingly disappointed.

If Erdoğan continues down this path, he and the AKP may not make it to the 2023 elections. Whether or not the 2016 coup attempt Erdoğan claims to have fended off was legitimate or contrived, walled off in his thousand-room palace, constructed at a cost of several hundred million dollars, it is questionable whether an army increasingly paid in worthless script will be willing to stand down, or even shoot down, their countrymen in an attempted overthrow of a regime increasingly unpopular.

Tags: Featured,newsletter