The government’s latest report puts the twelve-month official consumer price inflation rate at 8.5 percent, the highest since December 1981: As economists debate the causes of, and cure for, this price inflation, it’s worth recounting which schools of thought saw it coming. Although individuals can be nuanced, generally speaking the Austrians have been warning that the Fed’s reckless policies threaten the dollar. In contrast, as I will document in this article, two of the leaders of the Keynesian and market monetarist schools didn’t see this coming at all. . My Worst Professional Mistake Before diving into it, I need to address a problem: my hands-down worst professional mistake occurred during the early years of the Fed’s “QE” (quantitative easing) programs,

Topics:

Robert P. Murphy considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

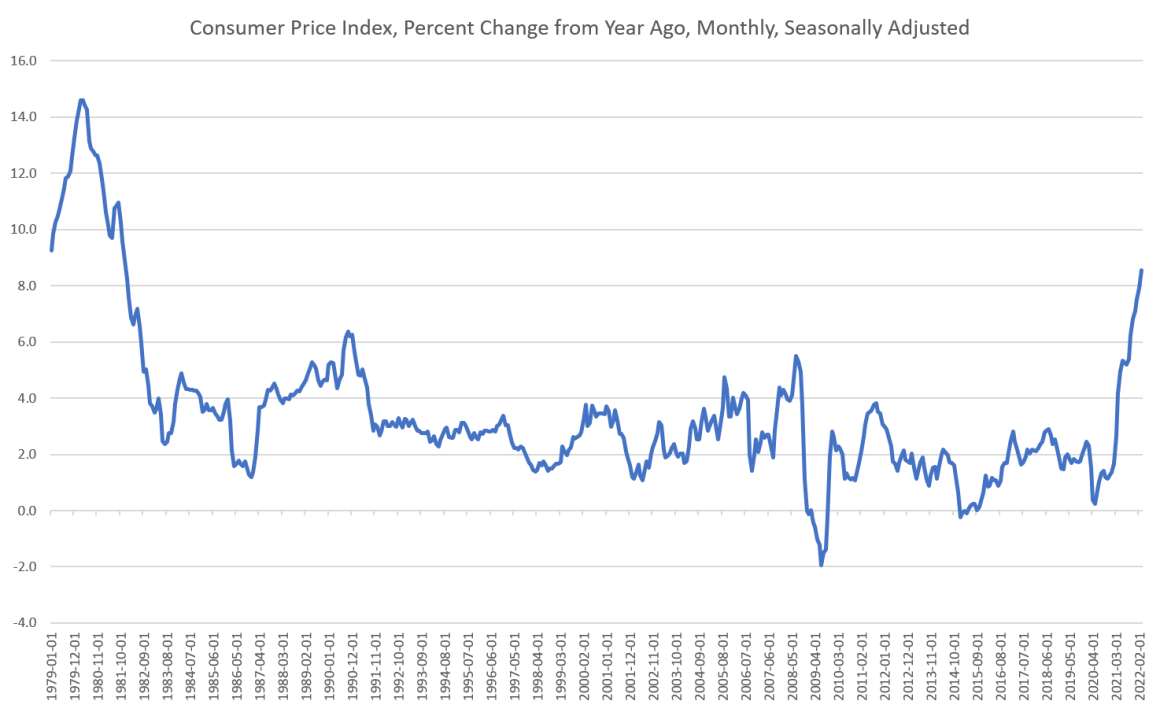

| The government’s latest report puts the twelve-month official consumer price inflation rate at 8.5 percent, the highest since December 1981:

As economists debate the causes of, and cure for, this price inflation, it’s worth recounting which schools of thought saw it coming. Although individuals can be nuanced, generally speaking the Austrians have been warning that the Fed’s reckless policies threaten the dollar. In contrast, as I will document in this article, two of the leaders of the Keynesian and market monetarist schools didn’t see this coming at all. |

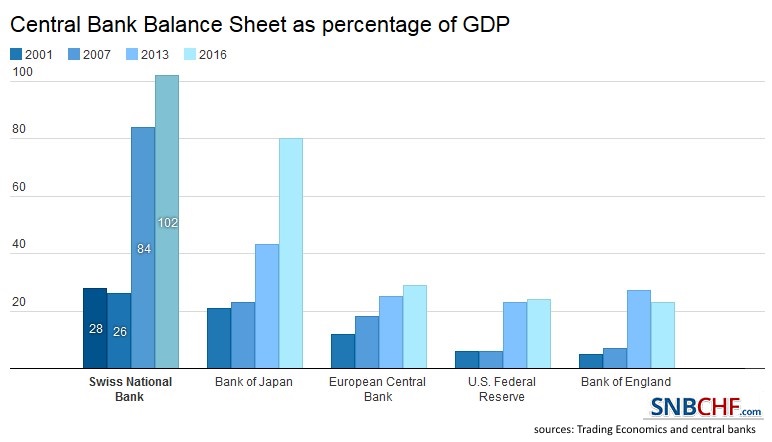

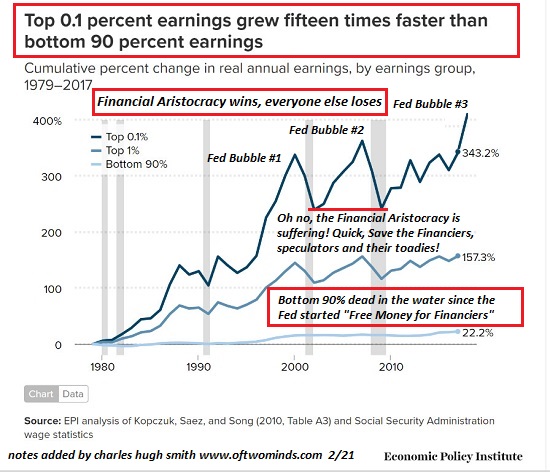

My Worst Professional Mistake

Before diving into it, I need to address a problem: my hands-down worst professional mistake occurred during the early years of the Fed’s “QE” (quantitative easing) programs, when I made bets on (consumer price) inflation with two economist colleagues. I ended up losing those bets and thereby gave Paul Krugman the opportunity to lecture me on my intellectual dishonesty because I clung to my (ostensibly falsified) Austrian model even after my prediction blew up in my face. Indeed, if you check out my Wikipedia entry, you’ll see that apparently my life story is that I was born, got my PhD, and lost an inflation bet—in that order. (For those interested in the details, I summarize the episode with relevant links in this postmortem blog post. I also participated in a 2014 Reason symposium along with Peter Schiff and others, commenting on the lack of inflation.)

Ever since the rounds of QE failed to yield surging consumer price inflation at the scale some of us warned of, the Keynesians and market monetarists understandably ran victory laps, saying that they were to be trusted over those permabear Cassandra Austrians. (To be sure, the market monetarists were far more civil about it than the prominent Keynesians.) So it is not with gloating or vindictiveness that I write the present article, but rather I do it to set the record straight and document for posterity that the leading Keynesians and market monetarists totally missed this bout of price inflation.

The Keynesians Camp: Paul Krugman and Klaus Schwab

Let’s do the fun one first: Paul Krugman has not fared well in light of our current inflationary experience. As late as June 2021, Krugman wrote an article in the New York Times titled “The Week Inflation Panic Died.” Here are some key excerpts, with my bold added, and keep in mind that when Krugman wrote this, the most recent Consumer Price Index (CPI) inflation rate was only 4.9 percent:

Remember when everyone was panicking about inflation, warning ominously about 1970s-type stagflation? OK, many people are still saying such things, some because that’s what they always say, some because that’s what they say when there’s a Democratic president….

But for those paying closer attention to the flow of new information, inflation panic is, you know, so last week.Seriously, both recent data and recent statements from the Federal Reserve have, well, deflated the case for a sustained outbreak of inflation …

o panic over inflation, you had to believe either that the Fed’s model of how inflation works is all wrong or that the Fed would lack the political courage to cool off the economy if it were to become dangerously overheated.

Both beliefs have now lost most of whatever credibility they may have had….The Fed has been arguing that recent price rises are similarly transitory … The Fed’s view has been that this episode, like the inflation blip of 2010–11, will soon be over.

And it’s now looking as if the Fed was right …

…. Monetary doomsayers have been wrong again and again since the early 1980s, when Milton Friedman kept predicting an inflation resurgence that never arrived. Why the eagerness to party like it’s 1979?To be fair, government support for the economy is much stronger now than it was during the Obama years, so it makes more sense to worry about inflation this time around. But the vehemence of the inflation rhetoric has been wildly disproportionate to the actual risks—and those risks now seem even smaller than they did a few weeks ago.

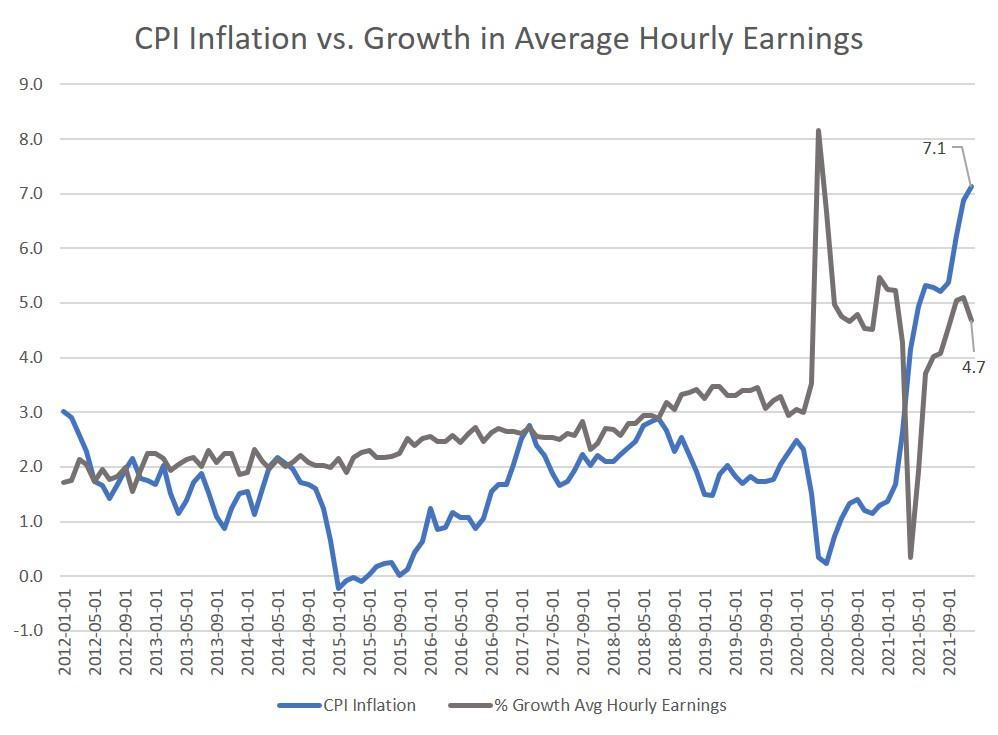

Of course, Krugman’s confident dismissal of those Biden-hating doomsayers blew up in his face, as CPI inflation kept ratcheting higher and higher. In a December 2021 NYT column, Krugman threw in the towel and admitted he had been wrong, but in his own special way (again, with my bolding):

The current bout of inflation came on suddenly…. Even once the inflation numbers shot up, many economists—myself included—argued that the surge was likely to prove transitory. But at the very least it’s now clear that “transitory” inflation will last longer than most of us on that team expected….

… I believe that what we’re seeing mainly reflects the inherent dislocations from the pandemic, rather than, say, excessive government spending. I also believe that inflation will subside over the course of the next year and that we shouldn’t take any drastic action. But reasonable economists disagree, and they could be right….

The latest projections from board members and Fed presidents are for the interest rate the Fed controls to rise next year, but by less than one percentage point, and for the unemployment rate to keep falling.

Perhaps surprisingly, my own position on policy substance isn’t all that different from either Furman’s or the Fed’s. I think inflation is mainly bottlenecks and other transitory factors and will come down, but I’m not certain, and I am definitely open to the possibility that the Fed should raise rates, possibly before the middle of next year….

Maybe the real takeaway here should be how little we know about where we are in this strange economic episode. Economists like me who didn’t expect much inflation were wrong, but economists who did predict inflation were arguably right for the wrong reasons, and nobody really knows what’s coming.

For those keeping score at home, remember that when I pointed out that Keynesians Christina Romer and Jared Bernstein had been notoriously wrong in their forecasts of unemployment following the Obama stimulus package, Krugman told us that “some predictions matter more than others.” So this time around, Krugman can’t argue that his botched inflation predictions are irrelevant. Instead, as we see above, he’s claiming that his opponents were right but for the wrong reasons. Even when Krugman is wrong, he’s still better than his enemies!

And for the sake of completeness, let’s reproduce this quotation from Klaus Schwab (who has doctoral degrees in both economics and engineering) and Thierry Malleret in COVID-19: The Great Reset. Writing in July 2020, Schwab and Malleret claimed:

At this current juncture, it is hard to imagine how inflation could pick up anytime soon…. The combination of potent, long-term, structural trends like ageing and technology … and an exceptionally high unemployment rate that will constrain wages for years puts strong downward pressure on inflation. In the post-pandemic era, strong consumer demand is unlikely. (p. 70)

So when he’s not plotting to take over the world, Klaus Schwab is making erroneous inflation predictions.

The Leader of the Market Monetarists, Scott Sumner

As I said earlier, the market monetarists are far more civil than Krugman, Brad DeLong, and some other leading Keynesians. (And as far as I know, they’re not bent on world domination either.) But to repeat myself: since 2008, the one trump card the market monetarists had in their rivalry with the Austrians was that many of us prematurely warned about consumer price inflation à la the 1970s, whereas the market monetarists relied on TIPS (Treasury inflation-protected securities) yields and other market indicators to reassure their readers that inflation wouldn’t be a problem.

In that context, then, it’s very interesting that Scott Sumner, founder and leader of the market monetarists, wrote a blog post entitled, “Fed Policy: The Golden Age Begins,” in January 2020. Here are the key excerpts, with my bold:

We are entering a golden age of central banking, where the Fed will become more effective and come closer to hitting its targets than at any other time in history. Over the next few decades, inflation will stay close to 2% and the unemployment rate will generally be relatively low and stable. And this certainly won’t be due to fiscal policy, which is currently the most recklessly pro-cyclical in American history.

… Fed policy is becoming more effective because it is edging gradually in a market monetarist direction….

If they continue moving in this direction, then NGDP [nominal gross domestic product] growth will continue to become more stable, the business cycle will continue to moderate, inflation will stay in the low single digits, and unemployment will stay relatively low and stable.

It won’t be perfect; the business cycle is not quite dead. There will be an occasional recession. But the business cycle is definitely on life support….

As an analogy, when I was young I would frequently read about airliners crashing in the US…. My daughter is a junior in college and doesn’t recall a single major airline crash in the US, excluding a couple of small commuter planes in the 2000s…. After each crash, problems were fixed and planes got a bit safer.

Recessions and airline crashes: They are getting less frequent, and for the exact same reason.

Before closing, let me deal with the obvious response from the market monetarist camp: They could defend Sumner’s claims by arguing that the Fed only strayed from the ideal path because of covid. Well, sure, but Sumner was still wrong for placing so much faith in central bankers and their “independence.”

Furthermore, as I explain in my chapter on market monetarism in this book, Sumner’s criterion of “NGDP growth” as a measure of tight or loose policy is almost a tautology. It is close to me arguing, “We will continue to see rising prices because of the Fed’s reckless policies, unless demand growth subsides, in which case we won’t.”

Tags: Featured,newsletter

Permanent link to this article: https://snbchf.com/2022/04/p-murphy-keynesians-market-monetarists-didnt-see-inflation/

Leave a Reply