The pursuit of decentralised digital systems continues despite a period of intense turbulence in the cryptocurrency markets. Keystone/ Valentin Flauraud The price of bitcoin has plummeted to a third of its peak value, an experimental cryptocurrency called Terra has crashed in spectacular fashion and several crypto companies have shed jobs or are faced with bankruptcy. Where does this leave the growing blockchain industry in Switzerland? “The market crash is going to be cataclysmic for a lot of Swiss start-ups,” Adrien Treccani, CEO of the Swiss crypto company Metaco, told SWI swissinfo.ch. “I predict that around 20% to 30% of them will die. They will disappear within the next six months.” The volatile cryptocurrency market has experienced yet another boom-and-bust

Topics:

Swissinfo considers the following as important: 6c) Crypto Currencies English, Business, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

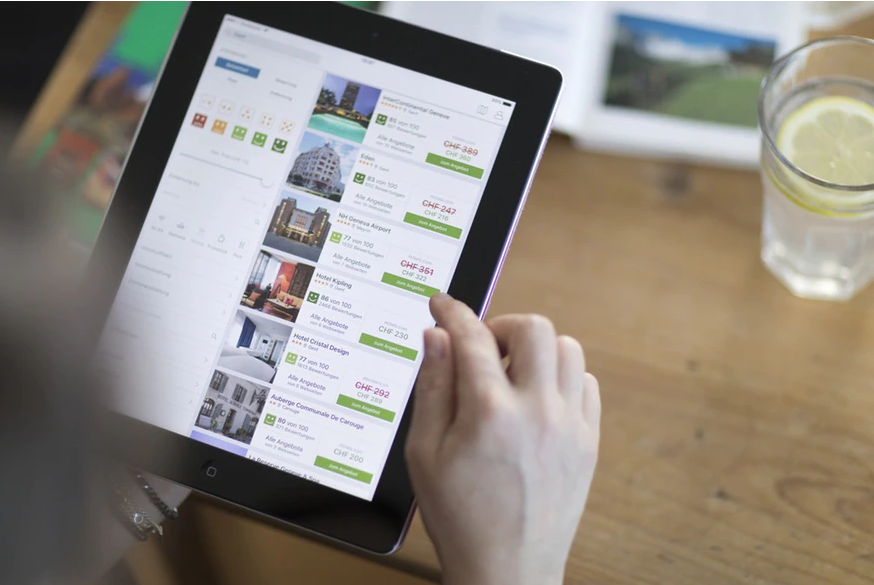

The pursuit of decentralised digital systems continues despite a period of intense turbulence in the cryptocurrency markets. Keystone/ Valentin Flauraud

The price of bitcoin has plummeted to a third of its peak value, an experimental cryptocurrency called Terra has crashed in spectacular fashion and several crypto companies have shed jobs or are faced with bankruptcy. Where does this leave the growing blockchain industry in Switzerland?

“The market crash is going to be cataclysmic for a lot of Swiss start-ups,” Adrien Treccani, CEO of the Swiss crypto company Metaco, told SWI swissinfo.ch. “I predict that around 20% to 30% of them will die. They will disappear within the next six months.”

The volatile cryptocurrency market has experienced yet another boom-and-bust phase. The price of bitcoin went up more than ten-fold between the middle of 2020 and the end of last year, and then slumped by 30%, with much of the losses being felt in the last couple of months.

The boom phase sucked in money from day traders and start-up investors, who were encouraged by a lack of other money-spinning opportunities and the joys of obtaining credit to invest at rock bottom interest rates.

Crushing setbacks

“We saw a lot of money blindly flow into dreams that were being sold by technology religion guys,” said Erik Wirz, managing partner of canton Zug headhunting firm Wirz & Partners. “People want to believe dreams, but a lot of it was vaporware. Several months ago, even before the crypto price crash, investors started asking: ‘Where is the business plan, where is the money?’”

Boosted by an extensive overhaul of financial and company laws to fold cryptocurrencies into the corporate landscape, the Swiss blockchain industry has grown to more than 1,000 companies, supporting 6,000 jobs.

The self-styled ‘Crypto Nation’ has yet to see job cuts on the scale of the US-based Coinbase exchange, or company meltdowns along the lines of the Three Arrows Capital hedge fund in the British Virgin Islands, the US firms Voyager Digital and Blockfi or the Singapore-based crypto lending outfit Vauld.

“My gut tells me that some companies in Switzerland are in trouble but how the market plays out in future, only time will tell,” said Dirk Klee, CEO of Zug-based Bitcoin Suisse. The company increased staffing levels by 60% to 300 last year, but insists that it has not overstretched itself, unlike other competitors.

“Other market participants have quadrupled their workforce, or even more, and they are now looking at corrections. We have been a little more prudent,” he added.

The recent crushing setbacks have also failed to dampen the enthusiasm of the Swiss blockchain industry as a whole. “It’s just one of the characteristics of the crypto markets that we have these crashes. This was no big surprise,” said Andy Flury, founder of the crypto financial services firm AlgoTrader, based in Zurich.

“There’s still a lot of experimentation and some technologies are very new. If some things don’t work out now it doesn’t mean they can’t do better in the future,” said Diana Biggs, Chief Strategy Officer at Valour, a Canadian-based company that issues crypto-backed investment products on stock exchanges. “There is no putting the brakes on this technology and turning back. I am still bullish on this space.”

Democratic internet

Such words are typical in Switzerland and may sound like bravado or sheer delusion. The underlying message is that the price of bitcoin is an irrelevance, like the froth on a cappuccino. What matters is the substance left behind when the bubbles have burst.

The goal of blockchain is to build a digital system that frees users from the constraints of the internet by reducing fees, paperwork and time wasted by intermediaries. It also aims to wrest control away from tech giants that harvest personal data for their own profit. The ethos is to create a new type of internet that is owned and controlled by a network of ordinary users.

Such a system, say it creators, will offer a fairer means of commerce, trading, voting, computer gaming, running a business, collecting royalties as an artist, storing personal data and a variety of other use cases.

“Crypto as an asset class is here to stay notwithstanding recent events,” Tracey McDermott, head of conduct, financial crime and compliance at Standard Chartered Bank, told the recent Swiss-Singaporean Point Zero Forum on financial technology in Zurich.

“None of our clients have withdrawn from contracts or delayed projects. The number of new enquiries has not decreased,” said Andy Flury. “The crypto crash is having no impact on the long-term digital assets strategies of the large financial companies.” AlgoTrader counts ten major banks among its clients, as does Swiss digital assets bank Sygnum. Metaco, another company that connects the classical financial world with cryptocurrencies, has recently signed up US banking giant Citi and Société Générale of France.

The recent market crash was accelerated by the failure of a form of cryptocurrency known as a stablecoin, which is designed to peg its value to traditional currencies or other assets, such as gold. The Terra stablecoin, which tried to peg to the US dollar, became wildly popular until it fell apart, taking billions of dollars of investor money with it. Innovation turned into destruction overnight.

This has led to a surge of new regulatory scrutiny from different countries, including the United States and European Union, and from international bodies that oversee the global financial markets.

There is also no denying that decentralised finance has seen much nefarious activity. The public’s lust for a quick buck provides fertile ground for ponzi schemes, insider trading, front-running and misleading marketing of crypto investment schemes.

“A lot of trading in digital assets looks like the US stock market in 1928 [a period of frenetic speculation that preceded the Wall Street crash],” Urban Angehrn, head of the Swiss financial regular, told the Point Zero Forum. “All kinds of abuse…are frequent and common.”

Closer regulatory scrutiny

The Swiss Financial Market Supervisory Authority has so far concentrated its efforts on preventing money laundering via cryptocurrencies. But Angehrn hinted that the time might be ripe for more stringent policing of market abuses.

“It’s not forbidden to speculate. Speculation is a legal activity,” he said. But fleecing speculators with shady practices is not OK. “We need to have orderly trading and transparency. We should have the means to fight abusive activities,” Angehrn warned.

Several cryptocurrency companies that started off life in remote offshore islands, such as the BitMEX and Binance exchanges, have taken note by increasingly moving parts of their operations to strongly regulated jurisdictions like Switzerland.

The cryptocurrency crash will also flush weaker performers out of the market. Many surviving companies view an anticipated period of depressed cryptocurrency prices – known as a ‘crypto winter’ – as an opportunity to quietly build without the trading frenzy distraction.

“This bursting bubble will filter out the noise and simplify the market. Normally after a big collapse, new opportunities emerge,” said Adrien Treccani.

Tags: Business,Featured,newsletter