I moved aside and watched our twelve-year-old van pull into the driveway. My wife opened the door, smiled, and told me she got the job. Putting the basketball down, I hugged her and told her I was proud. The job was a part-time evening and weekend position at the local country health food store, a good fit considering my wife’s interests. But deep down, a sense of sadness and partial defeat rolled over me. The ten-year period leading up to this moment had found my wife solely focused on homemaking and homeschooling our three children, a responsibility so demanding that few ever attempt it—even fewer see it through. But there we stood, eleven years into our marriage, resigned to the fact my single income was starting to fall short. Not due to any pay decrease,

Topics:

Oliver Adamson considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

I moved aside and watched our twelve-year-old van pull into the driveway. My wife opened the door, smiled, and told me she got the job. Putting the basketball down, I hugged her and told her I was proud. The job was a part-time evening and weekend position at the local country health food store, a good fit considering my wife’s interests. But deep down, a sense of sadness and partial defeat rolled over me. The ten-year period leading up to this moment had found my wife solely focused on homemaking and homeschooling our three children, a responsibility so demanding that few ever attempt it—even fewer see it through. But there we stood, eleven years into our marriage, resigned to the fact my single income was starting to fall short. Not due to any pay decrease, change in spending habits, or some major unforeseen event, but the result of government lockdowns and central banking monetary policies. I wanted blood.

I moved aside and watched our twelve-year-old van pull into the driveway. My wife opened the door, smiled, and told me she got the job. Putting the basketball down, I hugged her and told her I was proud. The job was a part-time evening and weekend position at the local country health food store, a good fit considering my wife’s interests. But deep down, a sense of sadness and partial defeat rolled over me. The ten-year period leading up to this moment had found my wife solely focused on homemaking and homeschooling our three children, a responsibility so demanding that few ever attempt it—even fewer see it through. But there we stood, eleven years into our marriage, resigned to the fact my single income was starting to fall short. Not due to any pay decrease, change in spending habits, or some major unforeseen event, but the result of government lockdowns and central banking monetary policies. I wanted blood.

To bathe in lament would be wrong. My wife and I have been and continue to be abundantly blessed. Our decision to have my wife stay home beyond her initial maternity leave led to a second and third child and an eventual decision to homeschool. All this on a single income stretched by a string of small sacrifices: being a single-used-vehicle family, refraining from taking exotic family vacations, and thrift shopping whenever it met our requirements, to name a few. These disciplines afforded us the ability to own a home—a mortgage that is—and, more importantly, to homeschool our three children.

Detailing our reasons for homeschooling would overwhelm the subject at hand, so I’ll exercise brevity. Public schools are no longer safe. Teachers no longer have the authority to maintain order and hold students to account; respect hit the off-ramp several exits ago. Large classrooms don’t afford teachers the ability to better know their students or offer them flexibility based on individual learning styles. Not that academics seem to matter anymore. Then there’s the indiscriminate spewing of left ideologies with little tolerance for pushback. No, thank you—we covet our kids too much. More than a new vehicle, second vehicle, picturesque vacation, and yes, even more than Gap Kids.

I was fortunate enough to receive an annual salary increase two years running, both of which outpaced official inflation numbers. An astute budgeter, I know we haven’t expanded our lifestyle to include more comforts or upgrades. So, we should be getting ahead, but we’re not. Given a choice between working six days a week or having my wife pick up some part-time work, we decided on the latter. This affords our kids more one-on-one time with Dad instead of less, hopefully reducing any feelings of guilt, regret, or resentment down the road. And needless to say, Mom benefits from a bit of time spent away from home. So, what happened? How did we go from building savings every month to relying on those savings just to cover expenses?

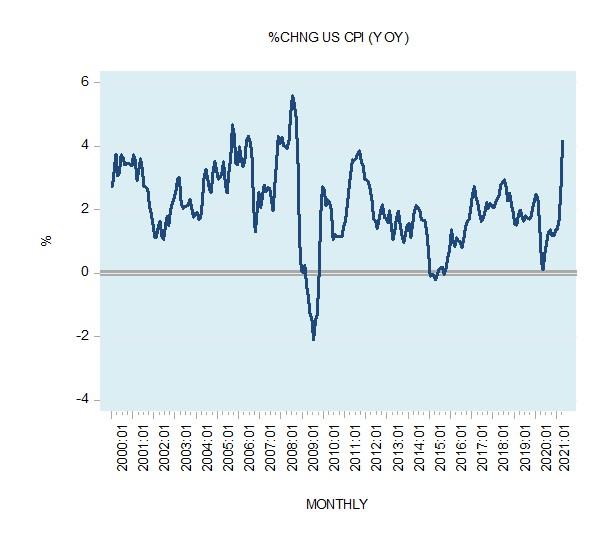

Rising consumer prices, a.k.a. price inflation, resulting from central bank increases to the money supply, a.k.a. monetary inflation. For added depth, we turn to “Monetary Inflation and Price Inflation,” an article published on mises.org which is part of economist Robert P. Murphy’s series entitled Understanding Money Mechanics. Murphy begins by including the following excerpt from Ludwig von Mises’s Economic Freedom and Interventionism: An Anthology of Articles and Essays, which highlights the importance of differentiating between price and monetary inflation:

There is nowadays a very reprehensible, even dangerous, semantic confusion that makes it extremely difficult for the non-expert to grasp the true state of affairs. Inflation, as this term was always used everywhere and especially in this country [the United States], means increasing the quantity of money and bank notes in circulation and the quantity of bank deposits subject to check. But people today use the term “inflation” to refer to the phenomenon that is an inevitable consequence of inflation, that is the tendency of all prices and wage rates to rise. The result of this deplorable confusion is that there is no term left to signify the cause of this rise in prices and wages. There is no longer any word available to signify the phenomenon that has been, up to now, called inflation. It follows that nobody cares about inflation in the traditional sense of the term. As you cannot talk about something that has no name, you cannot fight it. Those who pretend to fight inflation are in fact only fighting what is the inevitable consequence of inflation, rising prices. Their ventures are doomed to failure because they do not attack the root of the evil.

In the absence of any graphs or balance sheets depicting current monetary inflation rates, I recommend anyone interested visit the Federal Reserve Economic Data (FRED) site and access their many tutorials to get started. Verifications aside, none of the following should come as a shock to those following government responses to covid-19. Having limited economic activity through lockdowns, global governments have turned to their central banks to bail out their citizens and businesses alike. Growing government reliance on central bank monetary policies was evident long before this “pandemic.” Still, many have only recently become aware of the staggering rate at which the money supply has increased. To reiterate, this increase in money supply is what we call “monetary inflation” or simply “inflation.” What does history teach us about this topic?

Murphy’s article demonstrates the dangerous effects by referencing three historical examples of hyperinflation, the US Civil War, the Weimar Republic, and, more recently, Zimbabwe, which experienced unimaginable price inflation. Regarding the latter, he writes,

A more recent (and severe) hyperinflation occurred in Zimbabwe, from 2007 to 2009. In the worst month, November 2008, prices increased more than 79 billion percent, or 98 percent per day. As with other hyperinflations, in Zimbabwe too the connection between monetary and price inflation was evident.

But how does increasing the quantity of money cause consumer prices to rise?

In his book What You Should Know about Inflation, Henry Hazlitt explained their relationship like this,

Let us see what happens under inflation, and why it happens. When the supply of money is increased, people have more money to offer for goods. If the supply of goods does not increase—or does not increase as much as the supply of money—then the prices of goods will go up. Each individual dollar becomes less valuable because there are more dollars. Therefore more of them will be offered against, say, a pair of shoes or a hundred bushels of wheat than before. A “price” is an exchange ratio between a dollar and a unit of goods. When people have more dollars, they value each dollar less. Goods then rise in price, not because goods are scarcer than before, but because dollars are more abundant.

In the era of global lockdowns, we’ve seen increasing supplies of money, decreasing supplies of goods, and governments financing their citizens to forgo work and stay home. Fewer workers produce fewer goods, and as we’ve just learned, fewer supplied goods with increasing supplies of money lead to higher prices.

Although we haven’t experienced anything remotely close to Murphy’s earlier precedents, many families are being squeezed. Fortunately, avenues do exist which lead to improved financial outlooks. Living within one’s means, avoiding “bad” debt, implementing a budget, and substituting goods when specific prices soar, to name a few. Sadly, authoritarian governments equipped with central banking policies minimize the positive effects of making responsible personal choices. In my family’s case, having exhausted all other options, increasing our revenue stream was the only card left to play.

I can’t say enough about my wife—she’s a rock. Together, we know what we want for our family despite where the rest of the world may be heading. We knew there would be challenges and we would need to make sacrifices along the way—but it’s been worth every last one of them. We’re raising our children and leaving little to the state. We won’t shelter them from opposing views. That wouldn’t be right. Instead, we will introduce distinct topics and world views on our terms and will encourage our kids to think critically. Some say our aspirations will fail, and perhaps they’re right. God only knows. Until then, you’ll find us here in our home, building up our legacy—inflationary policies be damned.

Tags: Featured,newsletter