The pound continued to strengthen against the Swiss franc yesterday following the news that the UK’s current lockdown situation appears to be slowing the spread of COVID-19, causing a 0.85% movement in GBPCHF exchange rates throughout the day. Scientists at the London School of Hygiene & Tropical Medicine questioned 1,300 people in the UK in an online study, which found that the average number of daily contacts was down 70% now compared to before the country went into lockdown and social distancing measures were set out. John Edmunds, who led the study, said “if we see similar changes across the UK population, we would expect the epidemic to decline”. The UK also appears to be making inroads in finding a treatment for those affected by Coronavirus. A new drug

Topics:

Ben Fletcher considers the following as important: 1.) CHF, 1.) Swiss Franc Forecast, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The pound continued to strengthen against the Swiss franc yesterday following the news that the UK’s current lockdown situation appears to be slowing the spread of COVID-19, causing a 0.85% movement in GBPCHF exchange rates throughout the day.

Scientists at the London School of Hygiene & Tropical Medicine questioned 1,300 people in the UK in an online study, which found that the average number of daily contacts was down 70% now compared to before the country went into lockdown and social distancing measures were set out. John Edmunds, who led the study, said “if we see similar changes across the UK population, we would expect the epidemic to decline”.

The UK also appears to be making inroads in finding a treatment for those affected by Coronavirus. A new drug known as ‘Remdesivir’, manufactured by pharmaceutical company Gilead, has been fast tracked by the Government, with studies to be conducted at 15 NHS centres in England and Scotland.

The UK also received a welcome boost as Markit Manufacturing Purchasing Managers Index (PMI) data was released at 47.8, slightly better than the 47 expected.

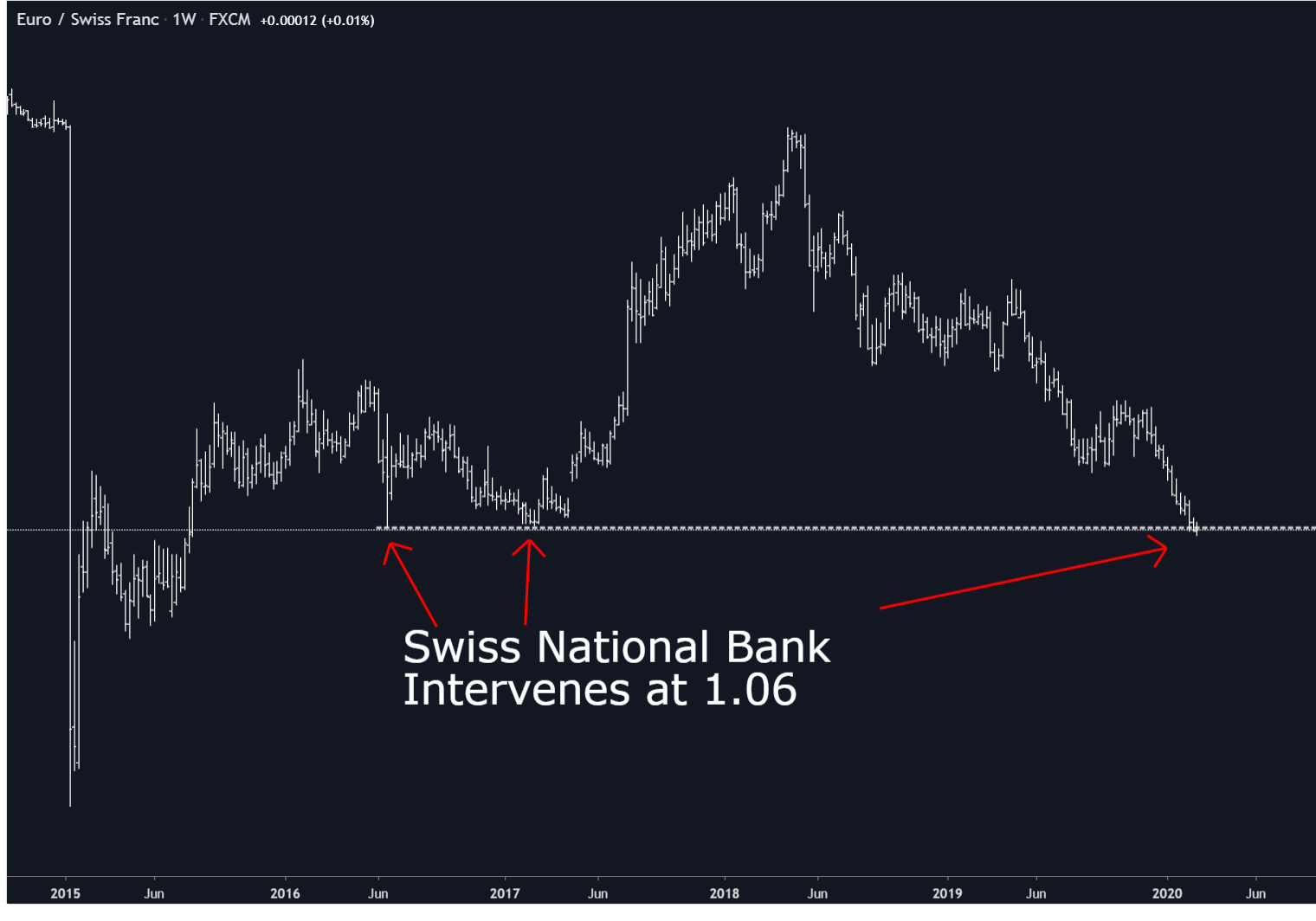

Swiss National Bank Outlines Plans to Expand on Emergency Liquidity Measures

As the death toll and new positive cases in Switzerland also continue to rise, its government yesterday outlined further preparations to expand on its emergency programme to help Swiss businesses impacted by Coronavirus. The Swiss National Bank has already given over half of the 20 billion Swiss francs set aside as emergency liquidity, and further funding will likely be added to this to support the economy. This news was also a contributing factor to Swiss franc weakness through yesterday’s trading session, as historically any monetary stimulus measures are often viewed negatively by the markets, causing investors to hold funds in other more stable currencies.

Swiss Inflation Figures Increase by 0.1% in March

This morning Swiss inflation data in the form of Consumer Price Index for March was released at -0.5% year on year, in line with market expectations, and increased by 0.1% compared to February. Rising prices for clothing taking into account end of season sales, and increases in prices for new cars were the main contributors to this slight improvement.

Tomorrow morning UK Markit Services Purchasing Managers Index for March will be released and is expected to fall to 34.8 from 35.7 noted in February. As the services sector makes up over 80% of the UK’s economic output, anything below the expected figure could cause the pound to weaken. Anything below 50 is seen as contraction, so it is already apparent from last month’s reading that this sector has already taken a hit, and further negative news could see GBPCHF exchange rates fall significantly. Clients with a GBPCHF currency exchange requirement could benefit from speaking to a member of the team ahead of this announcement, so that we can keep you informed of the latest market movements.

If you have a currency requirement and would like to discuss your options, feel free to get in touch using the form below.

Tags: Featured,newsletter