A Finite Life Span We have been promising to get back to the topic of capital destruction, which we put on hiatus for the last several weeks to make our case that the interest rate remains in a falling trend. Today, we have a different way of looking at capital destruction. Socialism is the system of seeking out and destroying capital. Redistribution means taking someone’s capital and handing it over as income to someone else. The rightful owner would steward and compound it, not consume it. But the recipient of unearned free goodies happily and uncaringly eats it up. Socialism is not sustainable. It inherits seed corn from a prior, happier system, and it lasts only as long as the seed corn. A Soviet propaganda

Topics:

Keith Weiner considers the following as important: Central Banks, Debt and the Fallacies of Paper Money, Featured, newslettersent, non-financial corporatios, On Economy, On Politics

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

A Finite Life SpanWe have been promising to get back to the topic of capital destruction, which we put on hiatus for the last several weeks to make our case that the interest rate remains in a falling trend. Today, we have a different way of looking at capital destruction. Socialism is the system of seeking out and destroying capital. Redistribution means taking someone’s capital and handing it over as income to someone else. The rightful owner would steward and compound it, not consume it. But the recipient of unearned free goodies happily and uncaringly eats it up. Socialism is not sustainable. It inherits seed corn from a prior, happier system, and it lasts only as long as the seed corn. |

|

Totalitarian SocialismThere are different flavors of socialism. The 20th century witnessed an aggressive totalitarian form. Both communism and national socialism feature military occupation of domestic territory and conquest of foreign lands. Few people willingly feed whatever they have into the sausage grinder of State sacrificial collectivism. And so totalitarian socialism has armed thugs all over the streets, both open military and secret police. There are frequent killings, of those suspected of disloyalty or holding back small scraps. In their constant fear of uprising, they use disappearances, interrogations, and torture to root out the names of traitors to their bloody revolution. Thankfully, the major totalitarian socialist regimes were defeated militarily like the Nazis, collapsed after they depleted all available capital like the Soviets, or reformed like China. |

Joseph Stalin’s image was plastered all over the Soviet realm – he was depicted as a “protector” and father figure, but in reality he was one of the most brutal dictators the world has ever seen. At the 34th Congress of the All-Union Communist Party in 1934, more than 100 delegates gave Stalin a negative vote, while the mayor of Leningrad and fellow politburo member Sergey Kirov only received three negative votes. - Click to enlarge Veteran members of the party approached Kirov, suggesting he should take over as party leader from Stalin – an offer Kirov declined. He then foolishly reported the conversation to Stalin. The latter suppressed the result of the vote and Kirov was murdered shortly thereafter (although it has never been proven, it is widely held that he was killed on Stalin’s orders). Stalin feared he might lose power and in a fit of paranoia began the Great Purge. It is estimated that from 1937 to 1938 alone, approximately 1.75 million people were executed (these estimates vary, as the number later officially admitted to by the authorities was “only” a little over 680,000. It is suspected though that many executions were covered up by disguising them as 10-year prison sentences “without the right to communication” and making up alternative causes of death later on). It is worth noting that several Western intellectuals have tried to whitewash Stalin’s crimes with an eagerness well in excess of that demonstrated by the KGB (the successor organization to the NKDV which managed the executions). [PT] |

Soft SocialismAnother flavor of socialism is based on so-called soft power. It taxes and regulates every private productive activity, owns and monopolizes some sectors, and promises a minimum level of subsistence to all citizens including food, shelter, and medical care. Unlike the totalitarian forms, this kinder, gentler socialism allows vigorous debate whether the government should criminalize cigarettes, allow people to hail a taxi using an app on their phone, and whether the government should include gender reassignment surgery in the list of medical services to be provided for free. However, as the citizens have mostly gone through government schools, there is almost no debate about whether or not government should take over medical care in the first place. This kind of socialism is not stable. It is either moving towards freer markets, as for example New Zealand famously did starting in the 1980’s. Or it is moving towards government control as the United States infamously did with Obamacare. It’s not stable, because it is rife with contradictions. For example, if I cannot afford my healthcare, and you cannot afford your healthcare, and John and Susie cannot afford their healthcare, then of course we as a collective cannot afford our collective healthcare plus a bureaucracy to manage it (not even counting the waste and corruption). No one with basic economic literacy would believe that. An 8th grader wouldn’t believe it! What makes it popular is the next contradiction. Most people expect to get free health care paid for by someone else. The thought of “free” is so enticing, that people overlook the obvious failings, such as the declining availability and spotty quality. In this flavor of socialism, the destruction of capital is obvious. You can see it in the overworked staff of the National Health Service unable to care for every patient and forced to ration health care and cancel surgeries. You can observe the shabby government projects which house huge and permanent underclasses. You can witness the stagnant economies, which provide little opportunity for business owners to accumulate wealth, fewer good jobs for workers, or hope for the future. |

|

Central Bank SocialismThere is a third flavor of socialism, which was unfortunately popularized by Milton Friedman. He did not see it as socialism, but as we shall show it certainly is. This type of socialism lacks the totalitarian flavor’s military officers, strutting about and demanding to see your papers. It also lacks the boundless welfare programs and endless Ministries of Micromanagement of Human Life of the softer flavor. I refer, of course, to central banking. Friedman advocated a steady expansion of the quantity of dollars, what he called the K% Rule. Friedman’s followers today favor other rules, for example to expand the quantity in order to grow GDP by what they feel to be the “right” amount. The man most people think to be Friedman’s diametric opposite, John Maynard Keynes, advocated expansion in response to whatever economic problem may come along. Former Fed Chair Janet Yellen, a die-hard New Keynesian, wrote a paper in which she argued for printing more dollars to enable employers to hire more workers. Whether the central bank is to expand the quantity of dollars at a steady rate, to achieve an economic goal, or purely at the discretion of philosopher-kings, the principle is the same. We consider them to be sub-flavors of the same flavor of socialism. The central bank can nudge us for our own good, if not the good of politically connected cronies. What is this nudging? They have found a very clever way to induce people to do as the central planners wish, without the machine guns or bloated bureaucracies. Keynes, citing Lenin, referred to “engaging all of the hidden forces of economic law”. In the same breath, he admitted that it was “on the side of destruction,” but that does not seem to have deterred anyone. What economic law induces people to act? It’s that people act according to incentives. The central bank can change certain incentives. We will leave off the falling interest rate for now, but let’s look at something else the central bank can do. It can make it so that credit is available to companies who don’t even produce enough revenue to cover their interest expense. Normally, such zombies (as they are called) would not be able to obtain credit. Who lends money to a company that will have to borrow more money just to cover the interest? But we are not in a normal world. We are in the third flavor of socialism. And the Fed has made it so that the zombies, who ought not to be able to get credit at all, have gotten mass quantities of it. And this brings us back to our theme of destruction of capital. It should be obvious that it’s destructive to feed credit to a company which cannot pay its cost of credit (and this is in a world of suppressed cost of credit, at that). Zombies wear out machinery that they cannot replace, and pay workers’ wages with borrowed funds that they cannot afford. When the end inevitably arrives, those who lent to the zombie lose their principal. It should also be obvious that zombies add to GDP, at least while they exist. So the GDP targeting crowd sees this as a good thing. And zombies produce goods, thus increasing supply and thus pushing down prices. So the inflation targeters justify even more of the policy that feeds credit to zombies. And zombies employ people, so the unemployment optimizers see the policy as good. Stock prices are also rising, so investors see it as good, not to mention Wall Street. By every conventional macroeconomic aggregate measure, feeding credit to zombies is a Good Thing. This is not an argument in favor of lending to zombies. It is an argument against using conventional macroeconomic aggregate measures. They are misleading. |

Convocation of the clueless – as we recently mentioned (in a caption to MN Gordon’s article Haunted by the Ghosts of the Eastern Bloc), central banks so to speak represent a special case of the socialist calculation problem. - Click to enlarge Even if one graciously assumes that central bankers have nothing but the best intentions, they are nevertheless unable to determine what the “correct” interest rate or money supply should be – regardless of the reams of data they consult. The widely accepted notion that so-called counter-cyclical monetary policy, which consists largely of letting the supply of money and credit grow at varying speeds, serves to “smooth” the business cycle is fundamentally misguided. In actual practice, it lengthens boom and bust cycles and vastly increases their amplitude, while dramatically decreasing the economy’s long term capacity for growth and undermining its structural soundness. [PT] |

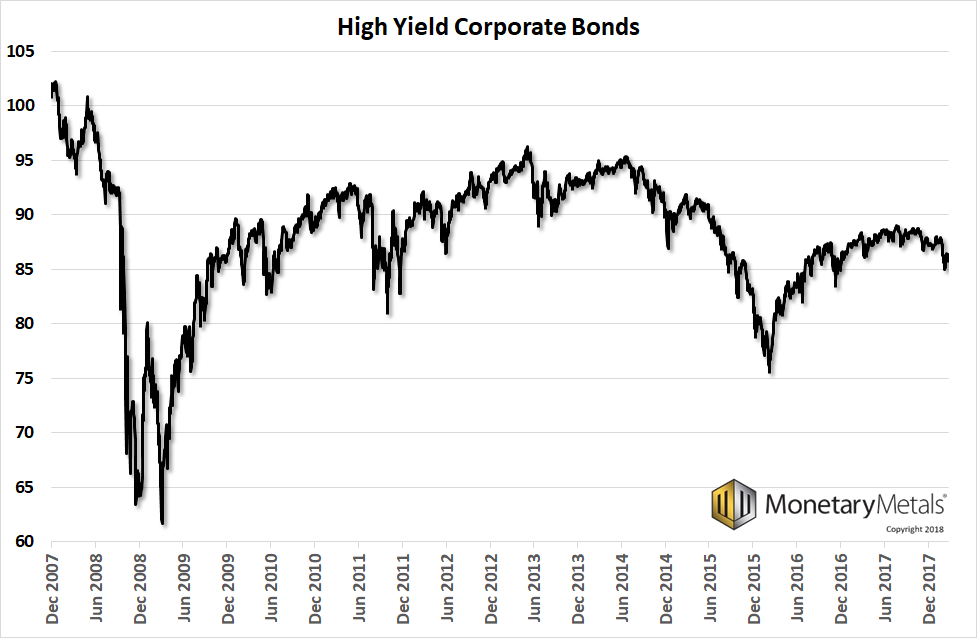

NudgingHowever, they’re used for a reason. They provide cover to this third flavor of socialism, for the central planners who nudge us down the socialist road to the destruction of capital. So how does this nudging work? What is the form of the incentive? They make it profitable to fork over your capital to zombies. People like to make a profit. Who would have known? Here is a chart of an ETF which owns high yield corporate bonds, presumably zombies among them. If you bought in the lows after the last crisis, you could have made capital gains of over 50% in four years (not counting the yield). After that, well it is not looking so good anymore. However, there is another trade that is still making money. At least for now. |

High Yield Corporate Bond , Dec 2007 - Dec 2017 |

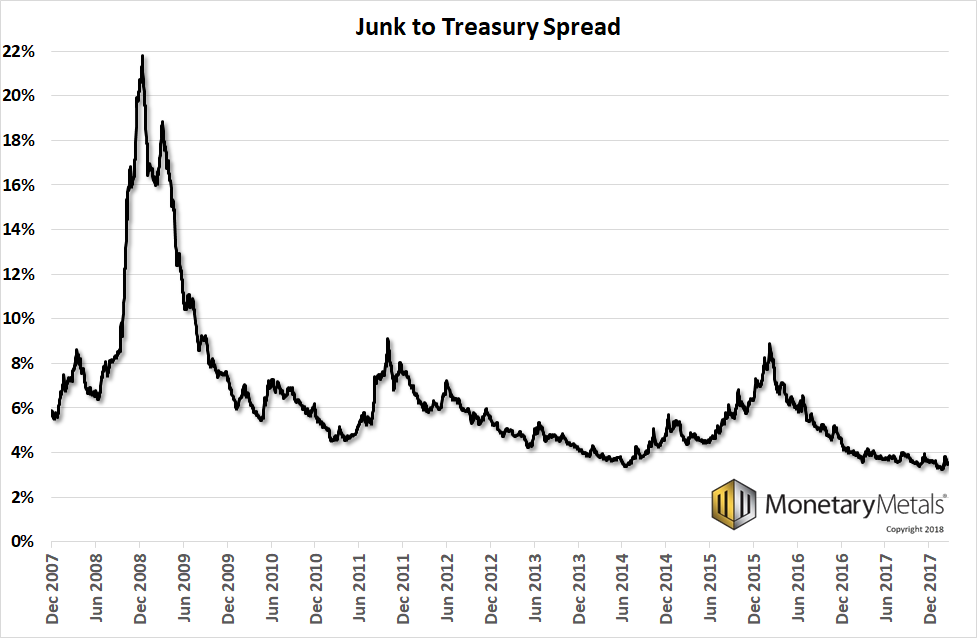

Spread between junk and treasury bondsHere is a graph of the spread between junk and treasury bonds (the BofAML US High Yield Master II Option-Adjusted Spread). There is currently only a 3.5% difference in yield between junk bonds and Treasury bonds. The way to have played this was to buy junk and short treasuries. The more this spread narrowed, the more you won. It performed brilliantly until mid-2014. Then you wanted to be out of it until 2016. After that, you had another good run until a month ago. We think this trade won’t be so good going forward. Not because it’s within a point of the all-time bottom. Though it is, and one would have to be worried about that. But because zombies are time bombs waiting to go off. With each passing day, they get closer to blowing up. Don’t forget that they are destroying investor capital, and piling up more debt every day. And also, they get closer to blowing up with each uptick in the interest rate. It looks to us like junk bond yields have been in a rising trend for about half a year. LIBOR has been in a rising trend for three years, steepening considerably since September. Lured by profits, investors are feeding capital to zombies, who destroy it. They do it because the Federal Reserve has made it profitable to do so. |

Junk to Treasury Spread, Dec 2007 - Dec 2017 |

| Keep in mind that employees of zombies buy houses, remodel kitchens, buy cars with 0% financing for 72 months, eat at restaurants, buy Swiss watches, etc. One could look at the major creditors of the zombies and their biggest vendors, and predict the impact to those entities. But beyond that, it is impossible to determine the full impact. The problem has grown very big.

Contrary to Milton Friedman, we argue that a central bank brings a flavor of socialism. The means may be different, but like the other flavors, the central banking flavor seeks out and destroys capital. The capital destruction is less obvious, especially if you look only at conventional macroeconomic measures such as GDP and unemployment. You must look at falling marginal productivity, or the rising number of people who are neither employed nor unemployed. We need to evolve away from central banks, socialism, and a policy of capital destruction. We need to move forward towards the gold standard, the monetary system of a free market. The monetary system where capital is accumulated, not consumed. |

US Non-Financial Corporate Liabilities, 1975 - 2018(see more posts on non-financial corporatios, ) |

Tags: central banks,Featured,newslettersent,non-financial corporatios,On Economy,On Politics