Summary:

If you think this is a robust, resilient, stable system, please check your Ibogaine / Hopium / Delusionol intake. Correspondent James D. recently asked for an update on the four intersecting cycles I’ve been writing about for the past 10 years. Here’s the chart I prepared back in 2008 of four long-term cycles: 1. Generational (political/social) 2. Price inflation/wage stagnation (economic) 3. Credit/debt expansion/contraction (financial) 4. Relative affordability of energy (resources) Intersection of Four Long-Term Cycles, 1900 - 2020 - Click to enlarge Here are four of the many dozens of essays I’ve written on these topics over the past decade: Long Cycles: Cheaper Goods, Costlier Capital, Income Disparity

Topics:

Charles Hugh Smith considers the following as important: Featured, newsletter, The United States

This could be interesting, too:

If you think this is a robust, resilient, stable system, please check your Ibogaine / Hopium / Delusionol intake. Correspondent James D. recently asked for an update on the four intersecting cycles I’ve been writing about for the past 10 years. Here’s the chart I prepared back in 2008 of four long-term cycles: 1. Generational (political/social) 2. Price inflation/wage stagnation (economic) 3. Credit/debt expansion/contraction (financial) 4. Relative affordability of energy (resources) Intersection of Four Long-Term Cycles, 1900 - 2020 - Click to enlarge Here are four of the many dozens of essays I’ve written on these topics over the past decade: Long Cycles: Cheaper Goods, Costlier Capital, Income Disparity

Topics:

Charles Hugh Smith considers the following as important: Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

If you think this is a robust, resilient, stable system, please check your Ibogaine / Hopium / Delusionol intake.

|

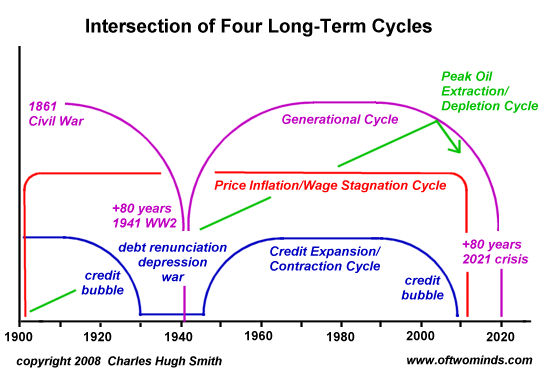

Correspondent James D. recently asked for an update on the four intersecting cycles I’ve been writing about for the past 10 years. Here’s the chart I prepared back in 2008 of four long-term cycles:

1. Generational (political/social)

2. Price inflation/wage stagnation (economic)

3. Credit/debt expansion/contraction (financial)

4. Relative affordability of energy (resources)

|

Intersection of Four Long-Term Cycles, 1900 - 2020 |

Here are four of the many dozens of essays I’ve written on these topics over the past decade:

Beyond the False Dawn: Global Crisis 2020-2022 (February 18, 2011)

We’re in a Boiling-Point Crisis of Exploitive Elites (June 19, 2017)

The key point that’s not communicated in the chart is there are dynamics that interact with each of these cycles. For example, demographics are influencing each of these trends in self-reinforcing ways.

Governments are borrowing more to fund the promises made to seniors decades ago when there were relatively few retirees compared to the working populace. Now that the ratio of those collecting government benefits to workers is 1-to-2 (one retiree for every worker), the system is buckling.

The “solution” is to borrow increasing sums from future taxpayers to fund pay-as-you-go healthcare and pension programs for retirees.

Technology is another dynamic that is actively influencing all these cycles in self-reinforcing ways. As technology is substituted for human labor, wages stagnate and the size of the populace paying taxes dwindles accordingly. The “solution” is once again to borrow more to substitute for declining purchasing power.

The dynamics driving wealth/income inequality and the rise of politically/financially dominant elites are also powering these cycles. As Peter Turchin has explained–a topic covered in my essay When Did Our Elites Become Self-Serving Parasites? (October 4, 2016)– social disunity / discord rises when the number of people promised a spot in the elite far exceeds the actual number of slots available.

In summary, the four cycles are intact and poised to intersect in a very messy fashion within the next decade. various centralized efforts have been made to paper over the secular stagnation, political polarization, brewing generational wars, resistance to globalism, rising cost of capital, decay of opportunity, soaring debts, rising dominance of speculation / malinvestment /mis-allocation of capital, diminishing returns on centralization, the marriage of Orwell, Huxley and Kafka in officially sanctioned propaganda, increasingly dysfunctional and self-serving institutions and the rising costs of energy, but every one of these makeshift efforts further erodes the resilience of the overall system and increases systemic fragility and vulnerability to self-reinforcing failures of key subsystems.

|

Here are a few charts that illustrate the trends / cycles:

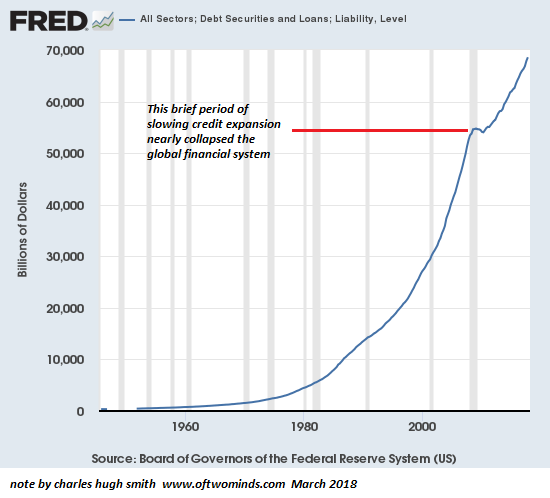

Total systemic debt: note that the tiny wobble in credit expansion in 2008 nearly collapsed the entire global financial system.

|

Debt Securities and Loans, 1960 - 2018 |

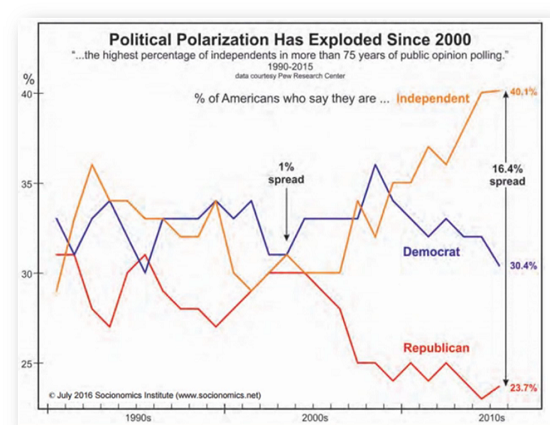

| Here’s political polarization: notice any common ground? |

Political Polarization, 1990 - 2018 |

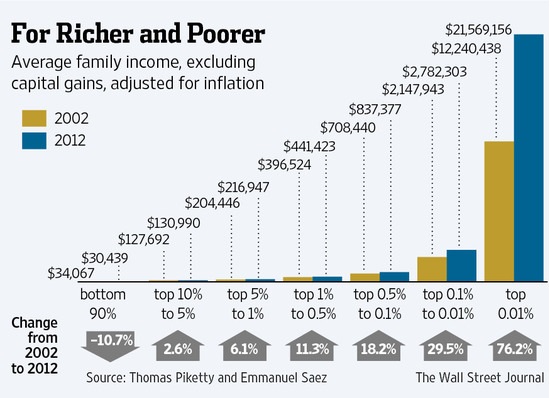

| The elites that are safely protected by the moat of the status quo are doing just fine while the disgruntled debt-serfs who were promised security and rising wages/wealth are massing beyond the moat. |

Average Family Income, 2002 - 2012 |

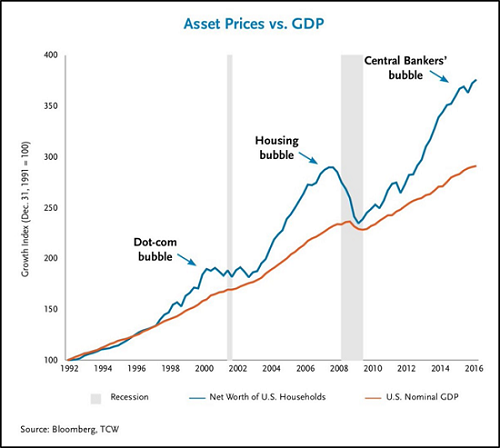

| Meanwhile, asset bubbles and soaring debt are the status quo’s go-to fix for every problem: |

Asset Prices vs GDP, 1992 - 2016 |

Tags: Featured,newsletter