Summary:

Many things that are scarce and thus valuable cannot be bought on the global marketplace. Now that almost every asset class is in a bubble, the question of where to invest one’s capital has become particularly vexing. The ashes of wealth consumed by the 2008-09 Global Financial Meltdown are still warm, at least to those who never recovered, and so buying assets at nosebleed valuations in the hopes of earning another 5% aren’t very compelling to anyone pursuing common-sense risk management. As it happens, I wrote a whole book on this vexing question, An Unconventional Guide to Investing in Troubled Times. I can’t summarize all the ideas presented in the book in one brief blog entry, but some basic principles will

Topics:

Charles Hugh Smith considers the following as important: Featured, newslettersent, S&P 500, S&P 500, The United States

This could be interesting, too:

Many things that are scarce and thus valuable cannot be bought on the global marketplace. Now that almost every asset class is in a bubble, the question of where to invest one’s capital has become particularly vexing. The ashes of wealth consumed by the 2008-09 Global Financial Meltdown are still warm, at least to those who never recovered, and so buying assets at nosebleed valuations in the hopes of earning another 5% aren’t very compelling to anyone pursuing common-sense risk management. As it happens, I wrote a whole book on this vexing question, An Unconventional Guide to Investing in Troubled Times. I can’t summarize all the ideas presented in the book in one brief blog entry, but some basic principles will

Topics:

Charles Hugh Smith considers the following as important: Featured, newslettersent, S&P 500, S&P 500, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Many things that are scarce and thus valuable cannot be bought on the global marketplace.

Now that almost every asset class is in a bubble, the question of where to invest one’s capital has become particularly vexing. The ashes of wealth consumed by the 2008-09 Global Financial Meltdown are still warm, at least to those who never recovered, and so buying assets at nosebleed valuations in the hopes of earning another 5% aren’t very compelling to anyone pursuing common-sense risk management.

As it happens, I wrote a whole book on this vexing question, An Unconventional Guide to Investing in Troubled Times.

I can’t summarize all the ideas presented in the book in one brief blog entry, but some basic principles will serve us well when bubbles abound.

1. Risk cannot be disappeared, it can only be masked or transferred to others.When anyone claims an investment is low-risk, they’re actually claiming either A) the risk has been obscured by fancy footwork or false claims, or B) the risk has been transferred to some mark, chump or bagholder–nowadays, that usually means the taxpayer, as profits are private and losses are socialized.

2. Value flows to what’s scarce. As economist Michael Spence and his colleagues have noted, conventional capital–the kind issued by central banks and private banks–is not scarce and therefore has little value. Ditto for conventional labor. This is why the returns on conventional capital and labor are so low.

Spence et al. suggest that what’s scarce in today’s global economy are ideas that create new business models, new productivity tools and new goods/services: Labor, Capital, and Ideas in the Power Law Economy.

This suggests an investment strategy of identifying what’s scarce, or what will soon be scarce, before everyone else.

3. Many things that are scarce and thus valuable cannot be bought on the global marketplace. The number one example of this is of course health, which is priceless because even having millions won’t buy your health back when it’s been lost.

Yes, you can get patched up with stents or costly meds or maybe score a black-market organ harvested from some unfortunate prisoner somewhere, but all this sort of thing merely keeps you alive; it doesn’t actually restore health.

So any investment in health will pay extremely high dividends. It doesn’t take a ton of cash to invest in one’s health; most of the investment is behavioral.

Other examples of what can’t be bought in the same way stocks, bonds and housing can be purchased: meaningful work, communities with a collective memory of how to get things done in the real world, a functioning community economy, etc.

Investing in work you find fulfilling and meaningful pays dividends that can’t be bought on the marketplace. Once again, investing in one’s skills and social/intellectual capital doesn’t require much cash; thanks to YouTube University and many other free or low-cost sources, anyone can start acquiring the eight essential skills I lay out in my book Get a Job, Build a Real Career and Defy a Bewildering Economy. The basic idea is to learn how to build your own career and job.

|

4. Comparing the relative value of various assets helps identify what’s relatively overvalued and undervalued. The key word here is relative: to say something is absolutely undervalued is trickier than concluding something is undervalued compared to other asset classes.

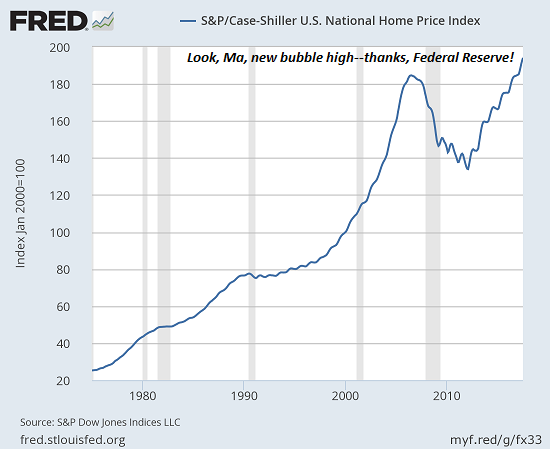

For example, compare housing in the U.S. and global commodities. Based on the national Case-Shiller Index, house prices have reached new bubblicious levels. Thanks, Federal Reserve!

It’s not much of a stretch to reckon that, hmm, valuations are looking a bit more likely to be overvalued here rather than undervalued.

|

S&P 500 and US Home Price Index, 1980 - 2017(see more posts on S&P 500, ) |

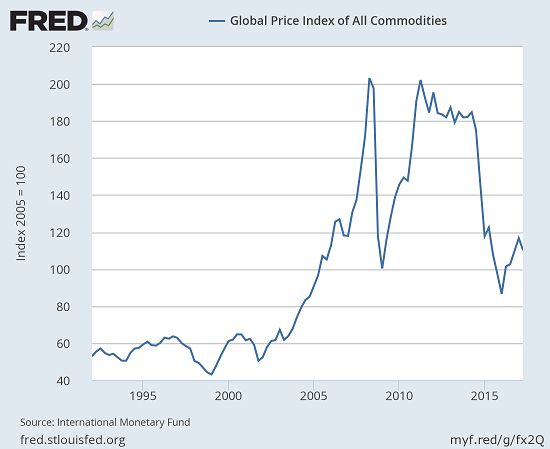

| Now ponder this chart of global commodity prices. It seems commodities are looking decidedly unbubblicious at these levels. |

Global Price Index of All Commodities, 1995 - 2017 |

Many commentators have noted that commodities such as precious metals, agricultural products, fertilizers etc. are considerably lower than their recent peaks.

So one possible strategy here would be to sell that apartment complex you bought in Seattle that’s doubled in value over the past few years and use the proceeds to start nibbling on some commodities that look beaten up, ignored, scorned or simply low in their historic range.

This doesn’t mean commodities can’t or won’t go much lower, or the Seattle apartments can’t or won’t go much higher; remember, risk cannot be disappeared. It’s an exercise in risk management, and making an assessment of what’s more or less likely to happen over the next few years. It’s an exercise in hedging gains by seeking exposure in assets that may become scarce and thus more valuable in the near future.

(This is not a recommendation to pursue this strategy; I mention it only as an example of the principle of comparing relative value.

Tags: Featured,newslettersent,S&P 500