Quarterly meeting of the Incrementum Fund The quarterly meeting of the Incrementum Fund’s advisory board was held on July 19. A pdf transcript of the discussion can be downloaded via the link below. We were once again joined by special guest Brent Johnson, the CEO of Santiago Capital. When Will the Helicopter Take Off? This time the debate revolved around the threat of “helicopter money”, which has become a lot more tangible after Shinzo Abe’s election victory and the aptly nicknamed Helicopter Ben’s visit to assorted Japanese GOSPLAN movers and shakers shortly thereafter. As always though, a wide range of topics was discussed, including the current market views of the participants. Below is the latest chart of the proprietary Incrementum inflation signal (a purely market-based signal that is more sensitive than the usual “inflation expectation” indicators), which continues to indicate that inflation-sensitive assets should be favored at present. Cartoon by Bob Rich, Click to enlarge.

Topics:

Pater Tenebrarum considers the following as important: Brent Johnson, Debt and the Fallacies of Paper Money, Featured, Helicopter Ben, Incrementum Inflation Signal, newsletter, On Economy, Shinzo Abe, The Stock Market

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Quarterly meeting of the Incrementum FundThe quarterly meeting of the Incrementum Fund’s advisory board was held on July 19. A pdf transcript of the discussion can be downloaded via the link below. We were once again joined by special guest Brent Johnson, the CEO of Santiago Capital. |

|

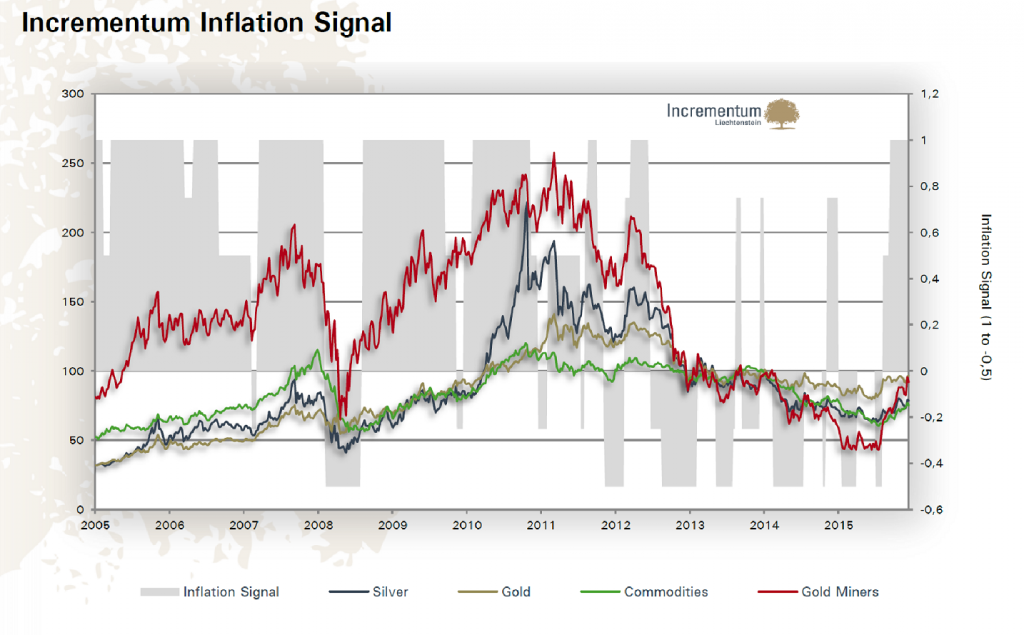

When Will the Helicopter Take Off?This time the debate revolved around the threat of “helicopter money”, which has become a lot more tangible after Shinzo Abe’s election victory and the aptly nicknamed Helicopter Ben’s visit to assorted Japanese GOSPLAN movers and shakers shortly thereafter. As always though, a wide range of topics was discussed, including the current market views of the participants. Below is the latest chart of the proprietary Incrementum inflation signal (a purely market-based signal that is more sensitive than the usual “inflation expectation” indicators), which continues to indicate that inflation-sensitive assets should be favored at present. |

The new obsession of liquidity junkies around the globe: helicopter money! This should cement the “TINA” rationalizations for buying hopelessly overvalued stocks and bonds, right? |

| This is particularly interesting right now: Although inflation-sensitive assets have rallied quite a bit, they are actually still trading at low levels historically. As we have pointed out in our own comment on the “helicopter money” threat (see “The Central Planning Virus Mutates” for details), price inflation seems to be on no-one’s radar right now, which makes expecting it a contrarian proposition well worth pondering (perhaps not in the short term, but certainly in the medium term).

If it were to appear on the scene, it would upset a great many plans, and ravage a great many portfolios. It would also boost portfolios prepared for the event though – as always, the formula “crisis = opportunity” applies. |

Incrementum Inflation Signal(see more for Incrementum Inflation Signal) |

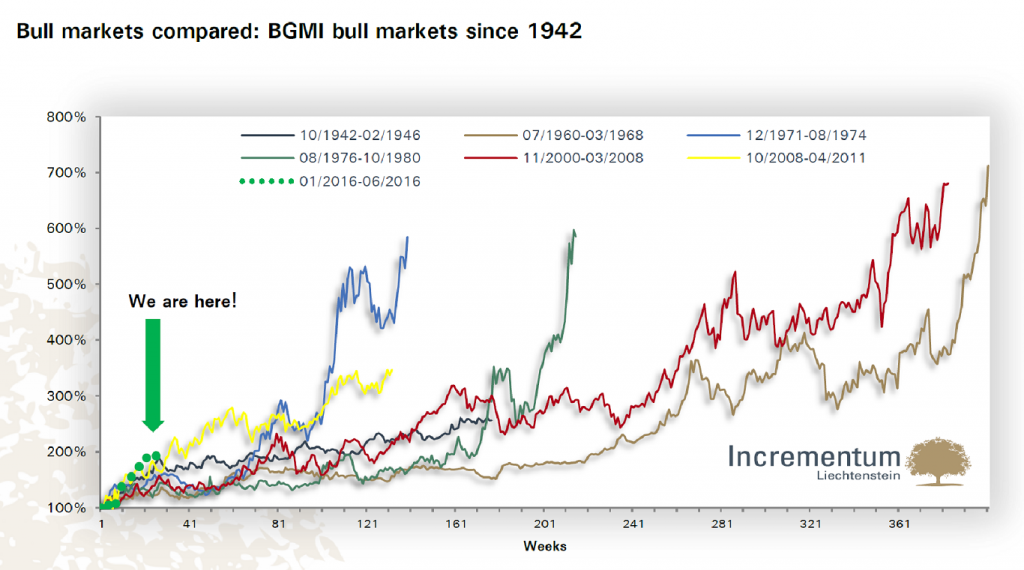

| In this context we would be remiss not to show you another chart from the transcript, which should be of great interest to gold bugs and those considering whether they should join the gold bugs. It shows the recent bull market in gold mining stocks compared to several historical bull markets. Naturally, this is not a guarantee for anything, but it is certainly interesting. |

Bull Markets Compared |

Here is the download link the the transcript. Enjoy!