Investec Switzerland. The SMI is set to underperform global markets this week after stocks lost ground on disappointing earnings reports and gloomy economic data releases. Stock markets around the world are also set to finish the week mostly lower as the fluctuating oil price, global growth concerns and deflationary pressures continue to rattle investor confidence. © Patrick Poendl | Dreamstime.com A Bad week for Swiss banks The underperformance from Swiss equities this week was largely driven by disappointing company news after Credit Suisse Group AG announced its biggest quarterly loss in seven years, after setting aside provisions for litigation, losses in its securities and writing off goodwill. Shares in the company slumped to their lowest level since 1991. UBS shares also saw significant losses this week after the bank reported a slowdown in its Wealth Management and Investment Banking divisions. The week’s biggest loser was however LafargeHolcim Ltd after one of its largest investors, Sberbank PJSC, said it was selling a stake in the company valued at about 1.5 billion Swiss francs (.5 billion). Grim Swiss economic data Economic data out of Switzerland also made for grim reading this week. The UBS Swiss Real Estate Bubble showed that Switzerland faced the risk of a real estate market bubble after its index rose to 1.41 from 1.38.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Investec Switzerland

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

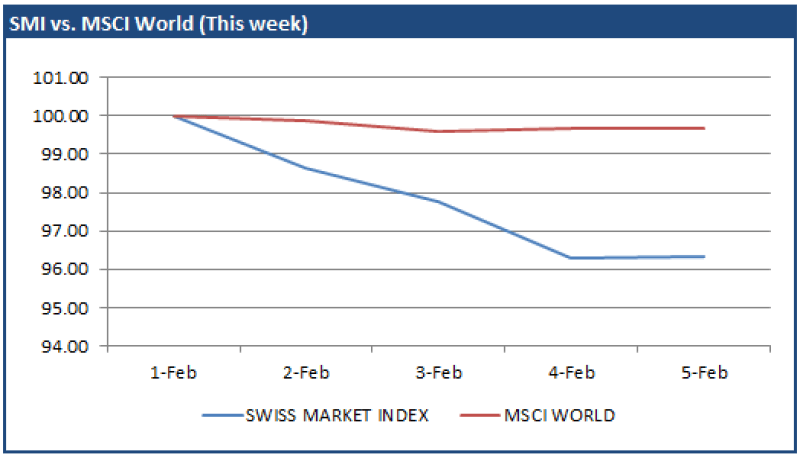

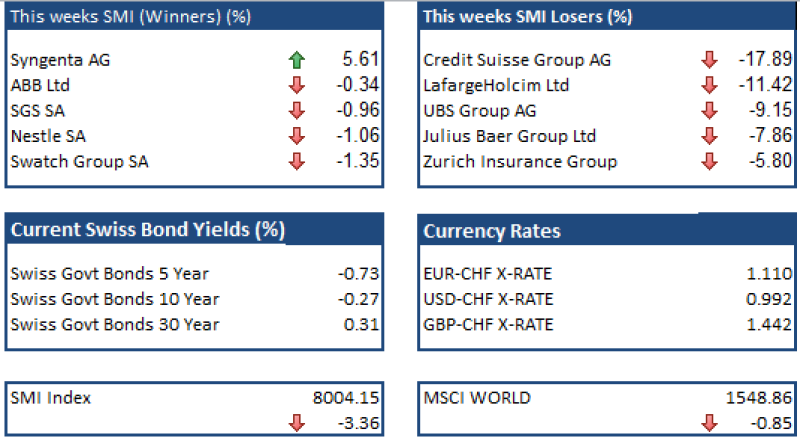

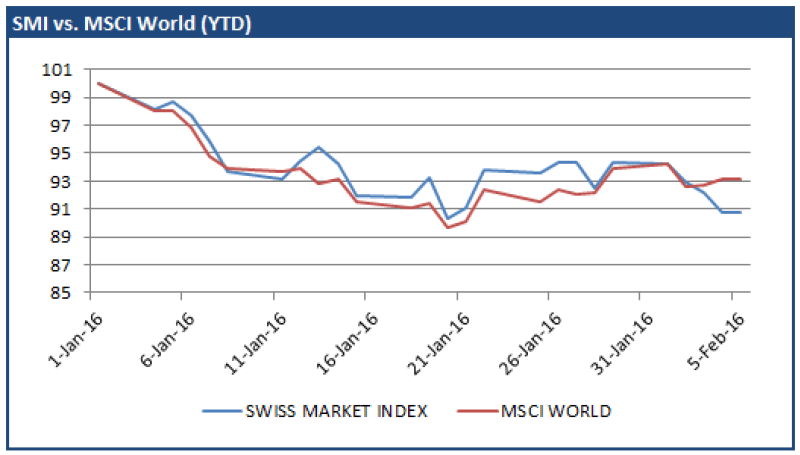

The SMI is set to underperform global markets this week after stocks lost ground on disappointing earnings reports and gloomy economic data releases. Stock markets around the world are also set to finish the week mostly lower as the fluctuating oil price, global growth concerns and deflationary pressures continue to rattle investor confidence.

© Patrick Poendl | Dreamstime.com

A Bad week for Swiss banks

The underperformance from Swiss equities this week was largely driven by disappointing company news after Credit Suisse Group AG announced its biggest quarterly loss in seven years, after setting aside provisions for litigation, losses in its securities and writing off goodwill. Shares in the company slumped to their lowest level since 1991. UBS shares also saw significant losses this week after the bank reported a slowdown in its Wealth Management and Investment Banking divisions. The week’s biggest loser was however LafargeHolcim Ltd after one of its largest investors, Sberbank PJSC, said it was selling a stake in the company valued at about 1.5 billion Swiss francs ($1.5 billion).

Grim Swiss economic data

Economic data out of Switzerland also made for grim reading this week. The UBS Swiss Real Estate Bubble showed that Switzerland faced the risk of a real estate market bubble after its index rose to 1.41 from 1.38. According to the report, house prices increased in the fourth quarter of last year and mortgage debt growth exceeded the rise in income at the fastest pace in five years.

A report on Tuesday showed that Swiss retail sales contracted for a fifth consecutive month in December as the warm weather hit spending on clothes and footwear. Bad news also came from the industrial sector this week after Switzerland’s manufacturing output stalled in January with companies hovering on the threshold between growth and decreasing production as firms struggle to adjust to the strong Swiss franc.

Better news for Swiss exporters

The week did however finally bring some good news for Swiss exporters; it appears that the Swiss franc may be losing some of its “safe haven” status in the face of continuing Swiss National Bank intervention. While the franc has traditionally acted as a haven in times of market turmoil, it has weakened 2.4% against the euro since the start of the year even amid a global equity rout. According to Swiss National Bank Vice President Fritz Zurbruegg the Japanese Yen is taking up much of the current safe haven slack. The SNB Vice President added however that the Swiss currency was still “very highly valued.”