Investec Switzerland. The Swiss Market Index (SMI) is set to finish this week higher tracking equity market gains around the world as investors begin to anticipate a new wave of economic stimulus from central banks. © Michael Flippo | Dreamstime.com Global equity markets rebounded from their post-Brexit losses as expectations of further stimulus gathered pace. Investors now expect the Federal Reserve to be slower in hiking rates and are also anticipating economic boosts from the Bank of England (BoE) and the Bank of Japan (BoJ) to support their struggling economies and stoke inflation. In the US, the S&P 500 and the Dow Jones hit new record highs on Thursday as the rally gained momentum. A rosy jobs report released last Friday along with better than expected earnings revenues for some of the big banks contributed to positive sentiment. J.P.Morgan, the biggest bank in the US by assets, reported a quarterly revenue rise that beat estimates by a large margin. In the UK, the Bank of England disappointed investors somewhat on Thursday after keeping base interest rates on hold at 0.50% despite the Brexit fallout. Investors had expected an immediate rate cut and potentially further stimulus. Minutes of the banks meeting did however show that most BoE members expect a policy easing in August.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, SMI

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

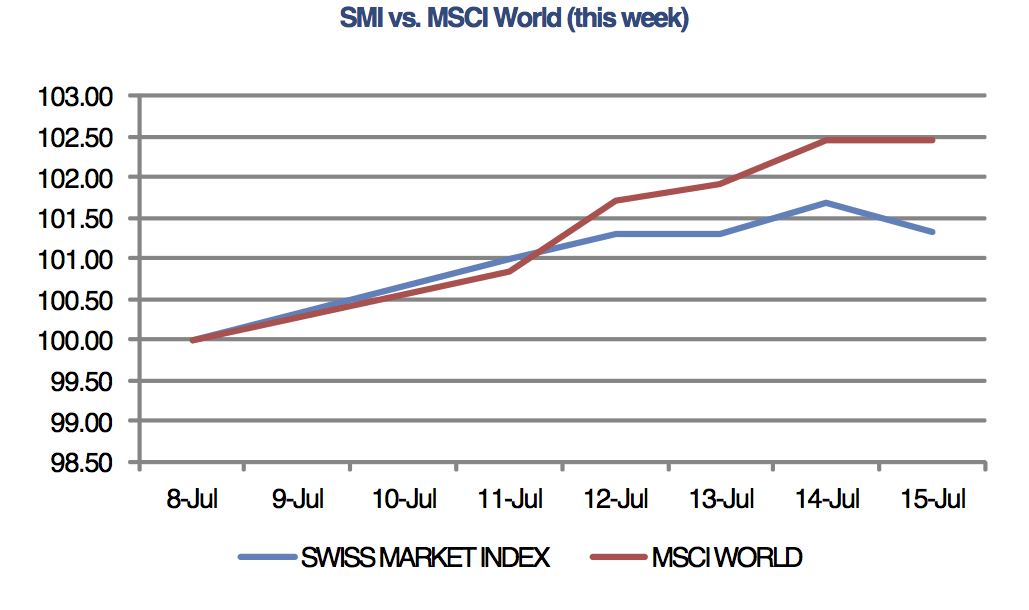

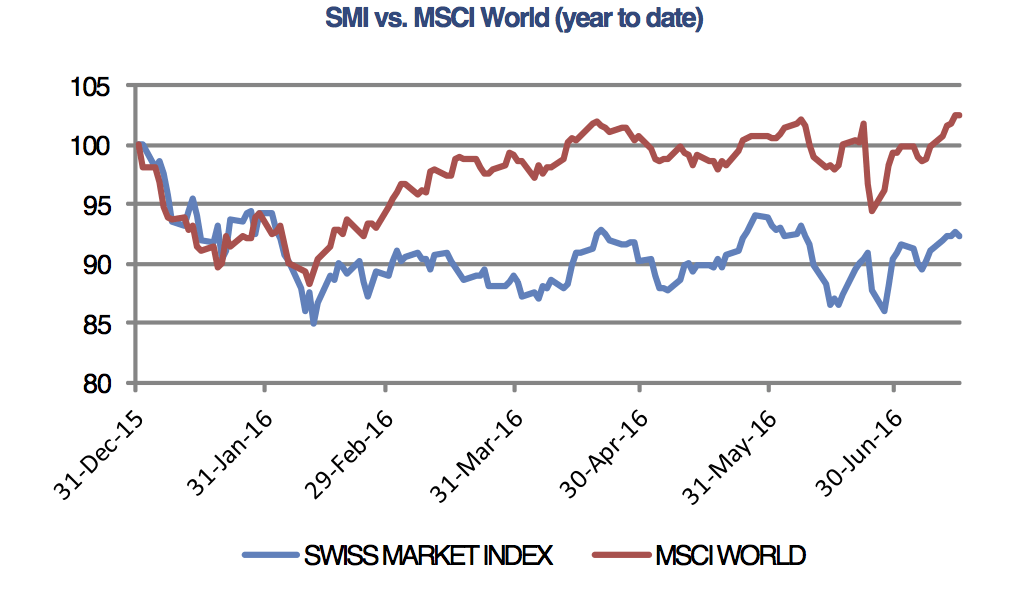

The Swiss Market Index (SMI) is set to finish this week higher tracking equity market gains around the world as investors begin to anticipate a new wave of economic stimulus from central banks.

© Michael Flippo | Dreamstime.com

Global equity markets rebounded from their post-Brexit losses as expectations of further stimulus gathered pace. Investors now expect the Federal Reserve to be slower in hiking rates and are also anticipating economic boosts from the Bank of England (BoE) and the Bank of Japan (BoJ) to support their struggling economies and stoke inflation.

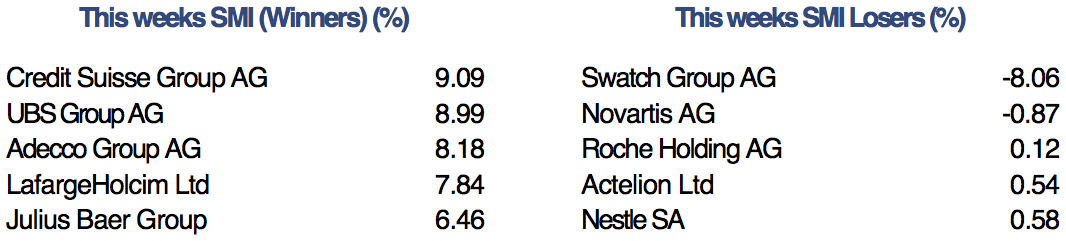

In the US, the S&P 500 and the Dow Jones hit new record highs on Thursday as the rally gained momentum. A rosy jobs report released last Friday along with better than expected earnings revenues for some of the big banks contributed to positive sentiment. J.P.Morgan, the biggest bank in the US by assets, reported a quarterly revenue rise that beat estimates by a large margin.

In the UK, the Bank of England disappointed investors somewhat on Thursday after keeping base interest rates on hold at 0.50% despite the Brexit fallout. Investors had expected an immediate rate cut and potentially further stimulus. Minutes of the banks meeting did however show that most BoE members expect a policy easing in August. Investors are now also speculating that Japan’s central bank will embark on a more aggressive form of economic stimulus in the coming months by directly financing the government’s deficit using a method known as “helicopter money.”

In Switzerland, economic news was light. Data showed that producer and import prices continued to decline 1.0% year on year in June although the fall was in line with expectations.

In company news, Swatch Group AG said that first-half profit is expected to have fallen more than 50% as demand from Hong Kong, France and Switzerland collapsed. Sales across the Swiss watch sector have declined rapidly as the stronger Swiss franc continues to discourage foreign consumers.