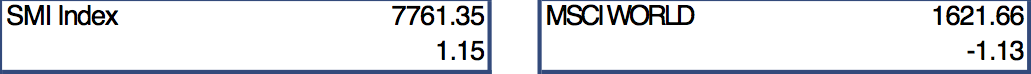

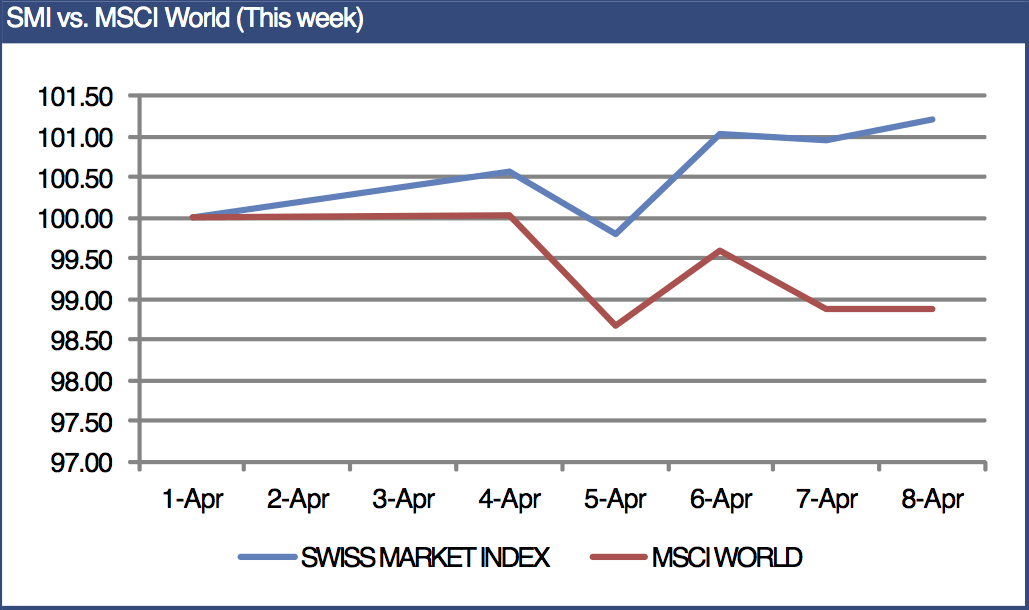

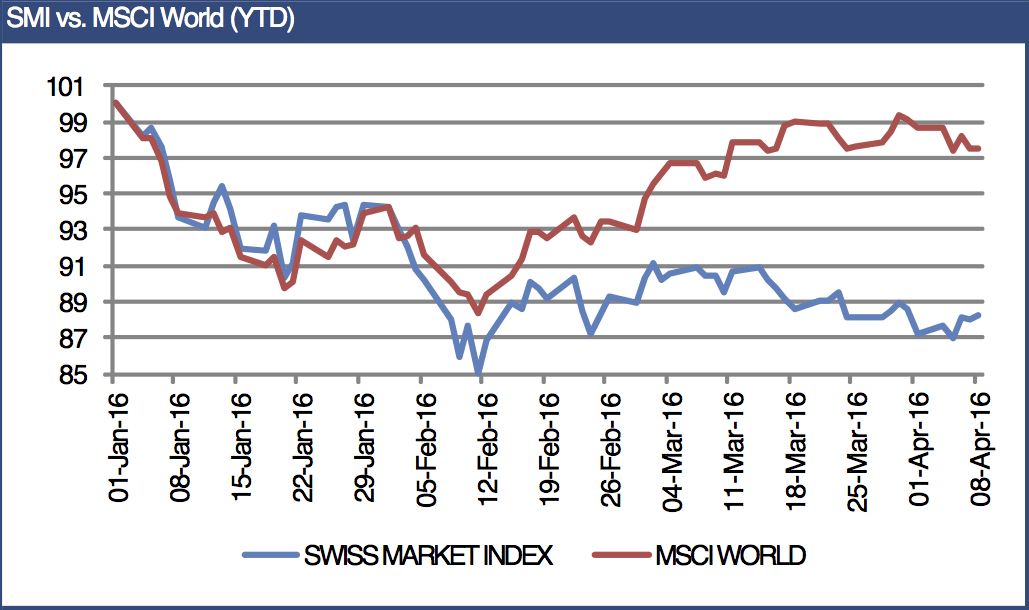

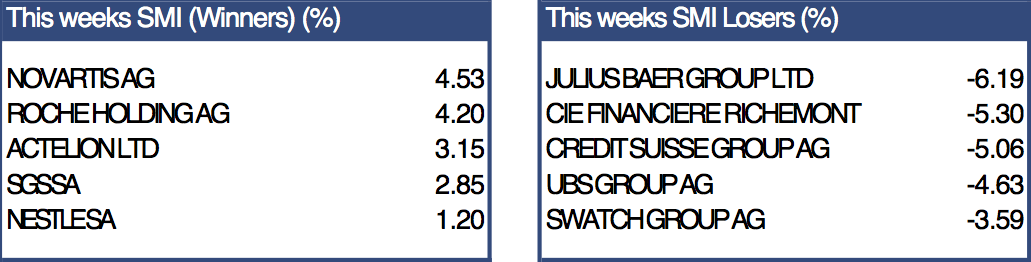

Investec Switzerland. The SMI is set to finish the week (+1.15%), significantly higher, having outperformed global equity markets (-1.13%), thanks to the strong performance of healthcare giants Novartis and Roche. Global equities fluctuated during the week receiving a boost towards the end of the week as investor sentiment improved, supported by stronger crude oil prices and comments from the US Federal Reserve. On Thursday, oil extended gains following the biggest advance in three weeks after crude stockpiles unexpectedly declined from the highest level in more than eight decades, while Kuwait indicated producers could reach an agreement to contain output even if Iran doesn’t participate. The sharp rise in oil prices increased risk appetite alongside the release of Federal Reserve meeting minutes that reaffirmed that US policy makers aren’t rushing to raise interest rates. Healthcare did well this week after the termination of the mega merger of Pfizer and Allergan fueled speculation of other consolidation in the sector. Investors are now focusing on the upcoming corporate earnings season. In Switzerland, the Swiss National Bank’s president Thomas Jordan reaffirmed that the SNB is able to ease policy further and how the negative interest rate is crucial to avoiding Swiss franc strength.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

The SMI is set to finish the week (+1.15%), significantly higher, having outperformed global equity markets (-1.13%), thanks to the strong performance of healthcare giants Novartis and Roche.

Global equities fluctuated during the week receiving a boost towards the end of the week as investor sentiment improved, supported by stronger crude oil prices and comments from the US Federal Reserve. On Thursday, oil extended gains following the biggest advance in three weeks after crude stockpiles unexpectedly declined from the highest level in more than eight decades, while Kuwait indicated producers could reach an agreement to contain output even if Iran doesn’t participate. The sharp rise in oil prices increased risk appetite alongside the release of Federal Reserve meeting minutes that reaffirmed that US policy makers aren’t rushing to raise interest rates. Healthcare did well this week after the termination of the mega merger of Pfizer and Allergan fueled speculation of other consolidation in the sector. Investors are now focusing on the upcoming corporate earnings season.

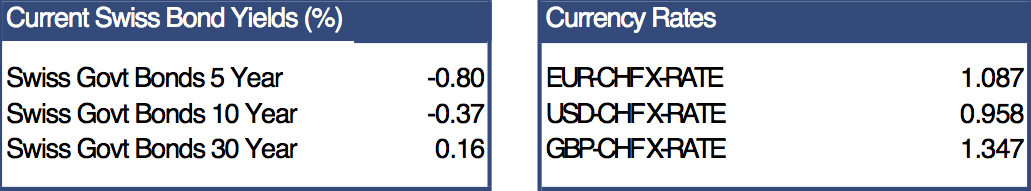

In Switzerland, the Swiss National Bank’s president Thomas Jordan reaffirmed that the SNB is able to ease policy further and how the negative interest rate is crucial to avoiding Swiss franc strength. He also added that any monetary policy action will be subject to a cost-benefit analysis, similar to what the SNB undertook when it decided to ditch its cap on the franc last year.

In economic data, the Procure.ch Swiss Purchasing Managers Index showed a positive overall picture for Swiss industry with all sub-components except employment reaching expansion levels – over 50 indicates growth. The PMI index increased by 1.6 point to 53.2, marking its highest level since October 2014, remaining in expansion territory for the fourth consecutive month. However, risks of setbacks remain with the Swiss franc still strong against the Euro.

Company news was light this week. Swiss Re said that reinsurance prices will continue to fall this year as competition for customers from hedge funds and other sources of alternative capital send premiums to their lowest level in four years. In other news, Fintech is seen as increasingly crucial to boost earnings in the insurance sector. Zurich Insurance Group AG is accelerating its cost reduction program, targeting savings of at least $1 billion by the end of 2018 with changes that will affect around 8,000 jobs.