Investec Switzerland. Swiss stocks are set to outperform global markets this week after another volatile session of trading that saw some stock indices suffering losses not seen since the depths of the global financial crisis. © Christy Thompson | Dreamstime.com Investor sentiment was hit early this week after China recorded its weakest annual pace of growth in a quarter century and the IMF downgraded global economic forecasts for 2016. However, the prospect of further central bank stimulus along with a modest recovery in the price of crude oil helped pull equity markets back from the brink of bear market territory. European Central Bank President Mario Draghi buoyed markets on Thursday, dropping a heavy hint that more stimulus was in the pipeline as fading growth and low inflation prospects force the central bank to review its policy. The comments were echoed on the other side of the world on Friday when the Nikkei newspaper reported that the Bank of Japan is “taking a serious look” at expanding its asset-buying campaign as sliding oil prices make it ever harder to reach its inflation goal. Commodity related equities also rallied later in the week after oil prices moved away from 12-year lows as cold US and European weather gave traders reason to cash in on record short positions.

Topics:

Investec considers the following as important: Business & Economy, Investec Switzerland, SGS SA, SMI, SMI beats MSCI, Zurich Insurance group

This could be interesting, too:

investrends.ch writes Sammelstiftung Vita erzielt 6,4 Prozent Rendite – Versicherte profitieren

investrends.ch writes Zurich stösst mit Beazley-Kaufangebot erneut auf Widerstand

investrends.ch writes Stewardship als zentrales Instrument verantwortungsbewusster Investoren

investrends.ch writes Zurich schreibt trotz Waldbränden mehr Gewinn

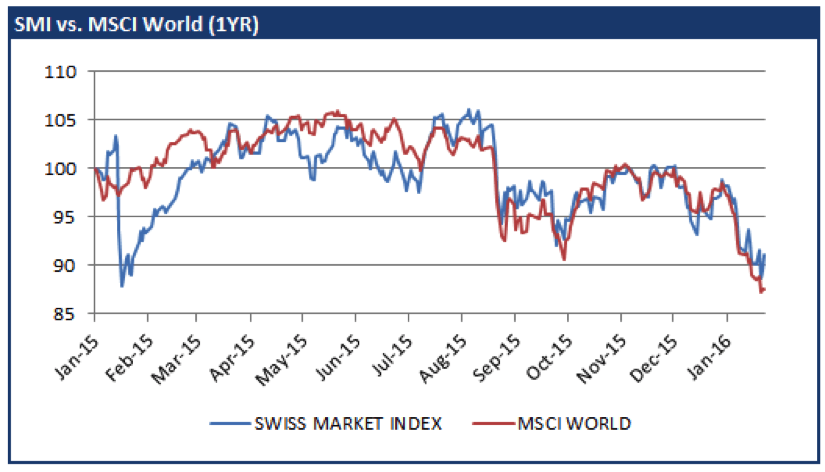

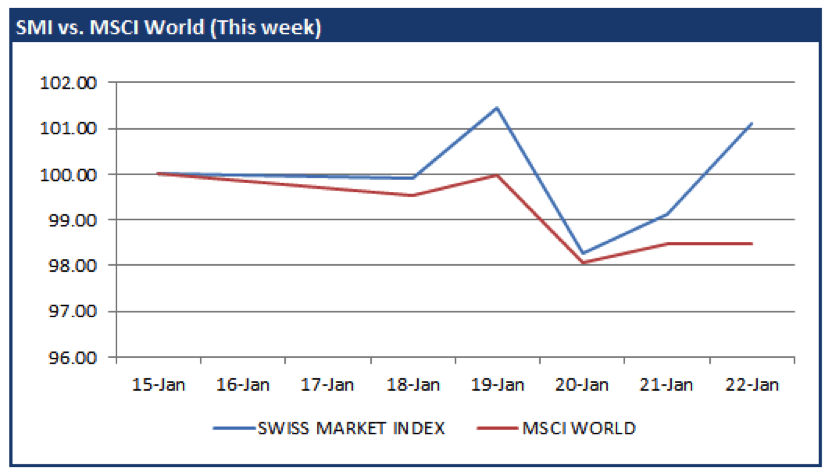

Swiss stocks are set to outperform global markets this week after another volatile session of trading that saw some stock indices suffering losses not seen since the depths of the global financial crisis.

© Christy Thompson | Dreamstime.com

Investor sentiment was hit early this week after China recorded its weakest annual pace of growth in a quarter century and the IMF downgraded global economic forecasts for 2016. However, the prospect of further central bank stimulus along with a modest recovery in the price of crude oil helped pull equity markets back from the brink of bear market territory.

European Central Bank President Mario Draghi buoyed markets on Thursday, dropping a heavy hint that more stimulus was in the pipeline as fading growth and low inflation prospects force the central bank to review its policy. The comments were echoed on the other side of the world on Friday when the Nikkei newspaper reported that the Bank of Japan is “taking a serious look” at expanding its asset-buying campaign as sliding oil prices make it ever harder to reach its inflation goal.

Commodity related equities also rallied later in the week after oil prices moved away from 12-year lows as cold US and European weather gave traders reason to cash in on record short positions. Analysts however warned that a sustainable recovery was unlikely given soaring inventories amid overproduction.

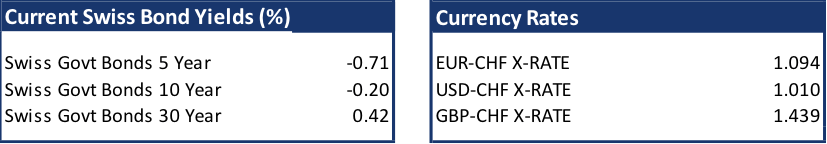

Switzerland’s economic news was light this week although Credit Suisse’s ZEW indicator tumbled to the lowest reading since July 2015. According to the report, which gauges expectations for Switzerland’s economy in the coming six months, the turbulent start to the new year, a strong Swiss Franc and lower inflation expectations have dimed growth prospects.

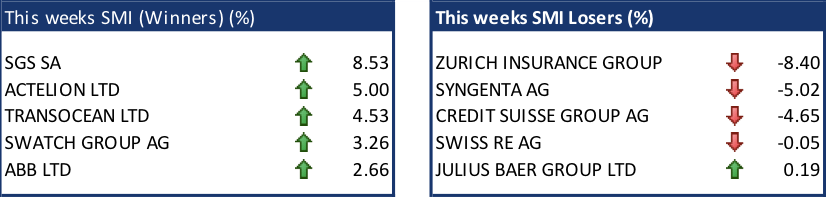

In company news, Zurich Insurance Group AG shares fell to their lowest level in more than three years this week after the company warned that it expects a second straight quarterly loss in its general insurance business.

SGS SA reported that full-year profit dropped 13 percent in 2015 as the world’s largest inspection firm grappled with the crash in commodity prices and a strong Swiss franc. However, SGS, which certifies products ranging from medical devices and industrial metals to children’s toys, said it still expects to achieve organic sales growth of 2.5 percent to 3.5 percent this year while maintaining an operating margin similar to 2015.

Even one of this week’s losers was a gainer