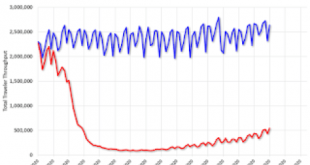

The stock market has recovered most of its losses from the March COVID-19 induced sell-off and the enthusiasm with which stocks are being bought – and sold but mostly bought – could lead one to believe that the crisis is over, that the economy has completely or nearly completely recovered. Unfortunately, other markets do not support that notion nor does the available economic data. Of course, markets look forward and there is the possibility that stock market...

Read More »The Fed’s Grand Bargain Has Finally Imploded

The Fed has backed itself not into a corner but to the edge of a precipice. Though the Federal Reserve never stated its Grand Bargain explicitly, their actions have spoken louder than their predictably self-serving, obfuscatory public pronouncements. Here’s the Grand Bargain they offered institutional investors and speculators alike: We’re taking away your low-risk, high-yield investments by slashing interest rates to near-zero, but we’re giving you endless asset...

Read More »Why the New Economics Just Boils Down to Printing More Money

[Editor’s Note: this article is adapted from a 2003 essay in the Quarterly Journal of Austrian Economics entitled “New Keynesian Monetary Views: A Comment.” As economists abandon theory in favor of makeshift plans to flood the economy with stimulus, Hülsmann here provides some helpful reminders of the fundamental problems behind the current economic consensus on money.] The essential fallacy of John Maynard Keynes and his early disciples was to cultivate the monetary...

Read More »Marc Chandler on Economic recovery and Jackie On Chinese ADRs (Chinese)

Mr. Chandler of Bannockburn explains the economic recovery and consumer spending, as well as the Fed's effort to call on Congress to act sooner rather than later. Jackie expresses her own view on Chinese ADR's future on listing in the US.( Chinese)

Read More »Marc Chandler on Economic recovery and Jackie On Chinese ADRs (Chinese)

Mr. Chandler of Bannockburn explains the economic recovery and consumer spending, as well as the Fed's effort to call on Congress to act sooner rather than later. Jackie expresses her own view on Chinese ADR's future on listing in the US.( Chinese)

Read More »Charles Hugh Smith: developments of Our society’s & cryto currenices past present and future

Please support me on: https://www.patreon.com/silver_the_antidote

Read More »Charles Hugh Smith: developments of Our society’s & cryto currenices past present and future

Please support me on: https://www.patreon.com/silver_the_antidote

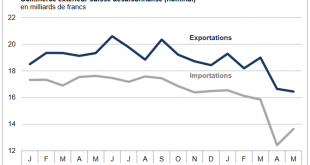

Read More »Swiss Trade Balance May 2020: signs of recovery in foreign trade

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

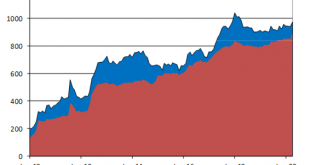

Read More »SNB Preview

The Swiss National Bank meets Thursday. It is widely expected to maintain its current policy stances but is likely to push back against CHF strength. Here, we highlight here the potential choices that lie ahead for the SNB. WHAT ELSE CAN THE SNB DO? The SNB meets quarterly in March, June, September, and December. At the March 19 meeting, the SNB took a series of measures to help mitigate the impact of the pandemic. Whilst SNB officials have always said that rates...

Read More »Coronavirus: latest antibody study suggests 10.8 percent of Geneva infected in first wave

© Eduard Goricev | Dreamstime.com A recently published update to the ongoing study in Geneva to assess the extent of SARS-CoV-2 infection suggests 10.8% of the population may have been infected in the first wave of infections. The study, which tests a sample of the population over time for IgG SARS-CoV-2 antibodies, started in early April 2020. The latest figures come from the fifth week of testing, which was concluded on 9 May 2020. In the first week, 4.8% tested...

Read More » SNB & CHF

SNB & CHF