I never thought someone would label me a "Permabull." This is particularly true of the numerous articles I wrote over the years about the risks of excess valuations, monetary interventions, and artificially suppressed interest rates. However, here we are. "Lance, you are just another permabull talking your book. When this market crashes you will still be telling people to buy all the way down." I get it. We have been bullish over the last couple of years, but...

Read More »Electricity bills slashed to bailout struggling Swiss steelworks

The federal government should help the ailing Swiss steelworks Keystone-SDA Listen to the article Listening the article Toggle language selector...

Read More »The Slow Motion Death of Syria

On December 8, 2024, the 24-year reign of Syrian strongman Bashar al-Assad came to an end after a rebel coalition of Al-Qaeda offshoots, Turkish proxies, and other Islamist militants overwhelmed the capital of Damascus. In effect, a Sunni Islamist saturnalia brought an end to the Middle East’s last secular Arab government. The Assad family, starting with Hafez al-Assad in 1971, has held an iron grip on Syrian politics for over five decades. As committed members of...

Read More »Swiss drugmaker Sandoz settles US anti-trust charges

Sandoz reaches further settlement in the USA Keystone-SDA Listen to the article Listening the article Toggle language selector...

Read More »De-Bamboozling the Critical Race Theory of Court Intellectuals

Owing largely to a campaign led by Florida, many people are now aware of the fallacies of Critical Race Theory. In recent months, some states have banned the “divisive concepts” of CRT. For example, in Alabama it was reported that:The bill has examples of divisive concepts such as “individuals, by virtue of race, color, religion, sex, ethnicity, or national origin, are inherently responsible for actions committed in the past by other members of the same race, color,...

Read More »Young Swiss voices: AI’s impact on future careers | #switzerland #AI

AI tools like ChatGPT are already transforming the way we work. But are young people in Switzerland concerned about their future careers? ? We hit the streets of Bern to see how young people feel about AI in their jobs. ? Let us know what you think in the comments. -------- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles,...

Read More »It’s Time to Renew Your Mises Membership

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »“Personnel Is Policy” Means the Rule of Law Is Dying

President-elect Donald Trump’s announced cabinet and White House staff appointments for his next administration have attracted praise from supporters, outrage from opponents, and even criticism from libertarian podcasters like Ron Paul and Radio Rothbard hosts Ryan McMaken and Tho Bishop regarding Trump’s hawkish national security picks. Everyone agrees that “personnel is policy” though, meaning that the outspoken policy preferences of many of Trump’s appointees...

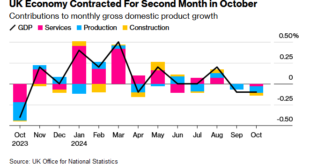

Read More »Britain And European Economic Growth Sputters

Yesterday's Commentary touched on the divergence between robust economic growth in the U.S. and near-recessionary conditions in Canada. We highlighted the importance of this to U.S. investors because of the historically strong correlation between the two economies. Unfortunately, Canada is not a one-off instance. Britain, Europe, and China also exhibit poor economic growth. Given the U.S. operates in a global economy, it's hard to imagine that economic stagnation...

Read More »The Role of Tax-Efficient Investing in Wealth Accumulation

When it comes to building long-term wealth, it’s not just about how much you earn but how much you keep. Taxes can significantly impact your investment returns, making tax-efficient investing a crucial component of any wealth accumulation strategy. By utilizing tax-advantaged accounts, employing strategies like tax-loss harvesting, and selecting tax-efficient funds, investors can reduce their tax burdens and maximize after-tax returns. Why Tax-Efficient Investing...

Read More » SNB & CHF

SNB & CHF