What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »Creating Wealth: The Cantillon or the Smith Way

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »What the Campus Protesters and Their Critics Get Right and Wrong

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »The Austrian – 2023 V-09 I-06

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »Are we losing the race to control ‘killer robots’? | Listen to our Inside Geneva #podcast 🎧

New lethal autonomous weapons are now becoming established in modern warfare. In the latest episode of our Inside Geneva podcast, we discuss their use and their regulation. Tap on the video on our main channel to listen to the full episode. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch...

Read More »It’s the PPI Once More!

In early September 2023 we reported on the Producer Price Index, the PPI. This price statistic takes a back seat to the Consumer Price Index in media reporting and the policy-setting agenda. Back then we explained what it was and what it was telling us about the economy.The timing of that episode reflected our concern that the sharp drop in the PPI to that point in time might not be a sign of things to come. The PPI had been dropping since mid-2022....

Read More »Get Ready for Weaker Growth and Higher Inflation. The Consensus Was Wrong.

The weak GDP figure for the first quarter came with a double negative: poor consumer spending and exports, plus a rise in core inflation. The US administration’s enormous fiscal stimulus underscores the importance of considering the weaker-than-expected data.A deceleration in consumer spending, a decline in the personal savings ratio to 3.6%, and poor exports added to a set of figures for investment that were also negative when we looked at the details.The gross...

Read More »The Fallacy of “Racism Equals Power Plus Prejudice”

A position that has gained popularity on the Left in recent decades is a push to redefine racism to prevent the term from encompassing racism against whites. According to this position, “racism equals power plus prejudice.” And while whites can experience racial prejudice, there exists a prowhite and anti-non-white bias in western institutions, which is what is meant by the term “power.” Accordingly, it is argued that the term “racism” should be reserved for...

Read More »Yen Slips, Yuan Jumps, Dollar is Mostly Softer

Overview: The dollar is mostly a little softer today in thin market conditions, with Tokyo, Seoul, and London closed for holidays. The Japanese yen is the weakest G10 currency, losing about 0.5% and slipping through last Friday's lows. At first, after Fed Chair Powell did not endorse rate hike speculation, the market thought he was dovish. But after the softer than expected jobs data and weakness in the ISM services, the market shifted from doubting one cut to...

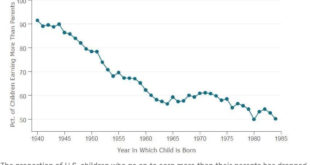

Read More »Killing the Golden Goose: Millennials Earn Less Than Their Parents Did

For the first time in our nation’s history, 30 year olds are doing worse than their parents.In other words, we killed the golden goose.Last week, Professor Scott Galloway went on an epic rant on MSNBC laying out for his well-heeled hosts exactly what young people are going through right now.Rattling off the numbers, for Americans born in 1951 — that’s baby boomers — fully 80% were earning more than their parents. By Gen X that was down to 60%. For Millennials it’s...

Read More » SNB & CHF

SNB & CHF