«It is the mark of an educated mind to be able to entertain an idea without accepting it.»Aristotle In today’s world, it is obvious that the competition of ideas is under serious threat and with it, the much-needed discussions on how to deal with certain topics or try to understand the world we live in. That is particularly worrying, especially when one considers that the western world went through the process of...

Read More »Stadler lands $600 million order in the US

Stadler’s first US order dates back to 2002 Swiss railway vehicle manufacturer Stadler Rail has won a $600 million (CHF597 million) order in the United States. The Metropolitan Atlanta Rapid Transit Authority (MARTAexternal link) on Friday announced its decision to award Stadlerexternal link the contract for 127 Metro (underground) trains with two options of 25 additional trains each. For Stadler, which has been present...

Read More »Cool Video: Fed’s Independence Challenged and Defended

Marc Chandler talking with Charles Payne and Quincy Krosby about Fed policy - Click to enlarge I was on the set Fox Business set this afternoon talking with Charles Payne and Quincy Krosby about Fed policy. Payne suggested that both the political left and right are trying to politicize the Federal Reserve to print money for their favorite programs. I suggest the Fed’s independence will not so easily be encroached upon....

Read More »The Hidden Cost of Losing Local Mom and Pop Businesses

What cannot be replaced by corporate chains is neighborhood character and variety. There is much more to this article than first meets the eye: In a Tokyo neighborhood’s last sushi restaurant, a sense of loss “Eiraku is the last surviving sushi bar in this cluttered neighborhood of steep cobblestoned hills and cherry trees unseen on most tourist maps of Tokyo. Caught between the rarified world of $300 omakase dinners...

Read More »Will Basel III Send Gold to the Moon, Report 2 Apr

A number of commentators have predicted that the rules of the Basel III bank regulations will cause gold to skyrocket (no, this article is not about our view that gold does not go up, that it’s the dollar going down, that the lighthouse does not go up, it’s the sinking ship going down in the storm). Will it? It would be easy to say—as with all of their other predictions of gold to infinity and beyond—“wait and see.” But...

Read More »FX Daily, April 02: Herding Cats

Swiss Franc The Euro has fallen by 0.07% at 1.1189 EUR/CHF and USD/CHF, April 02(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After surging yesterday, equities are struggling to maintain the momentum that carried that S&P 500 to its best level since last October. Most Asia Pacific equity markets advanced. Japan’s small losses were a notable exception....

Read More »GBP to CHF weakness after no majority for alternative Brexit

The pound to Swiss franc exchange rate still struggles to push higher amidst global uncertainty and the pressing issue of Brexit. The Swiss franc maintains the higher ground with its safe haven status amidst concerns of a global slowdown, the effects of which are already being seen across China and the EU. There are now fears that a slowdown is starting in the US which is why the US Federal Reserve has decided to not...

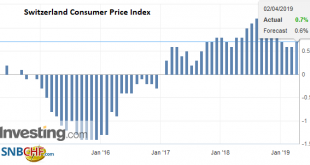

Read More »Swiss Consumer Price Index in March 2019: +0.7 percent YoY, +0.5 percent MoM

02.04.2019 – The consumer price index (CPI) increased by 0.5% in March 2019 compared with the previous month, reaching 102.2 points (December 2015 = 100). Inflation was 0.7% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The 0.5% increase compared with the previous month can be explained by several factors including rising prices for international...

Read More »April Monthly Currency Outlook

Poor economic data and soft inflation saw several central banks, including the Federal Reserve and European Central Bank, take a dovish turn in March. Contrary to expectations that interest rates would rise as the G3 central banks were no longer adding to their balance sheets on a combined basis. The sharp drop in interest rates and the flattening of curves in March is one of the key factors shaping the investment...

Read More »Million franc salaries cause friction in Bern

Andreas Meyer_© CFF_SBB_FFS Switzerland’s government recently voted for a ceiling on the salaries of those managing public companies such as Swisscom, Swiss Post, Skyguide and Swiss Rail. In response, the board of Swiss Rail wrote to the Federal Council requesting it to soften its position. From 2020, the company wants to pay its nine senior managers CHF 5.89 million, including a salary of more than CHF 1 million to...

Read More » SNB & CHF

SNB & CHF