Despite massive government and central bank stimuli, the global economy is seeing a concerning rise in defaults and delinquencies. The main central banks’ balance sheets (those of the Federal Reserve, Bank of Japan, European Central Bank, Bank of England, and People’s Bank Of China) have soared to a combined $20 trillion, while the fiscal easing announcements in the major economies exceed 7 percent of the world’s GDP according to Fitch Ratings. This is the biggest...

Read More »The Forgotten Greatness of Rothbard’s Preface to Theory and History

Anyone who advocates the ideas of the Austrian school of economics, whether broadly and publicly or even in the context of private discussions with friends and acquaintances, will almost immediately find themselves grappling with the tricky question of how to distill the core essence of what Austrian economics actually is, and how to convey those truly definitive characteristics as briefly and simply as possible. Given the nearly 150 years during which Austrian...

Read More »FX Daily, June 24: Risk Appetites Satiated for the Moment

Swiss Franc The Euro has fallen by 0.07% to 1.0672 EUR/CHF and USD/CHF, June 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The rally in risk assets in North America yesterday is failing to carry over into today’s activity. Asia Pacific equities were mixed. Korea and Indonesia led the advances with more than 1% gain. China and Taiwan also gained. Japan and Hong Kong. Europe’s Dow Jone’s Stoxx 600 is giving...

Read More »Restricted Market Trading Comments

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot There were minimal changes to the status quo as the week commences. Bangladesh has announced revised trading hours on the local exchanges. No change of status in Nigeria and Kenya as they both continue to face limited liquidity. Please see trading comments below. Bangladesh: Effective June 18, the Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE) revised their trading hours until further notice. The...

Read More »The Illusion of Control: What If Nobody’s in Charge?

The last shred of power the elites hold is the belief of the masses that the elites are still in control. I understand the natural desire to believe somebody’s in charge: whether it’s the Deep State, the Chinese Communist Party, the Kremlin or Agenda 21 globalists, we’re primed to believe somebody somewhere is controlling events or pursuing agendas that drive global responses to events. I submit whatever control we discern is illusory, as the dynamics unleashed by...

Read More »The Decline of the Third World

A Failure to Integrate Values The only region in the world that has proactively tried to incorporate western culture in its societies is East Asia — Singapore, Japan, Hong Kong, South Korea, and Taiwan. China, which was a grotesquely oppressed, poor, Third World country not too far in the past, notwithstanding its many struggles today, has furiously tried to copy the West. Famous Greek philosophers: their thoughts are a cornerstone of Western culture. [PT]Western...

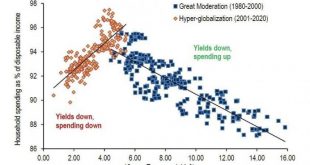

Read More »Central Bankers Will Bring Us Economic Stagnation

“Our country continues to face a difficult and challenging time….People have lost loved ones. Many millions have lost their jobs. There is great uncertainty about the future. At the Federal Reserve, we are strongly committed to using our tools to do whatever we can, for as long as it takes…to ensure that the recovery will be as strong as possible, and to limit lasting damage to the economy” –Jerome Powell, Chairman of the Federal Reserve, June 10, 2020 America is...

Read More »FX Daily, June 23: Weebles Wobble but they Don’t Fall Down

Swiss Franc The Euro has risen by 0.22% to 1.069 EUR/CHF and USD/CHF, June 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After early indecision, investors ramped the demand for risk assets, encouraged perhaps by indications that the Trump Administration going to support at least another trillion-stimulus package. The NASDAQ rallied to new record highs, and the dollar got thumped across the board. However,...

Read More »Swiss public transport expected to lose CHF1.5 billion due to Covid-19

On Swiss trains passenger numbers have increased very gradually, and currently stand at around 55% of normal capacity in regional trains and 45% on intercity trains. © Keystone / Christian Beutler The collapse in the number of commuters and other passengers on Swiss trains and buses due to the pandemic is likely to leave a big hole in the finances of public transport companies. The Le Matin Dimanche and SonntagsZeitung newspapers reported on Sunday that Alliance...

Read More »Glencore faces Swiss probe over alleged Congo corruption

Congolese demonstrations protest outside Glencore’s headquarters in Zug, Switzerland, in July 2018. © Keystone / Urs Flueeler The Office of the Attorney General of Switzerland (OAG) has opened a criminal probe into Swiss-based commodity trader and miner Glencore over alleged corruption in the Democratic Republic of the Congo, where it mines copper and cobalt. Glencore said in a statement on June 19 that the Swiss criminal investigation was for the multinational’s...

Read More » SNB & CHF

SNB & CHF