What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »A Reply to Shostak: Can Increases in the Gold Supply Cause a Business Cycle?

Frank Shostak recently wrote that an increase in the supply of gold by itself cannot cause a boom-bust cycle as described by the Austrian Business Cycle Theory (ABCT). If that were true, then Austrians would have no explanation for booms and busts prior to central banking.Shostak cites Robert Murphy, who wrote that mined money could enter the loan market and lead to a boom. Believing Murphy is in error, Shostak counters with,Murray Rothbard disagreed with this. He...

Read More »More Revisions Coming To Employment Data

In August, the BLS revised 2024 employment growth lower by 818k jobs in its preliminary revision of its Current Employment Statistics (CES). Despite the substantial revision, more reductions to the official employment data are likely to come next month. In January, the BLS will release its final benchmark revision. The preliminary and final revisions to BLS data are done annually. The revisions bridge the gap between the monthly BLS survey data used to report the...

Read More »Global Conditions Portend A Catch-Down In America

For $20,000, you can buy a global airline pass to see the world. Or, for the low price of free, you can take a quick trip with us worldwide. Unfortunately, our global trip is not as exciting as an around-the-world pass. Still, it may enlighten you about some economic struggles abroad. Moreover, why, in time, they may be problematic for the US. China, Britain, Europe, and other countries and regions are experiencing sluggish economic growth and, in some cases,...

Read More »Review: The Sources of Russian Aggression

[The Sources of Russian Aggression: Is Russia a Realist Power?, by Sumantra Maitra, Lexington Books, 2024; 205 pages]One of the unfortunate realities of the foreign policy debate in America is that few Americans are paying much attention. This general level of public ignorance makes it much easier for the American foreign policy elites to then feed the American public whatever lies suit the regime’s agenda.This has certainly been the case with the US’s current proxy...

Read More »Swiss rail to run solely on renewable electricity from 2025

SBB trains will only run on electricity from renewable sources from 2025 Keystone-SDA Listen to the article Listening the article Toggle language selector...

Read More »The Health Insurance Disaster

The recent murder of Brian Thompson, the CEO of United Health Care, has led many people to claim that private health insurance is an example of what is wrong with the free market, and that we ought in consequence of its manifest failures to institute a government run single-payer system. Some ghoulish leftists went so far as to post messages on Twitter expressing joy that Thompson had been killed. The Daily Mail reports: “The assassination of UnitedHealthcare...

Read More »The Economics of Medical Waiting Rooms

Americans regularly complain about wait times to obtain medical appointments, especially with primary care physicians and certain specialists. Waiting several weeks or a couple of months for an appointment is not uncommon, which can sound to Americans like purported wait times in Canada and other countries with socialized medicine. Economics and Third-Party Intervention Explain Long Waits Economic analysis of medical education explains what is behind the long wait...

Read More »Weak European growth dampens Swiss economic expectations

KOF and federal economists lower expectations for the Swiss economy Keystone-SDA Listen to the article Listening the article Toggle language selector...

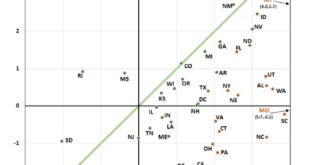

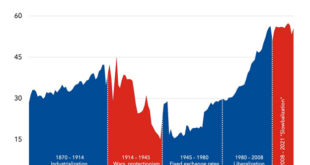

Read More »The Dollar And Domestic – International Relative Stock Returns

The U.S. dollar index is up over 6% this year, almost all attributable to a post-election surge. As many developed nations show stagnant economic growth or even contraction, the U.S. economy continues to hum. Further bolstering the dollar is the likelihood that the Fed will slow rate cuts or stop them after this Wednesday's FOMC meeting. Consequently, the Fed is considered more hawkish than other large central banks. Wall Street thinks the dollar will peak and...

Read More » SNB & CHF

SNB & CHF