If we had to guess which areas will likely experience the smallest declines in prices and recover the soonest, which markets would you bet on? Though housing statistics such as average sales price are typically lumped into one national number, this is extremely misleading: there are two completely different housing markets in the U.S. One is hot, one is not so hot. Just as importantly, one may stay relatively hot while...

Read More »UBS Consumption Indicator: Subdued private consumption in 2017 despite solid November figures

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. The UBS Consumption Indicator climbed to 1.43 points in November from 1.39. Another strong month in domestic tourism and the positive trend on the automobile market made the rise possible. Initially a solid...

Read More »Cool Video: Double Feature on Bloomberg

I am finishing the year like I began it, on Bloomberg Television, talking about the dollar and Fed policy. Bloomberg has made two clips of my interview available. In the first clip (here), I discuss the dollar. I reiterate my forecast for the the Dollar Index to head toward 120.00. The consolidation between Q2 15 and end of Q3 16 appears to me to be the base of the new leg up that has already begun.[embedded...

Read More »FX Daily, December 28: Short Note for Holiday Markets

Swiss Franc EUR/CHF - Euro Swiss Franc, December 28(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Equities: Good day in Asia, where the MSCI Asia-Pacific Index rose 0.3% to snap a six-day slide. Of note the Hang Seng re-opening from a long holiday weekend rose (0.8%) from a five-month low. Chinese shares that trade in HK also did well, rising 1.5%. Indonesia, which broke a nine-day slide yesterday,...

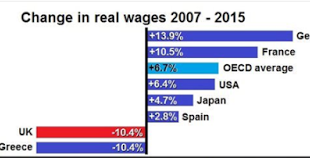

Read More »Great Graphic: Real Wages

This Great Graphic caught my eye. It was tweeted by Ninja Economics. Her point was about immigration. German had much higher immigration than the UK, but also saw real wage increase of nearly 14% in the 2007-2015 period, while real wages in the UK fell nearly 10.5%. She noted that Greece is the only developed country where real wages have collapsed as much as in the UK. This is amazing, and not because of...

Read More »Grab-Bag of Resolutions for 2017

I resolve to acquire skills, not credentials. Here’s a grab-bag of resolutions with something for just about every persuasion. 1. I resolve to never utter or write the word “Trump” in 2017. (Good luck with that…) 2. Having watched bitcoin rise from $250 (or perhaps from $25 or even 25 cents) to $900+, I resolve to finally buy some bitcoin before it soars over $1,000. (Please file under “this is intended as bemused...

Read More »Weekly Sight Deposits and Speculative Positions: SNB intervenes, while Speculators go Long CHF

Headlines Week Ending December 23 , 2016 Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later. This implies that speculators are long the dollar and short the Swiss franc and the euro. The last ECB meeting showed that the ECB might be dovish for a...

Read More »FX Daily, December 27: Markets Becalmed in Wait-and-See Mode

Swiss Franc EUR/CHF - Euro Swiss Franc, December 27(see more posts on EUR/CHF, ). FX Rates As skeleton teams return to the trading desks in New York, the US dollar is largely where they left it at the end last week. Japanese markets were open yesterday, while UK, Australia, New Zealand, Hong Kong and Canadian markets are still closed today. The Australian and New Zealand dollars are up about 0.2% from before the...

Read More »Crisis of Meaning = Crisis of Work

People were poor by today’s standards, so why do people remember the plantation life fondly? The answer is simple: community, purpose, sacrifice and meaning. Allow me to connect two apparently unconnected dots. Dot #1: The last sugar plantation in Hawaii is closing down, ending more than a century of plantation life in the 50th state. Dot #2: a new study found that Nearly 95% of all new jobs during Obama era were...

Read More »When Assets (Such as Real Estate) Become Liabilities

It will be the middle class that accepted the notion that “real estate is the foundation of family wealth” that will be stripmined by higher taxes on immobile assets such as real estate. Correspondent Joel M. submitted an article that struck me as a harbinger of the future: In Greece, Property Is Debt: “At law courts throughout Greece, people are lining up to file papers renouncing their inheritance. Not necessarily...

Read More » SNB & CHF

SNB & CHF