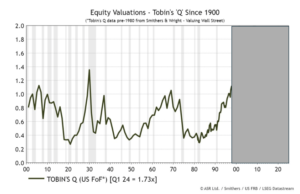

The combination of extremely rich equity valuations, high interest rates, and a new President taking bold actions will likely continue to whip stocks around for the foreseeable future. Alongside those volatility-provoking factors is that the S&P 500 just posted two annual twenty-plus percent gains in a row. Accordingly, seeing average or below-average returns this year and volatility spikes should not be surprising. If we are correct about volatility, it’s entirely possible that our worst behavioral traits as investors will be provoked. Given this possibility, it’s worth taking a break from our typical market or economic topics and focusing on behavioral economics.

Turn on CNBC or Bloomberg, and commentators discuss the economy, corporate earnings, and

Read More »