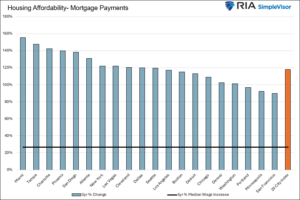

Housing affordability helps explain why residential real estate transactions have reached a standstill. Over the last five years, housing prices have surged. Per the Case-Shiller 20 City Home Price Index, home prices from 20 of the largest cities have risen between 33% and 80%. Over the same five-year period, mortgage rates jumped from 3.68% to 6.81%. Wage growth has helped to offset the higher prices and mortgage rates. However, with the median wage growth of 26% over the last five years, it has been woefully lagging.

We share the graph below to help contextualize the housing affordability problem. It highlights how much mortgage payments have risen over the last five years compared to wages. Consider that in 2019, a monthly mortgage payment for a $100,000

Read More »