We received a host of economics reports this past week; some good, others not so much. The week started with the Consumer Price Index report coming in better than expected at an increase of just 0.1% from the previous month (7.1% from a year ago), compared with respective estimates of 0.3% and 7.3%. This is great news (and the market responded in kind), as inflation continues to moderate not only here but also in Europe. US import and export prices were also both down in November. Economic sentiment continues to improve in Europe (ZEW survey better than expected) and in Japan (Tankan survey).

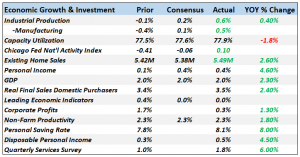

As far as the bad news: Well, retail sales declined 0.6% in November, worse than the estimate for a 0.3% drop. Industrial production ticked lower (-0.2% vs estimates of

Articles by Marcelo Perez

Weekly Market Pulse: Envy

December 12, 2022Legendary investor and Berkshire Hathaway vice-chair Charles Munger recently stated:

“The world is not driven by greed. It’s driven by envy.”

I think this perfectly encapsulates our current investing era. In a day and age where social media has replaced not only traditional news media but human interaction, where influencers and gamers are top career aspirations for the nation’s youth, where artists (content creators) are paid by the number of followers, likes, and comments, and where keeping up with the Jones’ (or the Kardashians, or the Windsors) is no longer a silent, Sisyphian struggle but a top-rated TV series or Netflix special, it is only natural for this poison to seep into the investing world.

Youtube stars dole out “investment strategies” left and right,

Weekly Market Pulse (VIDEO)

October 4, 2022Are investors at the point of maximum pessimism? Alhambra CEO Joe Calhoun talks about a horrible 3rd quarter, sentiment, and where investors can look right now.

[embedded content]

[embedded content]

Tags: Alhambra Research,Bonds,commodities,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Real Estate,stocks

Read More »Market Currents: Impact of Fed Tightening on Home Prices

September 29, 2022What impact does Fed tightening really have on home prices? Doug Terry, Alhambra’s Head of Investment Research, explains.

[embedded content]

[embedded content]

Tags: Alhambra Research,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Real Estate,stocks

Read More »Market Currents: Banks are Keeping Oil Prices High

September 28, 2022Who is really keeping oil prices high? Alhambra CEO Joe Calhoun says it’s the banks.

[embedded content]

[embedded content]

Tags: Alhambra Research,commodities,economy,Featured,Markets,newsletter

Read More »Market Currents – Is The Economy Contracting?

September 21, 2022Is the economy contracting? Alhambra’s Steve Brennan poses that question to CEO Joe Calhoun.

[embedded content]

[embedded content]

Tags: Alhambra Research,Bonds,commodities,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Real Estate,stocks

Read More »Investment Team Addition

August 30, 2022Weekly Market Pulse (VIDEO)

November 2, 2021Alhambra CEO talks about last week’s reversal in bonds yields, if there’s a growth scare, what the yield curve is saying, plus reports on wages & salaries, core capital goods, and jobless claims.

[embedded content]

[embedded content]

You Might Also Like

Weekly Market Pulse: Inflation Scare!

2021-10-25

The S&P 500 and Dow Jones Industrial stock averages made new all time highs last week as bonds sold off, the 10 year Treasury note yield briefly breaking above 1.7% before a pretty good sized rally Friday brought the yield back to 1.65%. And thus we’re right back where we were at the end of March when the 10 year yield hit its high for the year.

Weekly Market

Read More »Ask Bob – What Do I Do If I Choose The Wrong Medicare Plan?

October 22, 2021Alhambra’s Bob Williams answers the question, “What do I do if I choose the wrong Medicare Plan?”.

[embedded content]

[embedded content]

You Might Also Like

Weekly Market Pulse: Perception vs Reality

2021-10-18

It was the best of times, it was the worst of times… Charles Dickens, A Tale of Two Cities Some see the cup as half empty. Some see the cup as half full. I see the cup as too large.

Inflating Chinese Trade

2021-10-15

There was never really any answer given by the Chinese Communists for why their own export data diverged so much from other import estimates gathered by its largest trading partners. Ostensibly different sides of the same thing, it’s not

Read More »Weekly Market Pulse (VIDEO)

September 21, 2021Alhambra CEO Joe Calhoun discusses China’s Evergrand, this week’s Fed meeting, the overpriced stock market, and the latest CPI numbers and reports.

[embedded content]

[embedded content]

You Might Also Like

SNB Sight Deposits: Inflation Fear Decreasing, SNB Selling Euros

2021-09-20

Sight Deposits have fallen: The change is -0.2 bn. compared to last week, this means the SNB is selling euros and dollars.

Weekly Market Pulse: Buy The Dip, If You Can

2021-07-26

If you were waiting for a correction in stock prices to put some money to work, you got your chance last week. The Dow Jones Industrial Average was down nearly 1000 points at the low Monday and

Read More »Weekly Market Pulse (VIDEO)

September 21, 2021Alhambra CEO Joe Calhoun discusses China’s Evergrand, this week’s Fed meeting, the overpriced stock market, and the latest CPI numbers and reports.

[embedded content]

[embedded content]

You Might Also Like

SNB Sight Deposits: Inflation Fear Decreasing, SNB Selling Euros

2021-09-20

Sight Deposits have fallen: The change is -0.2 bn. compared to last week, this means the SNB is selling euros and dollars.

Weekly Market Pulse: Buy The Dip, If You Can

2021-07-26

If you were waiting for a correction in stock prices to put some money to work, you got your chance last week. The Dow Jones Industrial Average was down nearly 1000 points at the low Monday and

Read More »Weekly Market Pulse (VIDEO)

September 14, 2021Alhambra CEO Joe Calhoun responds to questions about a slowing economy, long-term economic impacts of COVID, stock prices and the business cycle.

[embedded content]

[embedded content]

You Might Also Like

SNB Sight Deposits: Inflation is there, CHF must Rise

2021-09-13

Sight Deposits have risen by +0.2 bn CHF, this means that the SNB is intervening and buying Euros and Dollars.

Weekly Market Pulse (VIDEO)

2021-09-08

Alhambra CEO Joe Calhoun talks about last week’s surprising market reaction to the unemployment numbers and why it’s important to study the bond market.

Weekly Market Pulse: Buy The Dip, If You Can

2021-07-26

If you were

Read More »Weekly Market Pulse (VIDEO)

September 8, 2021Alhambra CEO Joe Calhoun talks about last week’s surprising market reaction to the unemployment numbers and why it’s important to study the bond market.

[embedded content]

[embedded content]

You Might Also Like

SNB Sight Deposits: Inflation is there, CHF must Rise

2021-09-13

Sight Deposits have risen by +0.2 bn CHF, this means that the SNB is intervening and buying Euros and Dollars.

Weekly Market Pulse: Happy Anniversary!

2021-08-16

Today is the 50th anniversary of the “Nixon shock”, the day President Richard Nixon closed the gold window and ended the post-WWII Bretton Woods currency agreement. That agreement, largely a product of John Maynard Keynes, pegged

Read More »Ask Bob: Withholding Taxes From Social Security

July 22, 2021[embedded content]

[embedded content]

You Might Also Like

SNB Sight Deposits: Inflation is there, CHF must Rise

2021-07-19

Sight Deposits have risen by +0.2 bn CHF, this means that the SNB is intervening and buying Euros and Dollars.

RRP No Collateral Coincidences As Bills Quirk, Too

2021-07-12

So much going on this week in the bond market, it actually overshadowed the ridiculous noise coming from the Fed’s reverse repo. Some maybe too many want to make a huge deal out of this RRP if only because the numbers associated with it have gotten so big.

Another Round of Transitory: US Retail Sales & (revised) IP

2021-06-16

Same stuff,

Read More »Weekly Market Pulse (VIDEO)

July 19, 2021[embedded content]

[embedded content]

You Might Also Like

SNB Sight Deposits: Inflation is there, CHF must Rise

2021-07-19

Sight Deposits have risen by +0.2 bn CHF, this means that the SNB is intervening and buying Euros and Dollars.

Weekly Market Pulse: As Clear As Mud

2021-07-19

Is there anyone left out there who doesn’t know the rate of economic growth is slowing? The 10 year Treasury yield has fallen 45 basis points since peaking in mid-March. 10 year TIPS yields have fallen by the same amount and now reside below -1% again. Copper prices peaked a little later (early May), fell 16% at the recent low and are still down nearly 12% from the highs.

Read More »Weekly Market Pulse (VIDEO)

July 7, 2021[embedded content]

Weekly Market Pulse interview with Joe Calhoun.

[embedded content]

You Might Also Like

SNB Sight Deposits: Inflation Fear Decreasing, SNB Selling Euros

2021-07-05

Sight Deposits have fallen: The change is -0.5 bn. compared to last week, this means the SNB is selling euros and dollars.

Weekly Market Pulse (VIDEO)

2021-06-22

Weekly Market Pulse on June 21, where we look at significant things from last week’s events with Joe Calhoun.

Weekly Market Pulse: The Market Did What??!!

2021-04-19

One of the most common complaints I hear about the markets is that they are “divorced from reality”, that they aren’t acting as the

Read More »Weekly Market Pulse (VIDEO)

June 22, 2021[embedded content]

Weekly Market Pulse on June 21, where we look at significant things from last week’s events with Joe Calhoun.

[embedded content]

You Might Also Like

Weekly SNB Sight Deposits and Speculative Positions: Inflation is there, CHF must Rise

2021-06-21

Update June 21 2021: SNB intervening. Sight Deposits have risen by +1.1 bn CHF, this means that the SNB is intervening and buying Euros and Dollars.

Weekly Market Pulse (VIDEO)

2021-06-15

Weekly Market Pulse with Alhambra Investments, interview with Joe Calhoun.

Weekly Market Pulse: The Market Did What??!!

2021-04-19

One of the most common complaints I hear about the markets

Read More »Monthly Macro Monitor: Doom & Gloom, Good Grief

October 12, 2019When I first got in this business oh so many years ago, my mentor told me that I shouldn’t waste my time worrying about the things everyone else was worrying about. As I’ve related in these missives before, he called those things “well worried”. His point was that once everyone was aware of something it was priced into the market and not worth your time. That has proven to be valuable advice over the years and I think still relevant today.

We continue to hear, on an almost daily basis, about all the bad things going on in the world. Trade wars, real wars, Ukraine, impeachment, black listed Chinese companies, retaliation for black listing Chinese companies, tariffs on European goods (scotch??#$%^&!), climate scolding by woke teens, manufacturing recession, pension

Monthly Macro Monitor – June 2019 (VIDEO)

June 8, 2019[embedded content]

Alhambra Investments CEO reviews economic charts from the past month and his opinion of what they mean.

Related posts: Monthly Macro Monitor – March 2019 (VIDEO)

Monthly Macro Monitor – February (VIDEO)

Monthly Macro Monitor – December 2018 (VIDEO)

Monthly Macro Chart Review – April 2019 (VIDEO)

Monthly Macro Monitor – January 2019

Monthly Macro Monitor: Economic Reports

Monthly Macro Monitor: Well Worried

Tags: Alhambra Research,Featured,Monthly Macro Monitor,newsletter

Read More »Monthly Macro Monitor – March 2019 (VIDEO)

March 31, 2019Alhambra CEO discusses all the talk about the recent yield curve inversion and how he views it.

[embedded content]

Related posts: Monthly Macro Monitor – February (VIDEO)

Monthly Macro Monitor – December 2018 (VIDEO)

Monthly Macro Monitor – October 2018 (VIDEO)

Monthly Macro Monitor – January 2019

Monthly Macro Chart Review – March (VIDEO)

Monthly Macro Monitor: Well Worried

Monthly Macro Monitor – November 2018

Tags: Featured,Monthly Macro Monitor,newsletter

Read More »Monthly Macro Chart Review – March (VIDEO)

March 17, 2019Alhambra CEO discusses the most important economic reports from the past month.

[embedded content]

Related posts: Monthly Macro Chart Review – March

Monthly Macro Monitor – February (VIDEO)

Monthly Macro Monitor – October 2018 (VIDEO)

Monthly Macro Monitor – December 2018 (VIDEO)

Monthly Macro Monitor – September 2018

Monthly Macro Monitor – January 2019

Monthly Macro Monitor – September

Tags: Featured,Monthly Macro Monitor,newsletter

Read More »Bloomberg Interview with Jeffrey Snider

November 2, 2018Why Eurodollars Might Be Key to the Market Sell-Off (Podcast)

There’s a huge market out there that doesn’t get much attention: Eurodollars. These have nothing to do with the euro-dollar exchange rate. Instead, eurodollars are U.S. dollar-denominated deposits at foreign banks and overseas branches of American banks. They’re effectively a source of dollars that operates outside the control of the U.S., and have at various times been blamed for exacerbating interbank lending crunches. Jeff Snider, Head of Global Research at Alhambra, has a theory that recent market volatility might have its roots in some eurodollar drama. He speaks with Odd Lots about how this market grew in tandem with globalization, and how we should

Monthly Macro Monitor – September

September 20, 2018This has already been one of the longest economic expansions on record for the US and there is little in the data or markets to indicate that is about to come to an end. Current levels of the yield curve are comparable to late 2005 in the last cycle. It was almost two years later before we even had an inkling of a problem and even in the summer of 2008 – nearly three years later – there was still a robust debate about whether the US could avoid recession. The answer was, of course, no but we didn’t know that for sure until Lehman failed in September of 2008.

Our views on the economy are driven more by market based indicators than the economic data itself. We use these monthly reviews to look at all the data and try

Bi-Weekly Economic Review (VIDEO)

June 24, 2018[embedded content]

Information and opinions about the economy and markets from Alhambra Investments CEO Joe Calhoun.

Related posts: Bi-Weekly Economic Review:

Bi-Weekly Economic Review – VIDEO

Bi-Weekly Economic Review – VIDEO

Weekly SNB Intervention Update: SNB Resumes Interventions

Cookie policy

Privacy Policy

Bi-Weekly Economic Review: Oil, Interest Rates & Economic Growth

Tags: Bi-Weekly Economic Review,Featured,newsletter

Read More »Bi-Weekly Economic Review – VIDEO

June 4, 2018[embedded content]

Interview with Joe Calhoun about BiWeekly Economic Review 01/06/2018.

Related posts: The Currency of PMI’s

Why The Last One Still Matters (IP Revisions)

The Dismal Boom

Central Bank Transparency, Or Doing Deliberate Dollar Deals With The Devil

What About 2.62 percent?

More Pieces of Impossible

Not Do We Need One, But Do We Need A Different One

Tags: Featured,Markets,newsletter

Read More »Bi-Weekly Economic Review: Growth Expectations Break Out?

May 22, 2018There are a lot of reasons why interest rates may have risen recently. The federal government is expected to post a larger deficit this year – and in future years – due to the tax cuts. Further exacerbating those concerns is the ongoing shrinkage of the Fed’s balance sheet. Increased supply and potentially decreased demand is not a recipe for higher prices. In addition, there is some fear that the ongoing trade disputes may impact foreign demand for Treasuries. There are also, as our Jeff Snider has reported, some stresses in the Eurodollar market that are impacting Treasuries.

An unappreciated source of volatility is the mortgage market. Holders of mortgage securities, such as mortgage REITs, hedge with Treasuries

Bi-Weekly Economic Review

April 20, 2018[embedded content]

Related posts: Global Asset Allocation Update: The Certainty of Uncertainty

Why Trade Wars Ignite and Why They’re Spreading

The Genie’s Out of the Bottle: Eight Defining Trends Are Reversing

Bi-Weekly Economic Review: Investing Is Not A Game of Perfect

US-China Trade War Escalates As Further Measures Are Taken

Less Retail Jobs, More Amazon Robots: Get Used To It

Le Liban découvre la politique monétaire non conventionnelle

Tags: Featured,Markets,newslettersent

Read More »Bi-Weekly Economic Review

April 5, 2018[embedded content]

Bob Williams and Joseph Y. Calhoun talks about Bi-Weekly Economic Review for April 01, 2018.

Related posts: Bi-Weekly Economic Review: Embrace The Uncertainty

Bi-Weekly Economic Review

Bi-Weekly Economic Review: One Down, Three To Go

Bi-Weekly Economic Review: A Whirlwind of Data

Bi-Weekly Economic Review: Don’t Underestimate Gridlock

More Pieces of Impossible

Bi-Weekly Economic Review

Tags: Bi-Weekly Economic Review,Bob Williams,Featured,Joseph Y. Calhoun,Markets,newsletter

Read More »Bi-Weekly Economic Review

March 19, 2018[embedded content]

Bob Williams and Joseph Y. Calhoun talks about Bi-Weekly Economic Review for March 15, 2018.

Related posts: Bi-Weekly Economic Review: The New Normal Continues

Bi-Weekly Economic Review: Gridlock & The Status Quo

Bi-Weekly Economic Review: Maximum Optimism?

Bi-Weekly Economic Review: As Good As It Gets

Bi-Weekly Economic Review: Ignore The Idiot

Bi-Weekly Economic Review

Bi-Weekly Economic Review

Tags: Bi-Weekly Economic Review,Bob Williams,Featured,Joseph Y. Calhoun,newslettersent

Read More »Forget It, China’s Not Booming

January 28, 2018Jeffrey Snider

Jeffrey Snider, head of global investment research at Alhambra Investments, says China is in fact not growing rapidly, which sounds disheartening for commodity investors. He reckons a crucial investment metric has weakened, pointing to slower economic expansion:

https://www.bnn.ca/video/forget-it-china-s-not-booming-money-manager~1310003

Related posts: The Dismal Boom

U.S. Unemployment: The Dissonance Book

Bi-Weekly Economic Review: A Weak Dollar Stirs A Toxic Stew

Bi-Weekly Economic Review: Yawn

Bi-Weekly Economic Review: Extending The Cycle

Bi-Weekly Economic Review: Attention Shoppers

Bi-Weekly Economic Review