The near-term impact will likely be limited but this is a clear negative for trade negotiations.Shortly after the renminbi’s sharp depreciation on Monday, the US Treasury Department labelled China a currency manipulator. This is the first time in 25 years that the US government has designated a country as a currency manipulator.According to the US Treasury Department, the decision was triggered by the perceived lack of action by the PBoC to resist the renminbi depreciation. Given that the US government has already imposed (or promised to impose) significant tariffs on virtually all Chinese imports while sanctions on some Chinese technology companies are also already in place, the likelihood of additional aggressive action being taken by the US against China is low in the near

Read More »Articles by Luc Luyet & Dong Chen

Currency update – the Chinese renminbi

August 7, 2019Despite the CNY’s recent fall, we believe the People’s Bank of China will refrain from competitive devaluationFollowing US President Donald Trump’s announcement of a new 10% tariff on USD300 billion of Chinese goods, the Chinese renminbi (rmb) weakened sharply and breached CNY7.00 per USD.The recent rmb move, in our view, represents a major shift in the People’s Bank of China’s (PBoC) currency policy, reflecting the deteriorating outlook for trade negotiations with the US and the resulting additional downward pressure on the Chinese economy.Consequently, we have decided to change our forecasts for the rmb against the US dollar to CNY7.10 per USD for the entire time horizon (three, six and twelve months) from CNY6.95 per USD previously. However, we do not believe it is in China’s best

Read More »Another hot summer for the renminbi

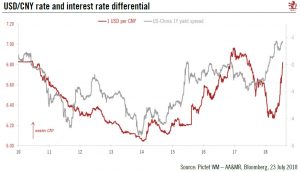

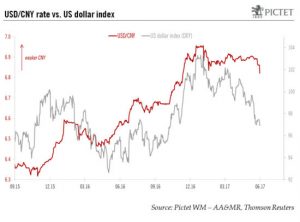

July 25, 2018China’s policy stimulus could continue to weigh on the renminbi in the near term, but fading support for the dollar and PBoC may limit downside risks for the Chinese currency.Since mid-June, the renminbi has come under severe downward pressure. The China Foreign Exchange Trade System (CFETS) renminbi index has lost roughly 4.7%, while the renminbi has dropped roughly 5.8% against the US dollar. As we are moving nearer to the psychological threshold of CNY7.00 per USD, concerns that the People’s Bank of China (PBoC) might be engineering currency depreciation are likely to increase. This is likely to have a significant impact on worldwide financial markets if similar episodes of renminbi weakness in August 2015 and June 2016 are of any guidance.In our view, the latest depreciation of the

Read More »New fixing mechanism limits renminbi depreciation against the U.S. dollar

June 1, 2017A new daily fixing mechanism gives the Chinese central bank more control over the exchange rate and reduces pressure on the renminbi in the case of renewed dollar strength.The People’s Bank of China (PBoC) recently announced the introduction of a “counter cyclical adjustment factor” (CCAF) to calculate the daily USD/CNY reference rate (the “fixing rate”). The previous formula used two factors: the USD/CNY spot close of the previous day and an adjustment factor taking into account overnight changes in demand and supply in the FX markets. The PBoC’s justification for the inclusion of a third factor, the CCAF, is to increase the weighting of macroeconomic fundamentals in the exchange rate price quotation.The CCAF mechanism could be used by the PBoC to reduce the impact of the USD/CNY spot

Read More »