Inside This Week’s Bull Bear Report

CFNAI Index Suggests Economy Is Slowing

How We Are Trading It

Research Report – CAPE-5, A Better Measure

Youtube – Before The Bell

Market Statistics

Stock Screens

Portfolio Trades This Week

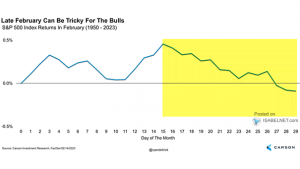

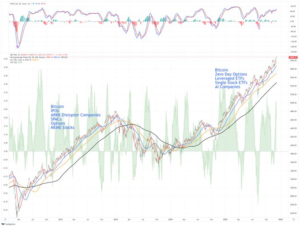

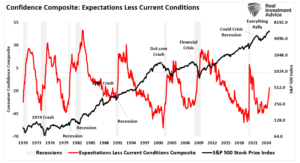

February Weakness And The Outlook For March

Last week, we discussed that continued bullish exuberance and high levels of complacency can quickly turn into volatility. Over the previous week, the market fell sharply following news of a potential viral outbreak in China and more concerns about tariffs from the Trump Administration. While those were the headlines that gained the market’s attention, the reality was that the market was overbought and on a sell signal, setting the market up for pullback. The correction was not

Read More »