Mere inflation—that is, the mere issuance of more money , with the consequence of higher wages and prices—may look like the creation of more demand. But in terms of the actual production and exchange of real things it is not.—Henry Hazlitt, Economics in One Lesson

Money is among the most important forms of technology. It solves the fundamental human problem of barter and allows us to transfer value across geography and time. By enabling efficient trade—and thereby profit and capital investment—money has been as critical to human development as fire and the wheel.

This money technology arose in the marketplace, without design by central authorities. Carl Menger explained the origin of money as the most saleable commodity. Ludwig von Mises explained its value as

Articles by Jeff Deist

A Permanent Wartime Economy

March 14, 2023Resources are scarce even when money is not.

Original Article: "A Permanent Wartime Economy"

This Audio Mises Wire is generously sponsored by Christopher Condon.

[embedded content]

Tags: Featured,newsletter

Read More »A Permanent Wartime Economy

March 8, 2023“Governments create money all the time. We do that for war.”

“This whole notion that you run government like you run a household…is a complete myth”Economist Prof Mariana Mazzucato tells #Newsnight Government’s should address social issues through taxhttps://t.co/P0zxS1DNGF pic.twitter.com/I6NLtXgDqN— BBC Newsnight (@BBCNewsnight) March 6, 2023This is the argument for more money printing, and perhaps unlimited money printing, recently advanced by Professor Mariana Mazzucato on prime-time BBC.

Channeling Warren Mosler, the godfather of modern monetary theory, Dr. Mazzucato argues against “austerity”—by which she means any natural restraints on government spending. In order to spend, sovereign states need not “earn” tax revenue like a household must earn money, nor

The New Inflationary Reality

February 27, 2023Recorded in Tampa, Florida on February 25, 2023.

[embedded content]

Tags: Featured,newsletter

Read More »Money versus Monetary Policy

February 22, 2023Money is simple. The political program of monetary "policy" is not.

Original Article: "Money versus Monetary Policy"

This Audio Mises Wire is generously sponsored by Christopher Condon.

[embedded content]

Tags: Featured,newsletter

Read More »Father Time versus Central Bankers

December 30, 2022Only Father Time helps us cut through the policy nonsense and understand interest rates conceptually.

Original Article: "Father Time versus Central Bankers"

This Audio Mises Wire is generously sponsored by Christopher Condon.

[embedded content]

Tags: Featured,newsletter

Read More »The Mises Institute’s Goal Is a World Free of War and Politics. Will You Stand by Our Side?

December 29, 2022Dear Friend,

In the midst of this busy Christmas season, I want to make sure you received our year-end letter from Lew Rockwell.

If you already responded, thank you! But if not, will you take a minute today to make your most generous contribution and support the Mises Institute?

We are all thankful to have the political season of 2022 over, but now the 2024 presidential election looms like a bad moon. The midterms solved nothing and brought no relief to a divided and angry America.

But as a supporter of the Mises Institute, you know a better world is possible.

Democrats are insane and full of hate, doubling down on their every failed idea. Conservatives, for their part, are clueless about money, markets, property, and the crucial need for peace. Democracy itself

Father Time vs. Central Bankers

December 15, 2022An excellent new book from Edward Chancellor, The Price of Time, sets out to explain both the theory and history of interest rates across five millennia and countless cultures. The theory is frequently bungled by economists; the history is frequently glossed over by historians. But thankfully Mr. Chancellor is up to the task. He is an excellent and engaging writer, owing presumably to his long career as a financial journalist.

We need more books like this. Economists tend not to ask basic questions like, “What are interest rates, where do they come from, and what purpose do they serve?” But they should. No less than Richard Cantillon and Eugen von Böhm-Bawerk, both quoted in the opening notes, viewed the phenomenon of interest on capital as the murkiest and most

“Classical Liberalism” Will Never Satisfy the Left

December 6, 2022“Today the tenets of this nineteenth-century philosophy of liberalism are almost forgotten. In the United States “liberal” means today a set of ideas and political postulates that in every regard are the opposite of all that liberalism meant to the preceding generations.”

—Ludwig von Mises, 1962 (emphasis added)

F.A. Hayek is back in the public eye, thanks to a promising and weighty new biography from Professors Bruce Caldwell and Hansjörg Klausinger. Predictably, the book has brought Hayek’s critics out of the woodwork. Consider the recent backhand in The Spectator by Lord Robert Skidelsky, titled “Friedrich Hayek: A Great Political Thinker Rather than a Great Economist.” Readers quickly understand the author actually thinks Hayek was neither. This is perhaps not

The Front Lines of the Language Wars

October 6, 2022Language is the perfect instrument of empire.

—Antonio de Nebrija, bishop of Ávila, 1492

The bishop was correct, in his time and ours. Spain proceeded to become the most powerful empire in the world over the following century, spreading her mother tongue across the Americas—just as the Roman army had imposed Latin across its sweep and just as the British Empire would bring English to India and Africa. American dominance in the twentieth century similarly meant English became the default international language of business. English speakers today enjoy the privilege of traveling a world where airport marquees, road signs, restaurant menus, hotel staff, and shopkeepers all cater to us.

So we might think the global language wars are over, with English declared the

From the Publisher September–October 2022

October 1, 2022Who frames the “climate” debate in this country? Or any political debate, for that matter?

We all know the answer. Left progressives have mastered the emotive art of posing supposedly good intentions as actual arguments. They enjoy a childlike state of suspended disbelief that allows them to insist reality can be legislated. Being progressive increasingly means never accepting responsibility for the plainly foreseeable consequences of your proposed policies.

How many times have you found yourself explaining rather than asserting, arguing from your heels rather than requiring your interlocutor to make a positive case for state intervention to fix X, Y, or Z? We see this across a wide range of issues: making the case for government action satisfies the urge to do

Inflation: State-Sponsored Terrorism

September 9, 2022I. Introduction

Remember the quaint old days of 2019? We were told the US economy was in great shape. Inflation was low, jobs were plentiful, GDP was growing. And frankly, if covid had not come along, there is a pretty good chance Donald Trump would have been reelected.

At an event in 2019, my friend and economist Dr. Bob Murphy said something very interesting about the political schism in this country. He said: If you think America is divided now, what would things look like if the economy was terrible, if we had another crash like 2008?

Well, we might not have to imagine such a scenario much longer.

If you think Americans are divided today, and at each other’s throats—metaphorically, but more and more literally—imagine if they were cold and hungry!

Imagine if we

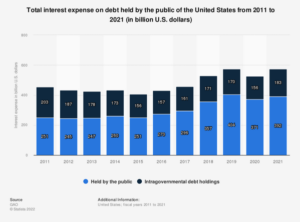

Rising Interest Rates May Blow Up the Federal Budget

July 12, 2022Congress enjoys exorbitant political privilege in the form of cheap deficit spending—but it may soon come to an end.

Original Article: “Rising Interest Rates May Blow Up the Federal Budget”

In fiscal year 2020, at the height of covid stimulus mania, Congress managed to spend nearly twice what the federal government raised in taxes.

Yet in 2021, with Treasury debt piled sky high and spilling over $30 trillion, Congress was able to service this gargantuan obligation with interest payments of less than $400 billion. The total interest expense of $392 billion for the year represented only about 6 percent of the roughly $6.8 trillion in federal outlays.

How is this possible? In short: very low interest rates. In fact, the average weighted rate across all

The Terrible Economic Ignorance Behind Covid Tradeoffs: My Speech to the Ron Paul Institute

September 10, 2021Some of you may know the name Alex Berenson, the former New York Times journalist who comes from a left-liberal background. He has been absolutely fearless and tireless on Twitter over the past eighteen months, documenting the overreach and folly of covid policy—and the mixed reality behind official assurances on everything from social distancing to masks to vaccine efficacy. He became a one-man army against the prevailing covid narratives.

Mr. Berenson is famous for creating a viral (no pun intended) phrase which swept across Twitter last year: virus gonna virus.

Which means: whether one is in Sweden or Australia, whether in New York or Florida, whether you have mask mandates or lockdowns or close schools or require vaccine passports—or do NONE of these

Can Economics Save Medicine?

June 24, 2021[This article is excerpted from a talk given June 17, 2021, at the Mises Institute’s Medical Freedom Summit in Salem, New Hampshire.]

Ladies and gentlemen, why are we here today?

First, in a certain sense medicine in America is broken. Doctors and patients are unhappy, the quality of care deteriorates, and costs keep increasing. Even before covid, US life expectancy declined three years running. Even before covid, too many Americans were sick, depressed, fat, and unhappy with their physical and mental health. I wonder if we’ll ever have accurate data about undiagnosed and untreated cancer and other serious illness as a result of the hospital and clinic lockdown. It strikes me this is the kind of information we might want before we consider another lockdown for any

A Libertarian Approach to Disputed Land Titles

June 6, 2021The recent spate of bombing violence in Israel’s West Bank, East Jerusalem, and Gaza demonstrates the enduring attachment both Israelis and Palestinians have to physical land in the country. Both sides make claims—legal, moral, and political—to land within Israel, from the southernmost tip of Gaza to the northernmost tip of the Golan Heights. This ongoing and often violent dispute is based on interrelated historical and religious events reaching back thousands of years, even before the origins of the biblical Holy Land. And while ancient disputes are inherently more difficult to resolve, twentieth-century events also weigh heavily on the current conflict. The Balfour Declaration in 1917, the official establishment of Israel by UN resolution in 1948, decisive

Read More »Why Is Economic Journalism So Bad?

March 16, 2021Niall Ferguson holds a PhD in philosophy from Oxford, taught history at Harvard and NYU, and wrote perhaps the definitive biography of Henry Kissinger.

So, naturally, Bloomberg hired him to write on economics.

His most recent column for Bloomberg is a strained mix of the Scot’s views on inflation, tempered slightly by a welcome skepticism toward Jerome Powell’s dismissal of the threat. Ferguson is still gun-shy from an exchange with Paul Krugman back in 2010 over inflation, but he’s at least willing to challenge Powell’s unwarranted reassurances. Yet as Ferguson wends his way through an examination of yields curves and velocity, and the “breakeven” inflation rate, readers get the strong impression he’s offering nothing more than a crapshoot designed to show off

Playing Games with Stocks

March 7, 2021The GameStop saga—can we call it an insurrection?—wants easy heroes and villains. Both are available.

The populist version of the story goes like this: a few thousand angry gamers, colluding via the now infamous WallStreetBets subreddit, brought at least one powerful hedge fund to its knees. Melvin Capital and other short sellers, completely blindsided, lost a reported $5 billion in what must have seemed like a sure-bet opportunity for their model of vulture capitalism.

Meanwhile GameStop, the plucky brick-and-mortar retailer thought to be going the way of Blockbuster Video, gained a reprieve from its looming execution date. Robinhood, the “free” app masquerading as a stock trading platform for the little guy, was exposed as a data-mining operation—one happy to

What Biden/Harris Will Do

January 24, 2021Paraphrasing the late Murray Rothbard, the “two party” system in America during the twentieth century worked something like this: Democrats engineered the Great Leaps Forward, and Republicans consolidated the gains. Wilson, Roosevelt, and Johnson were the transformative presidents; Eisenhower, Nixon, and Reagan offered only rhetoric and weak tea compromises. In politics, being for something always beats being against something, and Republicans were never much against expanding federal power provided they had a place at the trough.

George W. Bush challenged this dynamic in the early twenty-first century. Despite his own intellectual incuriosity, he used the terrorist events of 9-11 to advance a particularly noxious “conservative” foreign policy and justify a

Surviving Tech Purges: What We’re Doing at the Mises Institute

January 14, 2021[unable to retrieve full-text content]In the early 1980s few outlets existed for anyone interested in the Austrian school of economics or robust libertarian scholarship. Few universities taught Hayek, much less Mises or Rothbard. Libraries and bookstores carried little of interest for serious economists and thinkers in the old liberal tradition.

Read More »2021: Welcome to Post-persuasion America

January 8, 2021Mobilization and separation, not persuasion, is the way forward.

Original Article:

Welcome to 2021 in post-persuasion America!

I first heard this term used by Steve Bannon, architect of the surprising 2016 Trump campaign, in a PBS Frontline documentary titled America’s Great Divide. Speaking way back in the precovid days of early 2020, Bannon asserted the information age makes us less curious and willing to consider worldviews unlike our own. We have access to virtually all of humanity’s accumulated knowledge and history on devices in our pockets, but the sheer information overload causes us to dig in rather than open up. Anyone who wants to change their mind can find a whole universe of alternative viewpoints online, but very few people do (especially

Read More »Jeff Deist on Hoppe’s Democracy: The God That Failed

November 3, 2020Why don’t elections bring harmony and closure rather than ever greater political friction? Hans-Hermann Hoppe explained all of the fundamental problems with mass democracy more than 20 years ago in Democracy: The God That Failed.

Jeff Deist finishes his series on this devastating classic with a look at Hoppe’s final chapters, critiquing conservatism, liberalism, and constitutionalism. Why do both conservatism and liberalism fail? (hint: democratic mechanisms). Liberalism is property, not majority rule, and all governments tend to attack rather than defend property over time. So what is the best way forward, combining a liberal economic program with the old conservative understanding of natural order? And how do we get there? Don’t miss this discussion of Hoppe’s

The Absurdity of Covid “Cases”

October 5, 2020Today’s headlines announced Donald and Melania Trump “tested positive” for covid-19. Another claims nineteen thousand Amazon workers “got” covid-19 on the job. Both of these pseudostories are sure to ignite another absurd media frenzy.

As always, the story keeps changing: Remember ventilators, flatten the curve, the next two weeks are crucial, etc.? Remember Nancy Pelosi in Chinatown back in February, urging everyone to visit? Remember Fauci dismissing masks as useless? Why should we believe anything the political/media complex tells us now?

So what do these headlines really mean? What exactly is a covid “case”?

Since the beginning of the coronavirus outbreak, most US media outlets have been exceedingly credulous and complicit in their reporting. Journalists

The Search for Yield

June 9, 2020A no-holds-barred discussion of the economy after the coronavirus shutdown and George Floyd protests. Are we facing another Great Depression? Can there be a V-shaped recovery or is this wishful thinking? What will all the new money and credit created by Congress and the Fed mean for the dollar? What kind of economic mess will Trump or Biden inherit in 2021? How far will Fed chair Powell go to keep markets propped up? And how can you protect yourself and your savings?

Recorded at Avondale Brewing Company in Birmingham, Alabama, on June 6, 2020. Special thanks to Mark Walker for sponsoring this event.

You Might Also Like

Michael Flynn, Lori Loughlin, and the Permanent Culture of Prosecutorial Abuse

When

How Bad Is It?

May 15, 2020How bad is it?

That is the question on everyone’s mind as we come to grips with the economic carnage caused by global economic shutdowns, supply chain disruptions, and ongoing quarantines of million of people. Do we face another Great Depression, or simply a deep recession more like 2008? And equally important, are soft Americans prepared for either? Have we started to process all of this psychologically? Have we really come to terms with the enormity of the situation, with the unprecedented risk posed by business shutdowns? Are Americans so accustomed to a certain material standard of living that they do not understand how fragile it is?

Here is what we know.

Since February, 30 to 40 million of Americans have been thrown out of work. Four or 5 million file new

How to Think About the Fed Now

April 18, 2020.

[This text is excerpted from the introduction to The Anatomy of the Crash, a Mises Institute ebook to be released in April 2020.]

The Great Crash of 2020 was not caused by a virus. It was precipitated by the virus, and made worse by the crazed decisions of governments around the world to shut down business and travel. But it was caused by economic fragility. The supposed greatest economy in US history actually was a walking sick man, made comfortable with painkillers, and looking far better than he felt—yet ultimately fragile and infirm. The coronavirus pandemic simply exposed the underlying sickness of the US economy. If anything, the crash was overdue.

Too much debt, too much malinvestment, and too little honest pricing of assets and interest rates made

Mises and the “New Economics”

February 26, 2020[This article is excerpted from a talk delivered on February 22, 2020 at the Austrian Student Scholars Conference, hosted by Grove City College in Pennsylvania.]

I. Introduction

What a wonderful gathering of students today, on this impressive and beautiful campus. We can see why Hans Sennholz loved this place, and why Drs. Herbener and Ritenour so enjoy living and teaching here. You are all too young to serve as the “remnant,” so we will consider you the vanguard instead. I’m always impressed by young people with an interest in serious scholarship and ideas, who have the intellect to read 900-page books. We are told nobody reads anymore, and certainly not dense tomes about economic theory, but this raises a question: are the rare people who do read such books

Jeff Deist: The Tom Woods Interview

January 25, 2020TOM WOODS: This is the Tom Woods Show, and today I welcome Jeff Deist.

Everybody wants to know the sheer nuts and bolts of how somebody becomes Ron Paul’s chief of staff. I’ll tell a little story most people don’t know. About ten years ago, Dr. Paul was approached about doing an autobiography; he would have gotten a huge advance. There was big demand for it! But he just couldn’t believe people were interested in the details of his life. His heart wasn’t in it, so he decided to say no. I know you’re kind of the same way, but doggone it, Jeff Deist, there are some details I want to wring out of you!

You start off as a lawyer in California and have a successful career in the financial world, and then, somehow, you’re Ron Paul’s chief of staff, and somewhere along the

Understanding Money Mechanics

January 4, 2020Dr. Bob Murphy joins the Human Action Podcast to discuss one of the most important issues of all: how money and credit work in today’s society. Jeff Deist recently commissioned Murphy to write a series of articles on money mechanics, an exceedingly important topic for critics of the Fed—and today’s podcast serves as an introduction to the project. The articles will be compiled into an e-book, with plenty of graphics to simplify the basic process of money creation in a fractional reserve system. If you want to understand how the Fed works, how money and credit come into being, how interest rates arise, and what it all means for you, don’t miss this great upcoming series at mises.org.

Additional Resources

Jeff Deist on Understanding Fed Money Mechanics

The Cultural Consequences of Negative Interest Rates

December 4, 2019Negative interest rates are now entrenched reality in Europe, and not just for buyers of sovereign or corporate debt – even retail savings accounts are affected. What does this mean for real people trying to save for retirement? And more broadly, what does it mean for Europe culturally? Not to mention America, since Alan Greenspan tells us negative rates are coming here soon?

Our guest Rahim Taghizadegan from the independent Viennese Scholarium joins the show to discuss the anti-economics of negative rates. He is co-author of a new book titled The Zero Interest Trap. He is also a co-author of Austrian School for Investors.

Related posts: SNB Jordan: Cannot say how long negative interest rates will last

UBS: