Despite the more optimistic claims of political pundits and Federal Reserve officials (Jerome Powell, specifically), things are far from being under control. Notwithstanding archetypal Austrian objections to “loose” monetary and fiscal policies on the grounds that they create production structures that ultimately deplete the pool of real savings, the operational failures of central banks cross-globally are largely nested in faulty axioms. Intellectually corrupt frameworks of analysis also appear to be à la mode, recently inspiring Mark Carney, former governor of the Bank of England, to express his fears about a possible “liquidity trap” rendering monetary policy ineffective.

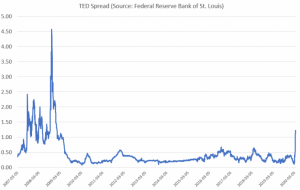

A well-known calendar low period in liquidity, mid-September of 2019 nonetheless produced