Here is what you need to know on Wednesday, February 14:

The US Dollar Index consolidates it’s gains early Wednesday after rising 0.7% to a fresh three-month high near 105.00 on Tuesday. Eurostat will release fourth-quarter Gross Domestic Product (GDP) data in the European session and there won’t be any high-tier data releases from the US later in the day. Several Federal Reserve (Fed) policymakers, including Chicago Fed President Austan Goolsbee and Atlanta Fed President Raphael Bostic, will be delivering speeches.

The data published by the UK’s Office for National Statistics (ONS) showed on Wednesday that inflation in the UK, as measured by the change in the Consumer Price Index (CPI), held steady at 4% in January. On a monthly basis, the CPI declined by 0.6%.

Articles by Eren Sengezer

USD/CHF trades at fresh 2020 highs above 0.9760 ahead of NFP

February 9, 2020CHF struggles to find demand as a safe-haven on Friday.

US Dollar Index pushes higher above the 98.50 mark.

Nonfarm Payrolls in US is expected to come in at 160K in January.

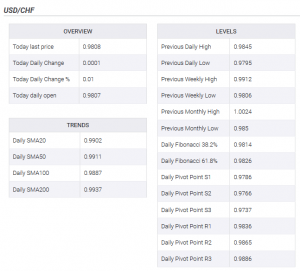

The USD/CHF pair closed the last four trading days in the positive territory and continued to edge higher on Friday to touch its best level since December 27th at 0.9772. As of writing, the pair was up 0.2% on the day at 0.9763.

The sour market mood fails to help the CHF find demand as a safe-haven after the Swiss National Bank made it clear that it was ready to cut its policy rate further and intervene in the FX markets if needed to curb the CHF’s value.

Will DXY stretch higher after NFP?

On the other hand, the broad-based USD strength it providing an additional boost to the pair. Ahead of

SNB’s Maechler: SNB will not change policy after being put on watch list by US

January 23, 2020Andrea Maechler

Being put on the currency manipulation watchlist by the United States will not change the Swiss National Bank’s (SNB) monetary policy, SNB Governing Board member Andrea Maechler said on Wednesday, per Reuters.

“The SNB is ready to intervene in FX markets if needed,” Maechler noted and added that the SNB will end negative interest rates as soon as they are able to.

Market reaction

The USD/CHF pair largely ignored these remarks and was last seen trading at 0.9690, adding 0.08% on a daily basis.

Related posts: US Treasury adds Swiss Franc back to its currency watch list – Bloomberg

US places Switzerland on trade ‘watch list’

Referenzzins – SNB-Direktorin Maechler drängt auf rasche Saron-Umstellung

More

USD/CHF finds support near 0.9800 before SNB’s Quarterly Bulletin

December 18, 2019Major European stocks post modest losses on Wednesday.

US Dollar Index clings to gains above 97.30.

Coming up: Swiss National Bank’s (SNB) Quarterly Bulletin.

The USD/CHF pair dropped to its lowest level since late August at 0.9798 on Wednesday but staged a technical recovery in the last hour. As of writing, the pair was up 0.05% on the day at 0.9808.

After major Asian equity indexes closed the day in the negative territory on Wednesday, European stocks struggled to gain traction to reveal a sour market mood, which benefits the safe-haven CHF. Additionally, the 10-year US Treasury bond yield is down 0.6% on the day to confirm the risk-off atmosphere. The lack of fresh developments surrounding the US-China trade deal seems to be forcing investors to book their

USD/CHF retreats to 0.9820 area as USD loses strength

December 17, 2019US Dollar Index erases daily recovery gains ahead of American session.

European equity indexes stay in the negative territory.

Coming up: Building Permits, Housing Starts and Industrial Production data from US.

The USD/CHF lost its traction in the last couple of hours and retraced its daily recovery gains pressured by the sour market mood and the broad USD weakness. As of writing, the pair was down 0.02% on the day at 0.9818.

The USD recovery during the early trading hours of the European session allowed the pair to stretch higher toward the 0.9850 area. The US Dollar Index, which tracks the greenback’s value against a basket of six major currencies, rose to 97.30 but reversed its direction. At the moment, the index is at 97.10, losing 0.04% on a daily basis.

SNB’s Jordan: Without negative rates, CHF would be more attractive and rise in value

November 1, 2019In his prepared remarks delivered to pension managers on Thursday, Swiss National Bank Chairman Thomas Jordan said negative interest rates and readiness to intervene in the forex market was still essential to ease the pressure on the Swiss Franc.

“Without negative rates, the Franc would be more attractive and rise in value,” Jordan further argued.

The USD/CHF pair largely ignored Jordan’s comments and was last seen trading at 0.9875, down 0.18% on a daily basis. Below are some additional quotes, as reported by Reuters.

“Negative interest rate protects traditional interest rate gap vs other countries.”

“Narrowing interest rate spread would increase upward pressure on the Franc.”

“Short-term interest rates could remain below usual levels even if central banks