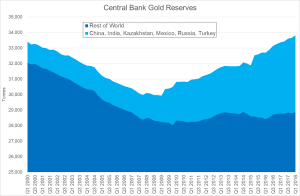

– There has been a recent change for the better in central bank attitudes to gold

– There has been “net gold demand by central banks – approx. 500 tonnes per year – as a source of return, liquidity and diversification”

– Policy shift to maintaining stable gold holdings reflects central bank concerns about financial markets and geopolitics

– Little in the current global economic and political environment to support any reason to change in this conservative position

– Central bank positivity to gold and gold buying should provide long-term underlying support to gold prices

Should central banks hold gold?

From the late 1980s into the new millennium the answer appeared to be in the negative, with global central bank

Articles by Bron Suchecki

Against Irredeemable Paper – Precious Metals Supply and Demand

July 26, 2017The Antidote

Something needs to be said. We are against the existence of irredeemable paper currency, central banking and central planning, cronyism, socialized losses and privatized gains, counterfeit credit, wealth transfers and bailouts, and welfare both corporate and personal.

When we write to debunk the conspiracy theories that say manipulation is keeping gold from hitting $5,000 (one speaker here at Freedom Fest claimed gold will go to $65,000), we are not trying to defend the Fed. When we discuss the flaws in predicting that kind of price, and the error in expecting to profit from it, we are not expressing a pro irredeemable dollar view.

We are saying there are good arguments against the regime of

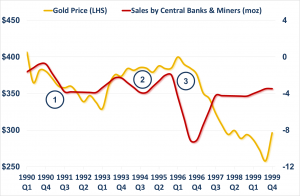

The Voldemort Effect: Gold Price and Gold Sales

April 1, 2016Gold market analysts have for many years puzzled over the unusual behaviour of the gold market during the 1990s, specifically the bizarrely flat gold price from 1993 to 1996 in the face of sustained selling pressure from central banks and gold miners hedging their production. To-date no one has been able to identify the hidden source of demand that was obviously supporting the gold market during that period.

In addition, conventional justifications that accelerated sales by central banks after 1996, which broke the gold market and drove the price down over 35% from $400 to $250, were just portfolio readjustments have been rejected by many analysts who instead see them as a conspiracy to suppress the gold price to ensure support for fiat currencies. But what if there was another more pressing reason for such central bank desperation?

The 1990s

Gold price in US dollars(1) compared to the combined gold sales volume (in millions of ounces) by central banks and gold miners during the 1990s.Note that during this decade the red line is always below zero, indicating sales of gold every quarter, and logically we should expect that such large and continuous sales would result in the gold price falling. You can see that during the beginning of the decade (marked 1 on the chart) that the gold price fell from 1990 through to 1993, in line with increasing volume of sales.

Monetary Metals Hires Bron Suchecki

February 12, 2016Scottsdale, AZ—Monetary Metals is pleased to announce that it has hired Bron Suchecki as Vice President, Operations. Bron will help the company develop new products and processes.

“We are excited to be able to attract someone of Bron’s caliber. We are growing to serve many customer opportunities, and Bron is a key part of our team,” said Keith Weiner, the CEO.

Bron leaves a management position at the Perth Mint, where he has become widely known over 20 years there. His areas of expertise include the physical side of the bullion business, risk management, and market analysis.

Bron will help the company grow its fund and market letter business, and develop additional products as part of the Monetary Metals vision.

About Monetary Metals

Monetary Metals is the leading company in gold investments, offering investors a gold yield on their gold. The company also publishes much of its groundbreaking proprietary research, to help the investment community better understand gold and its emerging role.