We show the monthly development of government bond yields over years, thanks to a table from the ECB. Click to expand, source ECB Disinflation in the Euro zone depresses bond yields everywhere, 2014 versus 2013 June 2014: By July 2013, government bond yields of European safe-havens have risen compared the rates of July 2012, but the ones of crisis countries decreased: Click to expand, source ECB The following was the data as of July 18th 2012, at the height of negative interest rates for safe-havens. Government bond yields under 2% (as of July 18th) Links: Government Bonds on Financial Times and on Forexpros George Dorgan (penname) predicted the end of the EUR/CHF at the CFA Society and at many occasions on SeekingAlpha.com and on this blog. Several Swiss and international financial advisors support the site. These firms aim to deliver independent advice from the often misleading mainstream of banks and asset managers. George is FinTech entrepreneur, financial author and alternative economist. He speak seven languages fluently.

Topics:

George Dorgan considers the following as important: Government Bonds

This could be interesting, too:

Jeffrey P. Snider writes They’ve Gone Too Far (or have they?)

Jeffrey P. Snider writes Why The Japanese Are Suddenly Messing With YCC

Jeffrey P. Snider writes Japan: Fall Like Germany, Or Give Hope To The Rest of the World?

Jeffrey P. Snider writes Bonds And Soft Chinese Data

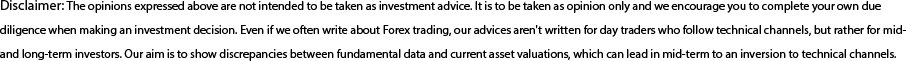

We show the monthly development of government bond yields over years, thanks to a table from the ECB.

Click to expand, source ECB

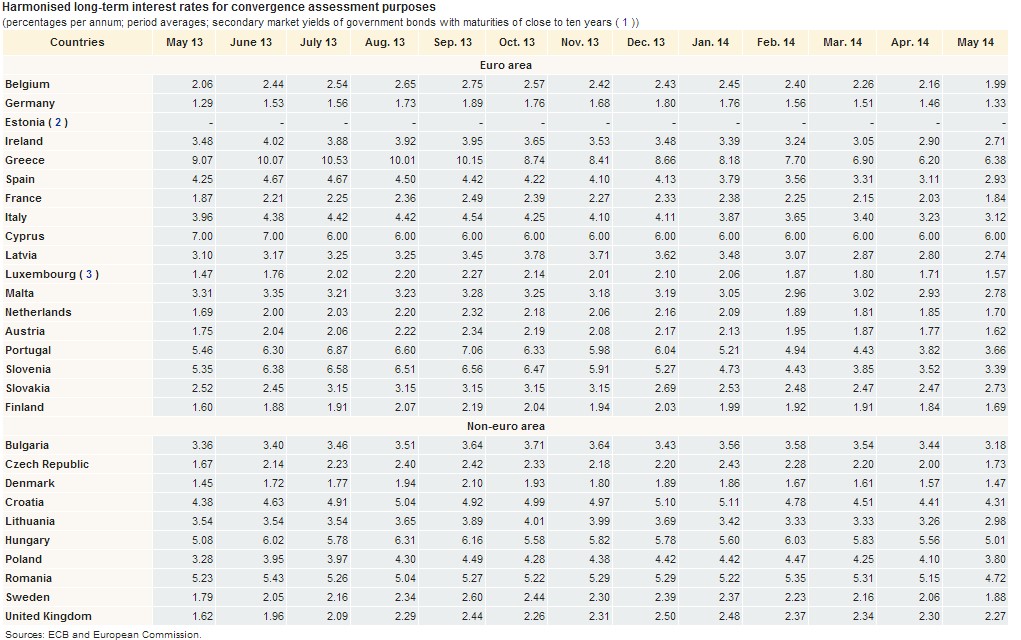

Disinflation in the Euro zone depresses bond yields everywhere, 2014 versus 2013June 2014:

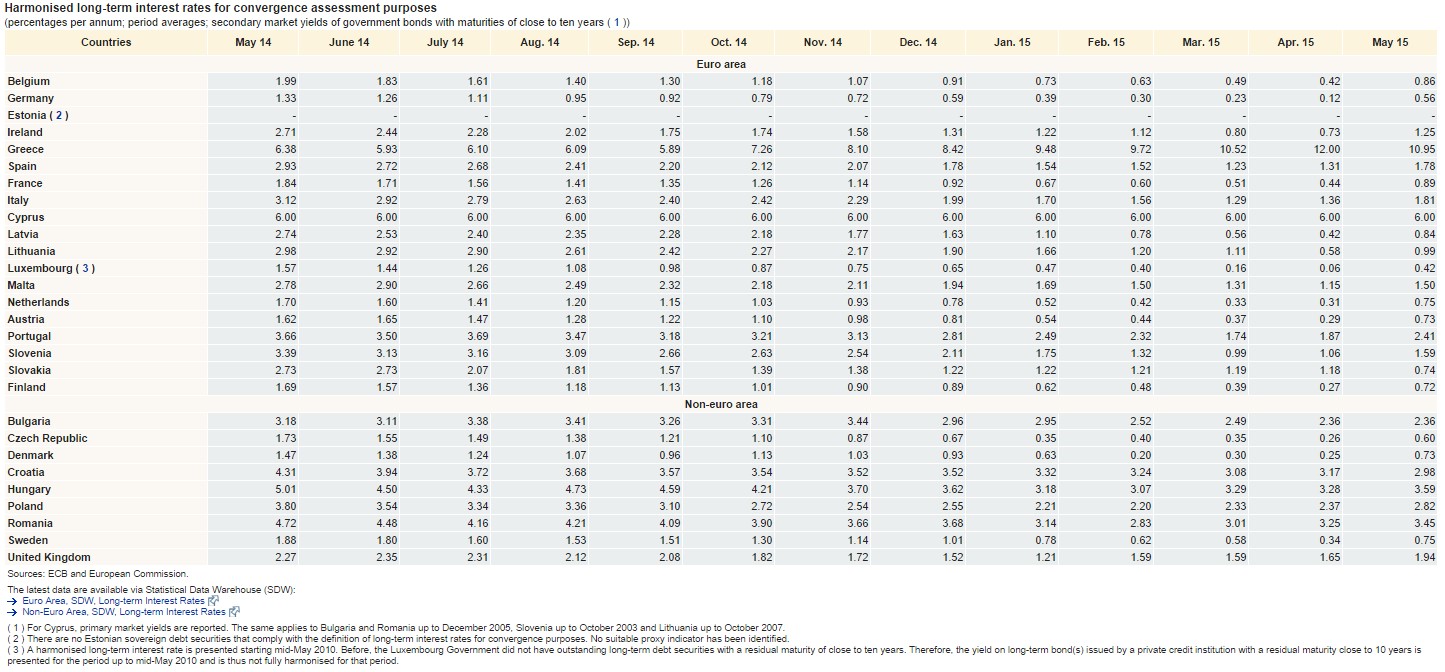

By July 2013, government bond yields of European safe-havens have risen compared the rates of July 2012, but the ones of crisis countries decreased:

Click to expand, source ECB

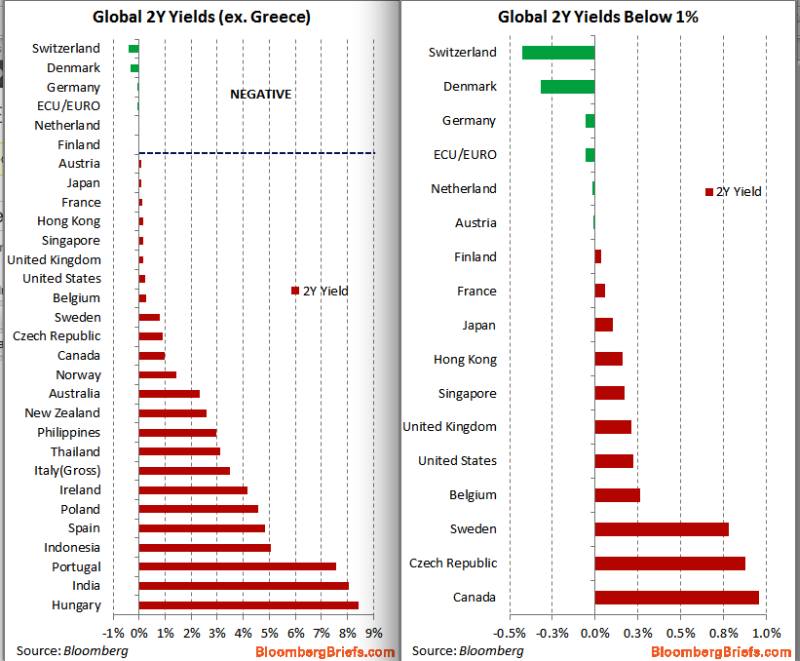

The following was the data as of July 18th 2012, at the height of negative interest rates for safe-havens.

Government bond yields under 2% (as of July 18th)

Links: Government Bonds on Financial Times and on Forexpros