Summary: Several regional Fed presidents want to begin talking about shrinking Fed’s balance sheet. Leadership does not appear to have great urgency, so don’t expect anything in this week’s statement. First step more hikes, then refrain from reinvesting payments and maturities, but slowly. The Federal Reserve meets this week, but there is, for all practical purposes, no chance that a rate hike is delivered. Whatever the Fed means by the gradual pace of normalization of policy, it precludes rate hikes at two successive meetings. Most market participants do not expect a hike at the next meeting in mid-March either. Bloomberg’s calculation suggests a 33% chance while the CME estimates the market has discounted a 20% chance. Our own interpolation is closer to the CME than Bloomberg. Some investors may have been disappointed with the sub-2% reading on the preliminary estimate of Q4 GDP reported last week, but Fed officials may be comforted by the fact that final domestic sales (GDP excluding net exports and inventories) accelerated to 2.5% from 2.1%. The economy is evolving along the lines the Fed suggested. The FOMC statement could also acknowledge that market-based measures of inflation expectations are rising.

Topics:

Marc Chandler considers the following as important: Featured, FOMC balance sheet, FX Trends, newslettersent, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Summary:

Several regional Fed presidents want to begin talking about shrinking Fed’s balance sheet.

Leadership does not appear to have great urgency, so don’t expect anything in this week’s statement.

First step more hikes, then refrain from reinvesting payments and maturities, but slowly.

| The Federal Reserve meets this week, but there is, for all practical purposes, no chance that a rate hike is delivered. Whatever the Fed means by the gradual pace of normalization of policy, it precludes rate hikes at two successive meetings.

Most market participants do not expect a hike at the next meeting in mid-March either. Bloomberg’s calculation suggests a 33% chance while the CME estimates the market has discounted a 20% chance. Our own interpolation is closer to the CME than Bloomberg. Some investors may have been disappointed with the sub-2% reading on the preliminary estimate of Q4 GDP reported last week, but Fed officials may be comforted by the fact that final domestic sales (GDP excluding net exports and inventories) accelerated to 2.5% from 2.1%. The economy is evolving along the lines the Fed suggested. The FOMC statement could also acknowledge that market-based measures of inflation expectations are rising. The five-year breakeven is above 2% for the first time in a couple of years and has increased more than 20 bp since the mid-December hike. A critical uncertainty is over the fiscal policy of the new US Administration. The FOMC’s information set, like that of investors, has not changed. The first priorities have been on trade and immigration. There was nothing in the December FOMC statement about fiscal policy, and this absence can persist. Given that several regional Fed Presidents have talked about the Fed’s balance sheet, it is not surprising that there have been several media and bank reports on the topic. However, there is no reason to expect that the last paragraph of the FOMC statement (before the summary of voting), where the balance sheet is discussed to be changed. The current policy is to reinvest principal payments from its agency holdings and rolling over maturing Treasury securities. It anticipates doing so until the normalization of the Fed funds rate is “well under way.” |

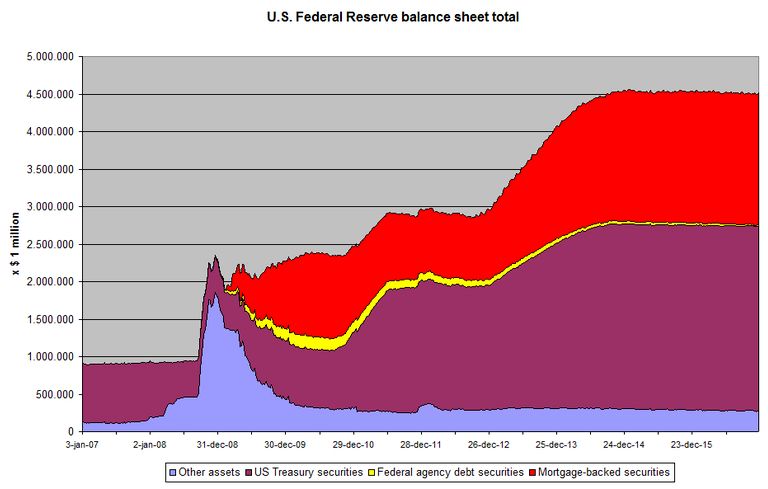

US Federal Reserve balance sheet total Source: commons.wikimedia.org - Click to enlarge |

The Fed’s leadership does not appear to be an in a particular hurry to reduce the balance sheet. It is clear that the first step will be more interest rate increases. It is not clear when the normalization process is well under way, but we suspect that later this year when the Fed funds target range is above 1% that the next step is possible. The next step is not the reduction of the balance sheet through sales of assets, but rather refraining from recycling principal payments and maturing issues in full. Officials will want some control over the process. There are over $200 bln of Treasuries in the Fed’s hands that mature this year. Next year’s maturities are more than twice as large. We also know that in the long-run the Fed prefer to have only Treasuries on its balance sheet.

Bernanke’s blog post from last week plays down the urgency that some have expressed. In addition to the gradual, passive approach when the Fed funds are further away from zero (lower bound), Bernanke suggested that officials figure out the desired size of the balance sheet in the long-term before starting the unwinding process. This will help manage expectations. Bernanke offers several arguments why the optimal size of the Fed’s balance sheet post-crisis is larger than before the crisis.

Some of President Trump’s economic advisors have expressed concerns over the size of the balance sheet, but at the same time, it seems clear that the Fed’s independence will not encroach. There is not a reason to challenge the independence of the central bank. With some conservative assumptions, it appears that over the next 18 months or so, the President will have the opportunity to alter the configuration of the Federal Reserve through appointments. Two of the seven seats on the Board of Governors are vacant. Yellen and Fischer’s terms as Chair and Vice-Chair end next year.

Tags: #USD,Featured,FOMC balance sheet,newslettersent