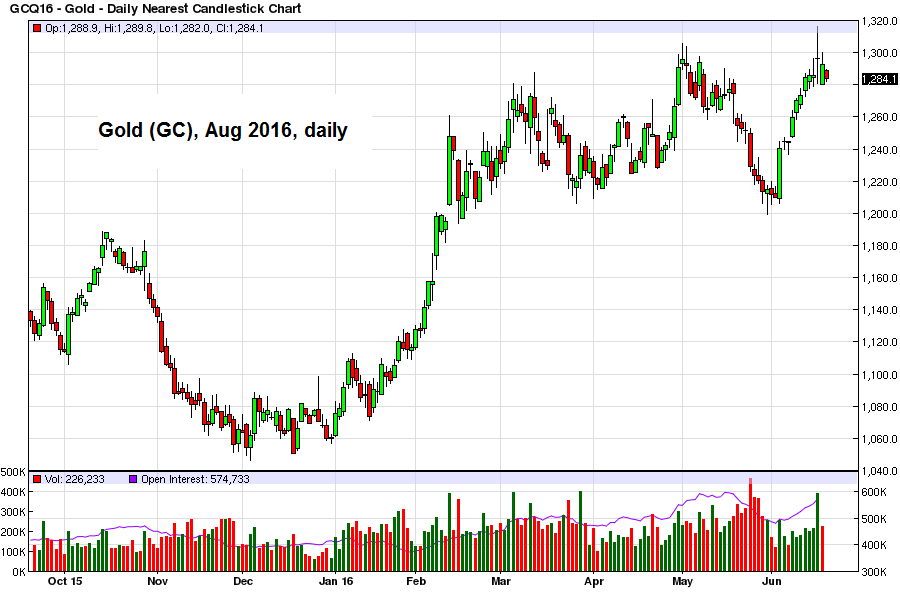

Summary The pain of negative yields and social chaos will be very long lasting and very good for gold. So, gold must go up, but Brexit is not one of the reasons why it should. This tells me that in the short term there will likely be a correction in the gold price, creating an opportunity to trade Going Up for the Wrong Reason Gold is soaring. It should—and a lot—but in my view not for the reason it is. Indeed gold is insurance for uncertain times, a time that Brexit seems to represent. But insurance is an administrative cost — one must minimize its use. Moreover, insuring against Brexit might ironically be equivalent to insuring against a good event. The market believes that Brexit will lead to wealth-destruction (based on its statist views, in which those running our institutions are omniscient, when they actually are quite naive, incompetent, and incapable of understanding the concept of complexity). Austrian Economics knows (“knows” because Austrian Economics is the only real economics) that Brexit will actually aid wealth-creation, by reducing the impact of European bureaucracy on the UK. August gold contract, daily – gold has been strong of late, but this seems to be driven by “Brexit” fears – click to enlarge. Brexit will also enable more control over migration into the UK.

Topics:

Jayant Bhandari considers the following as important: August gold contract, Debt and the Fallacies of Paper Money, Featured, newsletter, On Politics, Precious Metals

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

The pain of negative yields and social chaos will be very long lasting and very good for gold. So, gold must go up, but Brexit is not one of the reasons why it should.

This tells me that in the short term there will likely be a correction in the gold price, creating an opportunity to trade

Going Up for the Wrong ReasonGold is soaring. It should—and a lot—but in my view not for the reason it is. Indeed gold is insurance for uncertain times, a time that Brexit seems to represent. But insurance is an administrative cost — one must minimize its use. Moreover, insuring against Brexit might ironically be equivalent to insuring against a good event. The market believes that Brexit will lead to wealth-destruction (based on its statist views, in which those running our institutions are omniscient, when they actually are quite naive, incompetent, and incapable of understanding the concept of complexity). Austrian Economics knows (“knows” because Austrian Economics is the only real economics) that Brexit will actually aid wealth-creation, by reducing the impact of European bureaucracy on the UK. |

|

| Brexit will also enable more control over migration into the UK. While in an ideal world, I would want free movement of people, migration of people who refuse to assimilate will irrevocably harm Europe.

I recently spent a fair bit of time in Sweden, including visiting no-go areas of Malmö. Media headlines don’t bother me, and I don’t see migrants as security risks. My problem is that they import exactly the same social values and culture of irrationality that they left behind. They end up voting in ways that replicate socialism and its associated tyranny on their adopted home. And a 15-minute talk with a guy on the street should tell you in clearly that “reason” is not an antidote to “irrationality.” |

|

Decentralization vs. Democracy

Apart from possible short-term chaos, Brexit will be very good for the UK and the world economy.

Why do I think Brexit is good? Over the last 400 years, societies and economies around the world have become increasingly very complex. This has created huge pressure on the State to decentralize.

Quite to the contrary, driven by democracy, we have seen huge increase in centralization around the world, as has been the case with the EU. The State as it stands is completely unsustainable and I see pressures everywhere that will lead to big entities breaking into smaller ones.

Even more critical is the situation in what are called emerging markets, where almost nothing works and governments are merely bribe collection agencies.

There is one — and only one — thing that imparts value to gold in the long-term: when the economy becomes negative yielding. Naive governments around the world are repressing businesses. Democracy — the tyranny of the unqualified masses — means that people are voting for more of what created the problems in the first place.

This situation will not change until this totally anti-meritocratic system of running societies has come to an end. And as you know it is hard to imagine that democracy will come to an end any time soon.

Conclusion

The pain of negative yields and social chaos will be very long lasting and very good for gold. So, gold must go up, but Brexit is not one of the reasons why it should.

This tells me that in the short term there will likely be a correction in the gold price, creating an opportunity to trade. The market must take the price up for the right reasons, before one can be confident about the resilience of the advance.

Chart by: BarChart