Technological advancements, including biometrics, blockchain, encryption and artificial intelligence (AI), are fueling the advent of more efficient and secure authentication mechanisms. New methods and trends including passworldless authentication are already seeing significant traction from customers, which perceive them as not only more convenient than traditional authentication methods but also more reliable, a study by Entrust, an authentication specialist, found. The Future of Identity Report, released in March, shares findings of a global survey of 1,450 consumers across 12 countries, aiming to shed light on the identity market and identify emerging trends. While passwords have traditionally been the most popular means of primary authentication, results from

Topics:

Fintechnews Switzerland considers the following as important: 6c.) Fintechnews, Featured, newsletter, Security

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Technological advancements, including biometrics, blockchain, encryption and artificial intelligence (AI), are fueling the advent of more efficient and secure authentication mechanisms.

New methods and trends including passworldless authentication are already seeing significant traction from customers, which perceive them as not only more convenient than traditional authentication methods but also more reliable, a study by Entrust, an authentication specialist, found.

The Future of Identity Report, released in March, shares findings of a global survey of 1,450 consumers across 12 countries, aiming to shed light on the identity market and identify emerging trends.

While passwords have traditionally been the most popular means of primary authentication, results from the study show that they have outrun their course.

With more digital services available than ever, consumers are having a hard time recalling an ever-growing inventory of password credentials, with 51% of respondents stating that they reset a password at least once a month because they can’t remember it, and 15% responded doing so at least once a week.

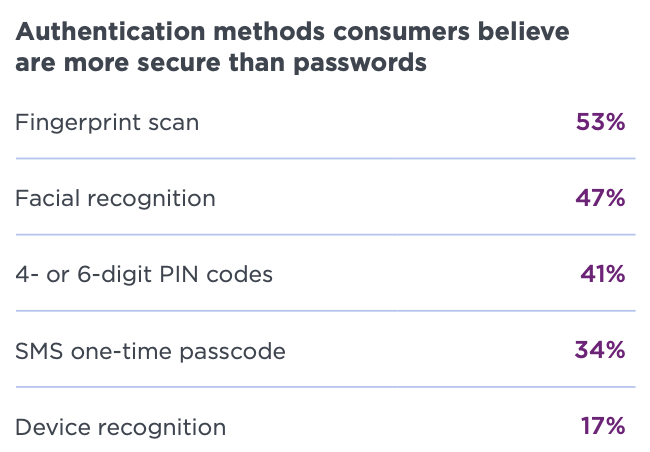

Against this backdrop, passwordless authentication solutions, especially those utilizing user biometrics, are gaining traction, with more than half of respondents stating that they view biometric solutions as more secure. 53% of consumers named fingerprint scans are the most secure authentication method, followed by facial recognition technology (47%). Only 6% said passwords are the most secure method.

Authentication methods consumers believe are more secure than passwords, Source: The Future of Identity Report, Entrust, 2023

Passwordless authentication is a security process which typically relies on security tokens, personal identification numbers and an individual’s unique biological characteristics such as fingerprint recognition, iris recognition, face recognition or voice analysis to verify a user’s identity.

In 2021, the passwordless authentication market was valued at US$12.8 billion. The market is projected to reach US$40.2 billion by 2031, growing at a compound annual growth rate (CAGR) of 12.2% from 2022 to 2031.

Driving this growth will be the growing advancement in technologies such as the Internet-of-Things (IoT) and AI, the rising awareness of the application of passwordless authentication in the banking sector and the increase in penetration of consumer electronic devices, a research study has said.

Results of the survey also reveal a preference for these new authentication methods. When given the choice between biometrics or a password, 74% of respondents will choose biometrics half the time or more. A third will always choose biometrics when available.

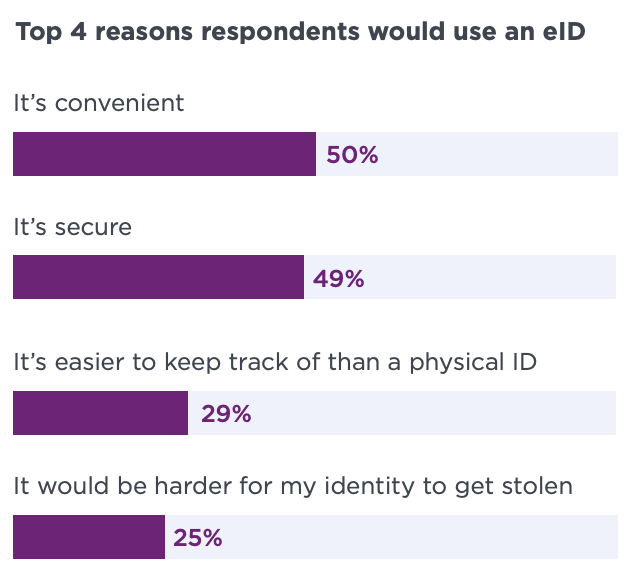

Another key finding of the study is the exploding popularity of digital identity, which consumers perceive as more convenient and secure than physical-only identity documents. Seven out of 10 of the survey respondents said they would likely use an electronic form of government-issued identification (eID) if one were available, with proponents citing improved convenience (50%) and security (49%) as the most important reasons why they would use eID.

Top 4 reasons respondents would use an eID, Source: The Future of Identity Report, Entrust, 2023

The digital identity solution market, which encompasses next-generation identity governance and administration solutions that use cutting-edge technologies such as machine learning (ML), biometrics, blockchain and AI to determine more accurately and seamlessly whether a person is who they claim to be, is a booming industry that’s been propelled by increased investment in digital transformation, the development of biometrics integration in smartphones, and new government regulations.

Globally, the digital identity solution market is projected to grow from nearly US$28 billion in 2022 to almost US$71 billion in 2027, a research has found.

Findings from the study also reveal that the majority of consumers understand that their control over personal information is diminishing. 74% of respondents agreed that sharing personal information in exchange for access to goods, services, and applications has become unavoidable and that they have no choice but to allow access. In fact, 55% of consumers believe they do not own their information at all.

Survey results also show that consumers are divided when it comes to how comfortable they are with organizations owning and storing a digital identity for them, even if that means accessing improved user experience. 54% said yes and that they would be comfortable, but 46% of consumers said no and that they should be the only one who owns their online digital identity.

Against this backdrop, the report argues that decentralized identity solutions have the potential to solve this issue. These solutions leverage technologies such as blockchain and other distributed ledger technologies (DLTs) to allow entities to create and control their own digital identity, all the white enabling superior user experiences. Examples of decentralized identity solutions include Microsoft Entra Verified ID, PingOne by Ping Identity, and IBM Digital Credentials.

The post User Authentication Enters New Era, Enabled by Biometrics, Blockchain, AI appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Tags: Featured,newsletter,Security