An intrusive intervention into the crypto market similar to what the EU has recently provided is not a sure promise of a Pareto efficient result. The cryptocurrency market has evolved at a rapid pace over the course of its short lifespan. With its community and users growing steadily. They offer the potential for new choices to be made in a field long dominated by government monopolies. They are a real financial alternative and might provide intense competition to central bank-issued currencies in the future. However, at the same time skeptics and environmentalists have expressed worry about the intensive energy consumption of cryptocurrency mining. . Crypto meets law and taxes Bitcoin for example uses more energy than entire countries. As demand for

Topics:

Antonios Marios Giannakopoulos considers the following as important: 6b.) Austrian center, 6b) Austrian Economics, Economics, economy, environment, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

An intrusive intervention into the crypto market similar to what the EU has recently provided is not a sure promise of a Pareto efficient result.

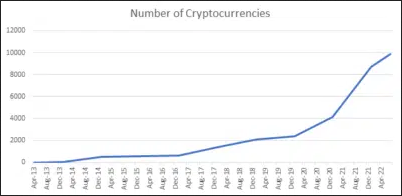

| The cryptocurrency market has evolved at a rapid pace over the course of its short lifespan. With its community and users growing steadily. They offer the potential for new choices to be made in a field long dominated by government monopolies. They are a real financial alternative and might provide intense competition to central bank-issued currencies in the future. However, at the same time skeptics and environmentalists have expressed worry about the intensive energy consumption of cryptocurrency mining. | |

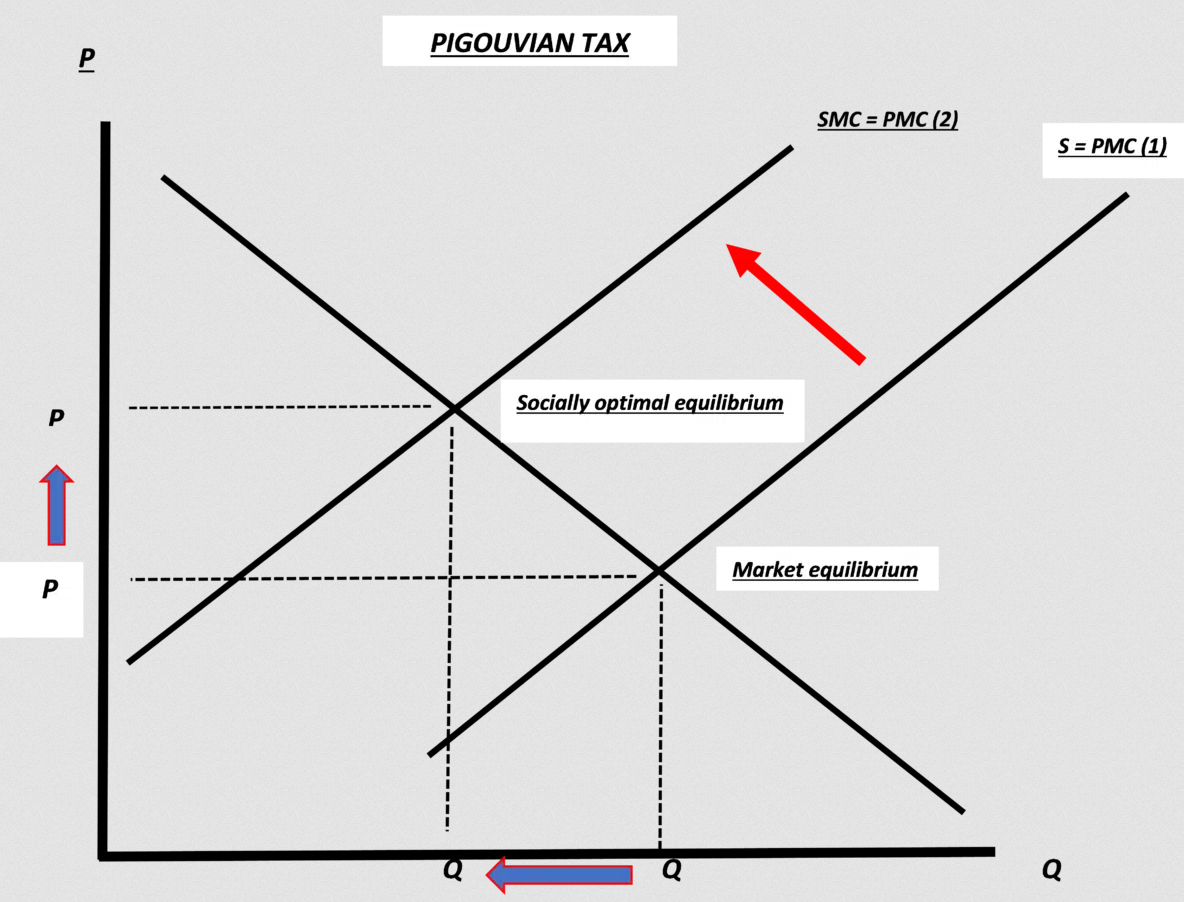

Crypto meets law and taxesBitcoin for example uses more energy than entire countries. As demand for digital currencies rises so will their energy consumption. Bitcoin has also a supply limit of up to 21 million coins meaning as we get closer to 21 million, the marginal cost of mining to produce it increases along with the amount of electricity required. The EU recently provided a legal framework for crypto assets with the intention “To reduce the high carbon footprint of crypto-currencies, particularly of the mechanisms used to validate transactions” plus “include in the near future crypto assets within the EU taxonomy, a classification system establishing a list of environmentally sustainable activities in order for the European Union to reach its environmental objectives outlined by the European Green Deal.” A possible alternative to an outright ban on cryptocurrencies would be a tax in order to minimize the negative externalities on the environment. The graph shows us how this type of tax would work: Under no government, intervention equilibrium is reached when the social marginal benefit (SMB) is equal to the personal marginal cost (PMC), which is lower than the social marginal cost (SMC) due to the additional costs created by economic activity. Such a market equilibrium is not socially optimal (in our case for the environment). When the tax is imposed, the supply of the negative externality will decrease (leftwards). Therefore, the increase in price will decrease the quantity demanded thus equalizing the social marginal costs SMC to the personal marginal cost, reaching a socially efficient equilibrium. While a Pigouvian Tax could make sense in order to compensate for the negative environmental impact its implantation is a tricky task. In theory, it should be equal to the negative costs by the externality, but these costs are hard to measure. This way, there is a risk of doing more harm than good leading to an inefficient result. Furthermore, due to the knowledge and calculation problem, the decision-makers are facing they have difficulty knowing which is the Pareto efficient result. |

Crypto, energy and the environment

Bitcoin for example uses more energy than entire countries. As demand for digital currencies rises so will their energy consumption. Bitcoin has also a supply limit of up to 21 million coins meaning as we get closer to 21 million, the marginal cost of mining to produce it increases along with the amount of electricity required.

It’s unlikely that bitcoin’s energy use will increase in a linear way. The energy for cryptocurrencies has become less reliant on carbon, alternative renewable sources of energy became more efficient and thus more viable for mining, Bitcoin could end up serving as a serious incentive for miners to invest in and build out these technologies. Plus, miners won’t continue expanding their mining operations at the current rates indefinitely since the marginal cost for mining increases that at one point it becomes unprofitable.

We can also see that the estimated annual energy consumed by the Bitcoin network is considerably lower than that consumed by other relevant industries as this research report from Galaxy digital shows While it’s true that around 60% of bitcoin is currently mined in coal-dominated China, Bitcoin miners are stationed in remote areas with rich hydro or wind resources. In other words, cheap electricity. In China, for example, about 80% of bitcoin is being mined the hydro-rich Sichuan province. Other Bitcoin mining centers that generate electricity are dominated by renewables like in Iceland, Quebec, Norway.

Another major Cryptocurrency, Ethereum, processes more than twice as many transactions as the bitcoin network while using only about one-third of the electricity consumed by bitcoin. Ethereum is also actively transitioning to a proof of stake mechanism in order to reduce its energy consumption.

Cryptocurrency mining is geographically independent. Miners can choose their bases or home based on the cheapest cost of electricity. Electricity usually comes from renewable sources that would otherwise be lost. The environmental impact of cryptocurrencies depends on factors over which the network has no real control: the way in which power is generated and how electricity is priced. Both factors vary greatly in different parts of the world.

Conclusion

As economics knows, costs greater than zero does not mean costs greater than benefit. Every single industry uses electricity to produce its output. Cryptocurrencies are not an exception in that regard. Proponents of digital currencies applaud the fact that the mining industry draws a big part of its electricity from renewable or sustainable sources than other industries. However, using electricity from those sources of electricity is still a cost and not a benefit. After all, even green energy is costly to generate. A rational system of calculation supported by market prices can help us weigh the costs and benefits. Developers are now looking for innovative methods to provide all the benefits of digital currency without the large carbon imprint. So, why shouldn’t we be optimistic about a new generation of eco-friendly cryptocurrencies? The path to balance between innovation and environmental protection is not an easy one, however, an intrusive intervention into the market will lead to less innovation and fewer choices for (EU) citizens that seek monetary alternatives.

Tags: Economics,economy,Environment,Featured,newsletter