The most important sustainable themes in 2021 were energy, social concerns and environmental issues. Keystone / Laurent Gillieron The volume of sustainable investments in Switzerland increased by almost a third last year, reaching an all-time high of CHF1.98 trillion ( trillion). This continuing growth – the rate is almost the same as last year – is mainly due to the increased use of sustainable investment approaches and the overall positive market development in 2021, according to the authors of the latest market studyExternal link published on Thursday by Swiss Sustainable Finance (SSF). The study was conducted in cooperation with the University of Zurich. According to the study, at CHF799.5 billion, sustainable funds account for just over half of the total

Topics:

Swissinfo considers the following as important: 3.) Swissinfo Business and Economy, 3) Swiss Markets and News, Featured, Latest News, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

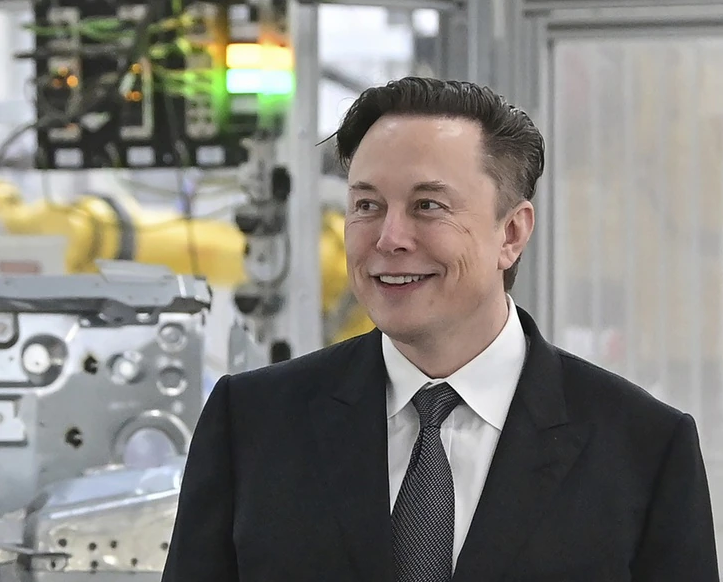

The most important sustainable themes in 2021 were energy, social concerns and environmental issues. Keystone / Laurent Gillieron

The volume of sustainable investments in Switzerland increased by almost a third last year, reaching an all-time high of CHF1.98 trillion ($2 trillion).

This continuing growth – the rate is almost the same as last year – is mainly due to the increased use of sustainable investment approaches and the overall positive market development in 2021, according to the authors of the latest market studyExternal link published on Thursday by Swiss Sustainable Finance (SSF). The study was conducted in cooperation with the University of Zurich.

According to the study, at CHF799.5 billion, sustainable funds account for just over half of the total Swiss fund market.

“The fact that more and more asset managers are incorporating sustainability aspects is gratifying and shows how essential they are for the investment process,” SSF President Patrick Odier said.

Thematic investments

Investments that exclude certain areas are the most popular investment approach. However, with an increase of 157%, sustainable thematic investments recorded the greatest growth of all investment approaches last year.

According to the study, the large providers of thematic investments are primarily responsible for this. The most important sustainable themes in 2021 were energy, social concerns and environmental issues.

For the survey SSF also asked asset managers how they measure the impact of their sustainable investments. A quarter of respondents measure the contribution against the United Nations Sustainable Development Goals (SDGs). Around half use a combination of measurement methods.

Tags: Featured,Latest news,newsletter