The Russian invasion of Ukraine has brought America’s foreign policy interventions under the limelight once again. Ryan McMaken argues that the US administration’s claim that countries should not have the right to a sphere of influence, implicitly addressing Russia, is hypocritical. The US opposes a sphere of influence for Russia and other regional powers, while at the same time has steadily expanded its own global outreach. Among other, one can judge how true this is by looking at the amount of US military spending and size of its foreign military interventions. The USA not only spends a disproportionately high amount of money on military relative to the rest of the world, but has also continued doing so when the Cold War was over and it could have set in motion

Topics:

Mihai Macovei considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Russian invasion of Ukraine has brought America’s foreign policy interventions under the limelight once again. Ryan McMaken argues that the US administration’s claim that countries should not have the right to a sphere of influence, implicitly addressing Russia, is hypocritical. The US opposes a sphere of influence for Russia and other regional powers, while at the same time has steadily expanded its own global outreach. Among other, one can judge how true this is by looking at the amount of US military spending and size of its foreign military interventions.

The USA not only spends a disproportionately high amount of money on military relative to the rest of the world, but has also continued doing so when the Cold War was over and it could have set in motion a virtuous cycle of international disarmament. The USA has also multiplied its foreign military actions and engaged in controversial and costly wars in Iraq and Afghanistan, harming both international peace and the global economy. From this point of view, Lew Rockwell’s scathing criticism of the US military interventions in Iraq and global hegemonic ambitions in general, appears still relevant after almost twenty-five years.

US Military Spending in Perspective

The US spends about 11 percent of its federal budget on defense, which is the third largest item after Social Security and Health, and costs almost twice as much as education. The US defense budget was $754 billion for the financial year 2022, before President Biden increased it by another $29 billion following the war in Ukraine.

However, this is not the full picture, because other federal spending is also closely tied to defense. The budgets of Department of Veterans Affairs ($113 billion), Homeland Security ($55 billion), the State Department ($64 billion), and the FBI and Cybersecurity in the Department of Justice ($10 billion) add another $242 billion to the base budget of the Department of Defense (DoD). By adding it all up, defense spending is set to exceed $1 trillion in 2022—i.e., 14 percent of the federal budget and 4 percent of gross domestic product.1

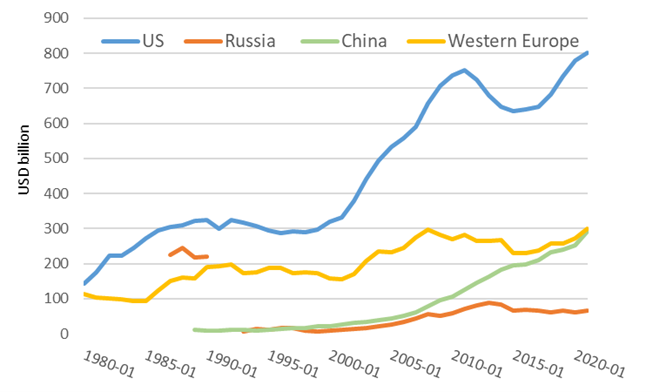

| The US defense budget represents not only a significant burden on the domestic economy, but looks completely disproportionate relative to other countries’ military outlays. According to the Stockholm International Peace Research Institute (SIPRI) the US military spending is greater than those of the next ten largest military expenditures combined. At around $800 billion in 2021, the US military budget was almost three times higher than China’s ($293 billion) and twelve times larger than Russia’s ($66 billion).

Except for China’s military budget which has increased about ten times over the last two decades, albeit from a very low level, the steady increase in the US military spending has widened the gap with the rest of the World (graph 1). Together with its allies in Western Europe, the US spent on military three times more than Russia and China combined in 2021. As the annual spending differential between the US and other countries took place over many years, it means that the United States’ overall military supremacy in terms of stock and quality of military equipment is undisputable. |

The key question is why the USA has not decreased dramatically its military spending when the Cold War was over and the main threat to its security disappeared. In the late 1980s, the Soviet Union’s military spending was very high at about $220 billion and almost in the same ballpark with the $300 billion spent by the US. However, when the Soviet Union disintegrated and its economy collapsed in the early 1990s, Russia’s military spending shrunk to a puny $10 billion on average during that decade. Yet, despite being a nuclear superpower, the US kept its military spending at the Cold War level of around $300 billion and later increased it exponentially during the War on Terror.

Endless Foreign Military Interventions Post–Cold War

The surge in US military spending over the last two decades mirrors a dramatic increase in the number of US military interventions. Monica Duffy Toft shows that US military interventions—i.e., the deployment of US armed forces to other countries—intensified over time, in particular after the Cold War.

Approximately 392 US military interventions took place since 1800, as reported by the Congressional Research Service in October 2017. Their frequency increased steadily, over fifty-year periods, from 39 in 1800–1849, to 47 in 1850–99, 69 in 1900–1949, 111 in 1950–99, and to 126 over only seventeen years between 2000–2017. By March 2022, the number of foreign military interventions had increased by a few dozen more. Another striking finding is that the number of US military interventions increased at least four times from the Cold War (46) to the post–Cold War period (188) until 2017.

Monica Duffy Toft also claims that the US military interventions since World War II have only rarely achieved their intended political objectives. The statistics presented show that big powers, such as the United States and Soviet Union, won a majority of conflicts with weaker adversaries up to 1950, but afterwards lost most of these asymmetric fights. Moreover, the interventions deemed “successful” have eventually cost much more that would have been considered reasonable previously.

For example, the recent military debacles in the Iraq and Afghanistan bear an exorbitant price tag of about $4–6 trillion, if the liability of providing medical care and disability benefits to war veterans and the cost of financing the war are included.

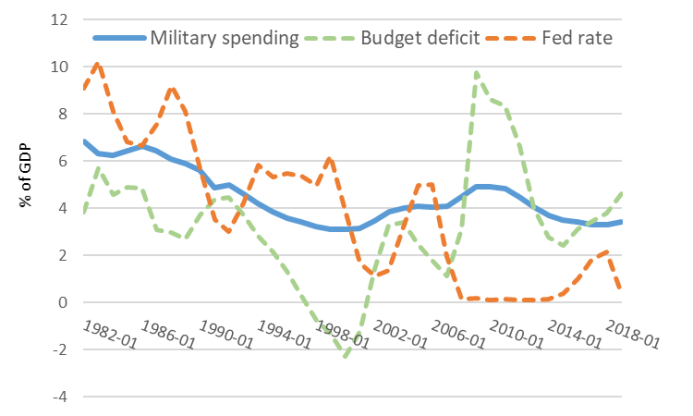

Economic Impact of Excessive Military SpendingLike any other government expenditure, defense spending represents a transfer of factors of production from market-oriented activities to government ends, thus reducing consumer welfare. In the 1980s, annual military spending of about 6 percent of GDP on average represented a heavy burden on the standards of living of the Americans and contributed to fairly large budget deficits of about 4 percent of GDP (graph 2). In the 1990s, despite remaining at the same high level in nominal terms, military spending declined gradually to 3 percent of GDP as nominal GDP advanced, helping reduce the overall budget deficit. However, this favorable trend ended abruptly in the early 2000s when military spending jumped again to 5 percent of GDP worsening the budget deficit and overall debt level. |

|

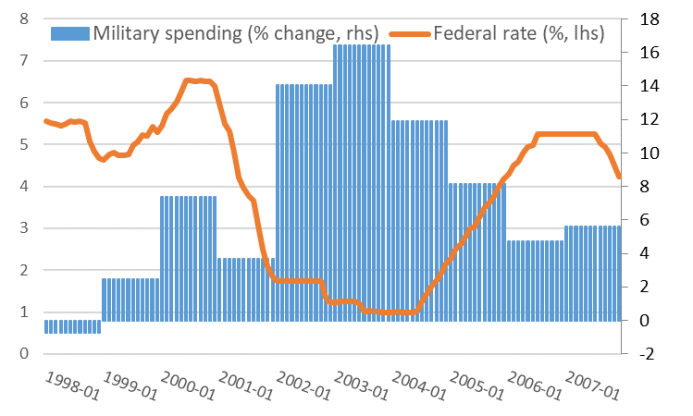

| It can also be argued that the massive increase in military spending in the 2000’s not only contributed to a sizeable fiscal deterioration, but also swayed the Federal Reserve System’s (Fed) expansionary monetary stance. Zooming in into this period, Graph 3 shows how the acceleration of military spending to double digit growth rates went hand in hand with the Fed’s slashing of interest rates to record lows. Ramping up money creation was the most expedient way for the American government to finance the wars and the burgeoning pubic debt at lower costs. The increase in foreign holdings of US dollars, given the latter’s special status of number one reserve currency in the world, helped keep domestic inflation below the pace of money creation. Nevertheless, interest rates were cut for too low and too long.2 |

Conclusions

The USA controls about 750 foreign military bases spread across eighty countries worldwide and spends more on its military than the next ten countries combined. After the collapse of the USSR in 1991, the US has missed a “unipolar moment,” in which, as a sole remaining superpower could have put an end to the global arms race.

Instead, it continued to increase its military budgets, greatly outspending the rest of the world and inciting other countries to follow suit. The US foreign military interventions have also multiplied and culminated into costly and lengthy wars, which left behind countries ravaged by civil wars in Iraq and Libya or under the same autocratic Taliban rule in Afghanistan.

In addition, the justifications for the military interventions in both Iraq and Libya were seriously questioned and the international law principles were not consistently followed (e.g., the invasion of Iraq without a UN mandate, Guantanamo Bay), tarnishing the United States’ international reputation. Instead of a defender of international order and freedom, the USA now is perceived as an aggressive interventionist power, as illustrated by Lew Rockwell.

Eventually most Americans realized that the wars in Iraq and Afghanistan had not been worth fighting. But, will the lesson be learnt that excessive US military spending should be cut and the military-industrial complex be kept under control in order to avoid such misadventures in the future?

- 1. Until 2022, the cost of military interventions was not included in the DOD base budget and fell under “Overseas Contingency Operations” which spent about $2 trillion on the War on Terror since 2001.

- 2. Even by the mainstream’s Taylor rule, monetary policy has been too expansionary in the early 2000s. Taylor’s monetary policy rule is a simple equation linking mechanically the level of the policy rate to deviations of inflation from its target and of output from its potential.

Tags: Featured,newsletter