I have always had a bad attitude toward official secrets regardless of who is keeping them. That prejudice and John Kenneth Galbraith are to blame for an unauthorized withdrawal I made from the World Bank. When I lived in Boston in the late 1970s, I paid to attend a series of lectures by Galbraith on foreign aid and other topics. The louder Galbraith praised foreign aid, the warier I became. His hokum spurred my reading and led me to recognize that foreign aid is one of the worst afflictions that poor nations suffer. As one critic quipped, foreign aid is money from governments, to governments, for governments. After I moved to Washington, foreign aid became one of my favorite targets as an investigative journalist. When I talked to the chief of the US Agency

Topics:

James Bovard considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

I have always had a bad attitude toward official secrets regardless of who is keeping them. That prejudice and John Kenneth Galbraith are to blame for an unauthorized withdrawal I made from the World Bank.

When I lived in Boston in the late 1970s, I paid $25 to attend a series of lectures by Galbraith on foreign aid and other topics. The louder Galbraith praised foreign aid, the warier I became. His hokum spurred my reading and led me to recognize that foreign aid is one of the worst afflictions that poor nations suffer. As one critic quipped, foreign aid is money from governments, to governments, for governments.

After I moved to Washington, foreign aid became one of my favorite targets as an investigative journalist. When I talked to the chief of the US Agency for International Development (AID), Peter McPherson, in 1985, my blunt questions had him literally screaming at me within four minutes of the start of the interview. McPherson probably screamed even louder when he saw the article I wrote thrashing AID.

Foreign aid was revered by the Washington establishment, and the World Bank epitomized the arrogance of the financial masters of the universe (at least in their own minds and press releases). The World Bank, heavily subsidized by US taxpayers, profited from every debacle it spawned. The more loans the bank made, the more prestige and influence it acquired. After a profusion of bad loans to Third World governments helped ignite a debt crisis, I warned in a 1985 Wall Street Journal piece that expanding the World Bank’s role “would be akin to appointing Mrs. O’Leary’s cow as chief of the Chicago Fire Department.”

I was astounded at how many despots the World Bank was propping up. Bankrolling tyrants was the equivalent of a Fugitive Slave Act for an entire nation, preventing a mass escape of political victims. Yet almost all the details of World Bank loans were suppressed, allowing its perfidious officials to pirouette as saviors. In 1987, I rattled the bank’s roof with a Wall Street Journal article headlined “World Bank Confidentially Damns Itself.” That article was based on a stash of confidential bank documents that I had finagled.

Perhaps the bank’s worst offense was propping up Communist regimes, perennially bailing out their command-and-control economies. In the late 1970s, the bank helped finance a brutal Vietnamese government program to forcibly resettle millions of farmers in conquered South Vietnam. The bank poured billions of dollars into Hungary, Yugoslavia, and Romania. A confidential bank analysis in 1986 admitted the failure of its Communist lending program: “Projects have been prepared to meet Five-Year Plan objectives which could not be questioned or analyzed by the Bank.” Why were US tax dollars underwriting hostile Communist regimes?

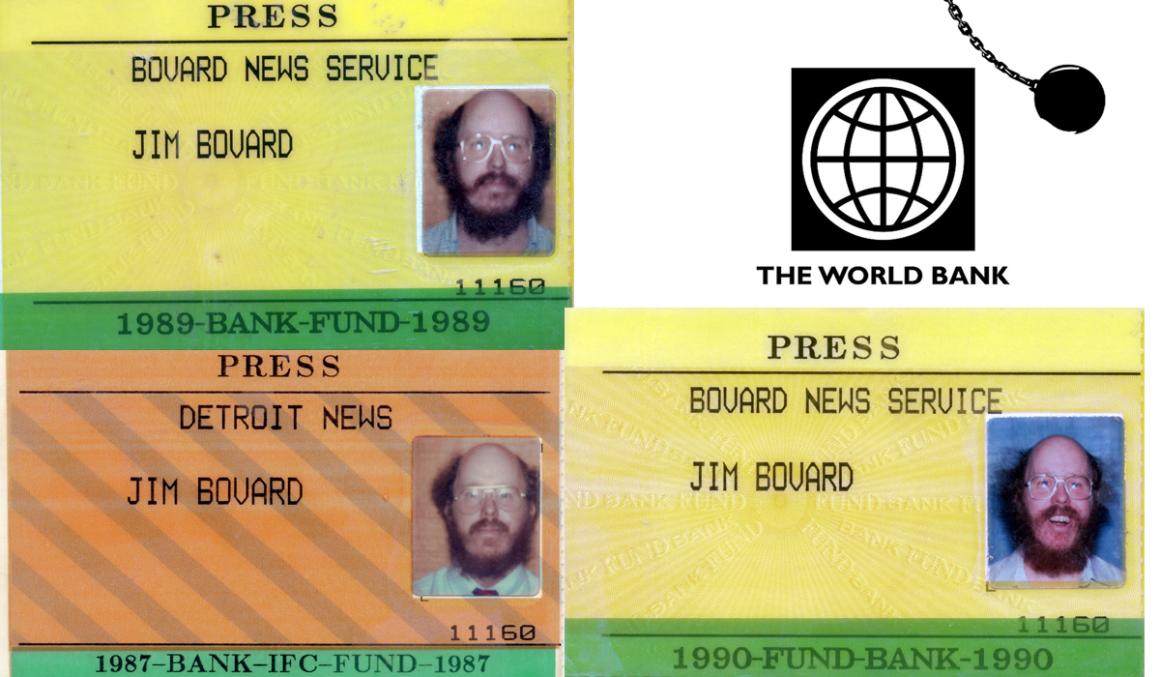

In the 1980s, the World Bank headquarters in downtown Washington had far tighter security than most federal agencies. The media was only permitted unsupervised entry into that building during the annual meetings that occurred each September. During the 1987 meetings, I roamed far and wide inside the bank. Visiting the press office of the International Finance Corporation (IFC), a World Bank branch that supposedly loaned only to private entities, I scooped up a handful of their current press releases and asked about older releases. A pert twenty-something Canadian secretary directed me to an adjacent filing room. I entered and noticed one filing cabinet had a drawer labeled “Pending Projects.” There were too many people milling about the press room to check that drawer, but my curiosity was piqued.

The following year, the World Bank was rattling its tin cup for another $14 billion commitment from the US government. Considering the bank’s dismal record in the prior decade, boosting its coffers would be throwing good money after bad.

So I returned to the scene of financial precrimes in June 1988. I needed a pretext to enter World Bank headquarters, so I scheduled a visit to its research library. After guards vigorously searching my bike courier-style shoulder bag, I was handed a large VISITOR identification badge. It was important not to lose that badge, so I stuffed it into my pants pocket. After a pit stop at the library, I dropped by the IFC press office. The secretary recognized me and we chatted about how life in Washington compared to Ottawa. World Bank employees received lavish tax-free salaries, so she wasn’t suffering too badly.

“Would you mind if I check some of your old press releases?” I asked.

“Sure—go ahead,” she said and pointed to the file room.

I ambled into the room, walked over to that filing cabinet, and grinned ear to ear when the Pending Projects drawer slid smoothly open. I skimmed the file titles and was transfixed by one labeled Poland. Why would a private sector branch of the World Bank be lending to a bankrupt Communist country? Poland owed $38 billion to the West—with zilch chance of repayment, given its floundering economy. The bank had never made a loan to Poland before. Why were they adding a new Communist regime to their welfare rolls? And why was the World Bank rushing to add its seal of approval to a military dictatorship that was tottering due to waves of heroic nationwide strikes by Solidarity?

I slipped the Polish file into my courier bag and strolled out to the main press room. I saw a secretary schlepping a stack of papers down the hall and followed her to a copy room.

I got in line and was soon bantering with the secretaries ahead and behind me about the brutal Washington summer weather and the latest subway fare increase. World Bank officials tend to be even haughtier than US senators, and perhaps my friendly demeanor was almost a novelty.

My turn arrived and I laid that file onto the intake slot for the copier. I pushed the Copy button but the machine wouldn’t budge without a code.

I turned to one of the women I had been chatting with, smiled, and two minutes later, slipped the forty-page copy into my courier bag.

I glided back into that file room and tucked the original document back in the drawer. If there were a bank internal investigation, that might throw them off the trail. I might have faced federal charges and prison time if I had been caught absconding with confidential financial documents from a quasi-government United Nations organization. However, if the bank suspected that one of their own employees or a US government official had leaked the document, they might hesitate to dig too deeply, since that could cause them more embarrassment than it was worth.

Making a copy was one thing, but getting out of the building was another. Those photocopies were too bulky to stash under my clothes—my favorite hiding place when I roamed the East Bloc. I considered asking the guard his prediction for the upcoming Redskins season but instead relied on the dull-eyed, working stiff motif. The guard glanced at my shoulder bag and waved me on.

After exiting bank headquarters, I paused on K Street, skimmed the first pages, and knew I had struck gold. Back in my home office, I called the gutsiest editor I knew—Tim Ferguson, the editorial features editor at the Wall Street Journal. Tim sighed audibly when I related how the copy migrated into my bag, but he was game for a story. (Some editors I later dealt with would have phoned the World Bank, apologized profusely, and offered a sworn affidavit that I should be indicted for undermining trust in a US government–backed institution.)

I whittled up the article and over the next few days spent hours on the phone with a French lady in the IFC press office, getting her official responses to the less incendiary charges in the piece. At 4 p.m. on the day before publication, during the last call locking up the final details, I nonchalantly added: “Also, I want to confirm that the World Bank is still on track to make a loan to the Hortex cooperative in Poland.”

“THAT’S SECRET INFORMATION!” she squealed, her accent flaring up like an Air France stewardess whose butt had just been grabbed.

“I need to confirm that project is moving forward.”

After a terse pause, she said: “Yes.”

Even though this was the most important case in the article, I did not mention it to her until the last minute. I had prior experience with government agencies pulling out all the stops to kill a threatening article before it hit print.

My piece in the next day’s Wall Street Journal disclosed: “The IFC is eager to begin lending to Poland, as a March 24 confidential project analysis shows.” A memo from a top bank official touted a proposed $18 million loan to a Polish agricultural cooperative and fretted that “there is a real danger that the Polish authorities may become frustrated with the international financial institutions…. A fast, early investment by IFC would have enormous effect on IFC’s standing in Poland, would demonstrate IFC to be a flexible, responsible institution and would increase the number of investment possibilities in the pipeline. IFC would achieve a great deal of good will by an early investment.”

The World Bank wanted to be loved by its bankrupt Communist borrowers—and also wanted to maximize the “investment possibilities” for subsequent World Bank handouts. A confidential analysis justified the loan based on the agricultural firm’s net worth, calculated by the official exchange rate of 175 Polish zlotys to the dollar. But the black-market exchange rate at that time was thirteen hundred zlotys to the dollar. Misstating the exchange rate by 600 percent plus was the World Bank’s version of “close enough for government work.” If the same switcheroo had been made by a US banker granting a federally guaranteed loan, the banker could have been “cuffed and stuffed.”

The confidential document praised Poland for introducing a “radical version of market socialism.” It heartily approved the Polish government’s “introduction of a progressive tax aimed at containing wage increases”—a tax that crucified miserly paid workers on an altar of central planning follies (“Swedish taxes on Ethiopian wages,” according to dissidents). When the Communists held a referendum on economic reforms in late 1987, a top World Bank official urged Poles to vote for the government’s plans. The World Bank wanted to reform communism, but the Polish people wanted freedom instead. My WSJ article concluded that the World Bank was subverting real reform and “has betrayed the citizens of the Third World and East Europe.”

A retired World Bank press officer later told me that my article hit the bank like a concussion bomb, spurring emergency early morning meetings to try to contain the political damage. The World Bank launched a counterattack to pressure the Wall Street Journal to retract the story, but to no avail. Bank officials were convinced an insider gave me the confidential Polish documents on a silver platter. But being a freelancer means making your own silver platters.

Five months after my WSJ piece, and just after the US presidential election won by George H.W. Bush, the bank approved that first loan to Poland. The New York Times reported that the bank planned to give up to $250 million to Poland the following year. But the military dictatorship in Poland effectively collapsed in mid-1989, before the World Bank could open the floodgates with subsidized loans. The inflation rate in Poland rose to 5,000 percent, destroying any pretense of rational investment by the World Bank or any other entity.

Later that year, World Bank president Barber Conable bashed my work in a New York Times piece. His article was paired with an “opposing view” piece from me that concluded: “The World Bank’s ‘have money, must lend’ syndrome will continue to be a curse to the world’s oppressed citizens … Mr. Conable should retire as soon as possible.” Conable is long gone, but, unfortunately, the World Bank lives on.

Tags: Featured,newsletter