The Federal reserve says that inequality is a problem. At the same, the Fed also pretends to have nothing to do with it. Last September, for instance, Jerome Powell bemoaned the “relative stagnation of income” for people with lower incomes in the United States, but then claimed the Fed “doesn’t have the tools” to address this issue. Instead, Powell, being the chairman of this ostensibly “independent” and “nonpolitical” central bank, called for the federal government to engage in fiscal policy efforts at income redistribution. Powell, of course, is wrong, and he probably knows he’s wrong. In any case, if the Fed were actually concerned about wealth and income inequality, the Fed would stop doing what it has done over the past decade. It would end its ultralow

Topics:

Ryan McMaken considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Federal reserve says that inequality is a problem. At the same, the Fed also pretends to have nothing to do with it.

The Federal reserve says that inequality is a problem. At the same, the Fed also pretends to have nothing to do with it.

Last September, for instance, Jerome Powell bemoaned the “relative stagnation of income” for people with lower incomes in the United States, but then claimed the Fed “doesn’t have the tools” to address this issue. Instead, Powell, being the chairman of this ostensibly “independent” and “nonpolitical” central bank, called for the federal government to engage in fiscal policy efforts at income redistribution.

Powell, of course, is wrong, and he probably knows he’s wrong. In any case, if the Fed were actually concerned about wealth and income inequality, the Fed would stop doing what it has done over the past decade. It would end its ultralow interest rate policy and quantitative easing.

These policies have been at the center of the post–Great Recession economy, in which wealthy owners of stocks and real estate become ever more fabulously wealthy, even as ordinary people face stagnating employment, low economic growth, and a rising cost of living. This only accelerated during the economic crises of 2020, when endless Fed efforts to prop up the stock market meant that financial markets soared—and with them the portfolios of the wealthy—even as unemployment rose to record levels. Even Jim Cramer could see what was happening and declared Fed policy to be a part of “one of the greatest wealth transfers in history.”

The ways that the Fed effects wealth transfers to the financial sector and the state—at the expense of everyone else—have long been the domain of Austrian school critics of central banks. That is, we’ve long noted in these pages how financial repression and so-called easy money have fueled vast riches for Wall Street, while leaving the middle classes and lower-income Americans behind.

But one need not rely on Austrian critics to get insight into the damage done by modern monetary policy.

In her new book, Engine of Inequality: The Fed and the Future of Wealth in America, Karen Petrou looks in detail at how Fed policy over the past decade—especially quantitative easing (QE) and ultralow interest rates—have benefited the wealthy while leaving most ordinary people behind.

Petrou is one of the more interesting and informative analysts examining the financial services sector. As the head of Federal Financial Analytics Inc., she has provided research on the banking sector for more than thirty years, but in recent years she’s become more focused on exposing and examining the unhealthy and destructive effects of Fed policy.

Petrou takes a different approach from the Austrians. She appears to have arrived at her conclusions from observing the trends and outcomes produced by Fed policy and then working backward into a theoretical framework. The data seems to have prompted her to ask why things have gone so badly after more than a decade of “unconventional” Fed policy. When it comes to identifying the problem, she’s come to the right conclusions.

In any case, Petrou’s book is important because it is the work of a Wall Street insider who no longer swallows the Fed’s propaganda line that the Fed’s interest rate manipulation—as Powell puts it—”supports the economy across a broad range of people.”

The reality is something different. As Petrou notes, the “perverse effect” of Fed policy has been to create “acute inequality and resulting risks to both growth and financial stability.”

The Mythical “Wealth Effect”

How did this happen?

Since the 2008 financial crisis and the Great Recession, the Federal Reserve has increasingly ratcheted up its efforts to increase liquidity and drive down interest rates. This is done as part of an effort to prop up the financial sector. It is assumed that a robust financial sector will grease the wheels of the economy overall and that the wealth in the financial sector will somehow trickle down to the rest of the economy via a theoretical “wealth effect.”

Specifically, to do this, the Fed engages in quantitative easing, in which it purchases government bonds and financial assets. These assets are placed in the Fed’s portfolio in exchange for dollars, which then flow into the financial sector. This raises the prices of financial assets while lowering yields and interest rates. It also increases the money supply.

Since the Great Recession began, the Fed has added more than $8 trillion in assets to its portfolio—which means trillions of dollars have poured into banks and nonbank financial institutions.

[Read More: “Financialization: Why the Financial Sector Now Rules the Global Economy” by Ryan McMaken]

As Petrou notes, the effect of this policy has been extremely beneficial for the wealthy. Because so much money has been injected into the financial sector, stock prices have skyrocketed, and the prices of other assets—especially real estate—have soared.

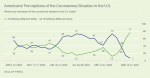

Petrou shows that if we look at the data, however, we find that this economic boon hasn’t done much for those who don’t already have robust stock market portfolios and real estate assets. That is, the lower half of the US in terms of wealth and income. In fact, from 2001 to 2016, the median wealth of Americans in the bottom 80 percent of income earners has fallen.

According to Petrou’s analysis, as stock prices and real estate prices have climbed, the economic prospects of many ordinary people have remained flat, or worse. She notes that from 2010 to 2020, employment growth was unimpressive and that during this period “Fed intervention led only to the slowest economic recovery in modern memory.” She writes:

US economic growth was at best lackluster before COVID and the “full” employment about which the Fed was wont to brag was in fact less impressive when labor-participation rates and other factors are carefully considered.

On the eve of the 2020 financial collapse, the US’s economic recovery could only be described as “fragile” and disappointing for anyone who wasn’t in the top quintiles of earnings and wealth.

Soaring prices in stocks cannot be shown to have benefited those who don’t own many stocks. Moreover, since the Great Recession, housing prices were largely flat among lower-priced homes in middle American markets. The benefits of asset price inflation in housing is felt far more in expensive coastal cities, where the wealthy own higher-priced real estate.

How Ultralow Rates Punish Ordinary Savers

In addition to asset price inflation is the problem of yield chasing, fueled by ultralow interest rates. This doesn’t just leave low- and moderate-income families behind as asset price inflation does. Ultralow interest rates actually punish ordinary, conservative savers who lack the wealth or sophistication necessary to gain the benefits of high-risk yield chasing in the markets.

Banks and hedge fund managers have access to many tools to take on higher risk and seek out the corners of the market where higher interest offers a better yield. So, ultralow interest rates still leave Wall Street a variety of options. Most ordinary families don’t have those options.

Petrou explains:

Ultra-low rates fundamentally eviscerated the ability of all but the wealthy to gain an economic toehold; instead they lead investors to drive up equity and other asset prices to achieve their return … but average Americans hold little, if any, stock or investment instruments. Instead, they save what they can in bank accounts. The rates on these have been so low for so long that these thrifty, prudent households have in fact set themselves back with each dollar they save. Pension funds are just as hard-hit meaning not only that average Americans can’t save for the future, but also that the instruments on which they count for additional security are unlikely to meet their needs.”

Moreover, as banks and other lending institutions searched for higher yields, they lost their interest in lending to regular people:

As a result [of QE], the Fed’s ultra-low rates led to the yield-chasing that propelled financial markets ever higher even as regulated financial institutions changed their business model from taking deposits and making loans to average households to one betting on stocks and offering loans and other services to wealthy households, financial markets, and giant corporations. Ultra-low rates failed to trickle down to low-, moderate-, and even middle-income households.

This is not due only to interest rate policy, however. Petrou also explains how banking regulations after the Great Recession have further driven banks away from lending to small businesses and ordinary borrowers. Federal regulation has further fueled a strengthening of megabanks, which are better able to meet regulatory benchmarks. Community banks, meanwhile—which serve smaller markets and small-time borrowers—are increasingly disappearing. Consequently, wealth continues to be centralized in Wall Street.

Petrou presents all of this information using evidence from countless quantitative studies from a variety of sources, including the Bank of International Settlements and even some member banks of the Federal Reserve System. Hundreds of footnotes enable the reader to follow these reports back to their sources and see for themselves what has happened: Fed policy has done wonders for billionaires and hedge fund managers. The data suggests others have clearly done less well.

Petrou’s book certainly has its shortcomings. The book’s monetary policy discussion doesn’t begin until chapter 5, nearly sixty pages in. Before that, the reader must slog through an overly long discussion about the evils of inequality. Petrou’s discussion on digital currency appears to be out of place, and her conclusions are not terribly convincing. And the final quarter of the book is a laundry list of recommended regulations and changes that amount to little more than tinkering with monetary policy. That is, this book is far too timid in calling for any real restraint on Fed power.

But as a resource for quantifying the results of the Fed’s unconventional monetary policy, this book is valuable indeed. There is a well-researched and well-detailed hundred-page core in this book that shows in a dozen different ways what should be regarded as undeniable at this point: the Fed is a force for impoverishment, economic stagnation, and inequality.

Tags: Featured,newsletter