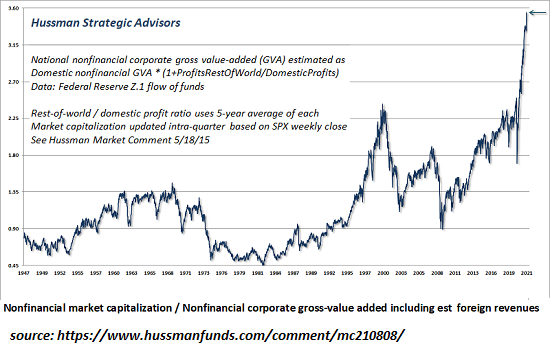

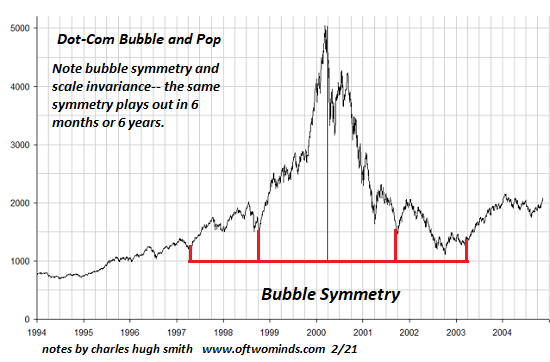

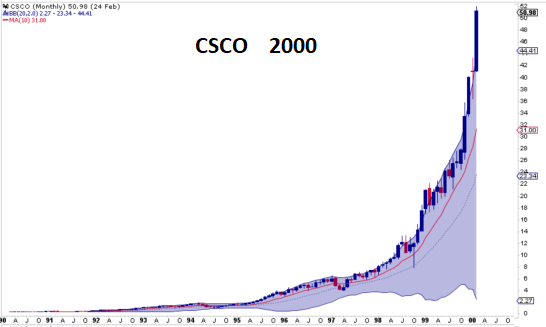

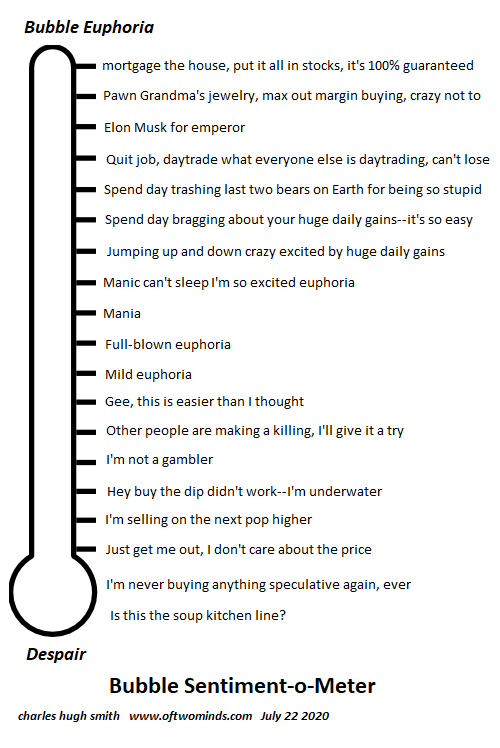

So sorry, America, but your central bank is certifiably insane, and it’s not going to magically work out. History definitively shows that speculative bubbles always pop–always. Every speculative bubble mania, regardless of its supposed uniqueness–“it’s different this time”–pops. No speculative bubble has ever “reached a permanently high plateau” and then remained on the plateau for years. So what does the Federal Reserve do? It inflates the biggest speculative bubble in modern history and then implicitly promises it will never pop. Dear Fed, are you insane? You might as well make a public pronouncement that stocks have “reached a permanently high plateau” that will be followed by a permanent ascent to ever-higher plateaus, as that is the implicit message

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

So sorry, America, but your central bank is certifiably insane, and it’s not going to magically work out. History definitively shows that speculative bubbles always pop–always. Every speculative bubble mania, regardless of its supposed uniqueness–“it’s different this time”–pops. No speculative bubble has ever “reached a permanently high plateau” and then remained on the plateau for years. So what does the Federal Reserve do? It inflates the biggest speculative bubble in modern history and then implicitly promises it will never pop. Dear Fed, are you insane? |

|

| You might as well make a public pronouncement that stocks have “reached a permanently high plateau” that will be followed by a permanent ascent to ever-higher plateaus, as that is the implicit message you’ve been sending punters and pundits.

To promise a speculative mania that never ends is insane, yet that is precisely what the Fed is doing. Nothing else matters except “the Fed has our back.” |

|

|

|

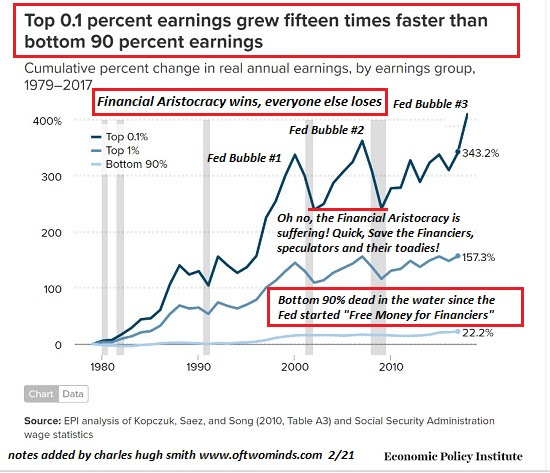

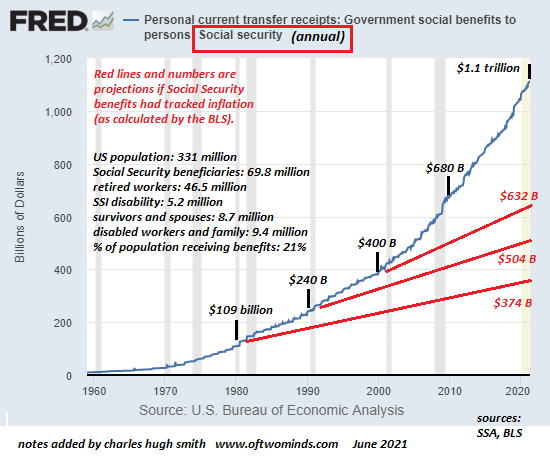

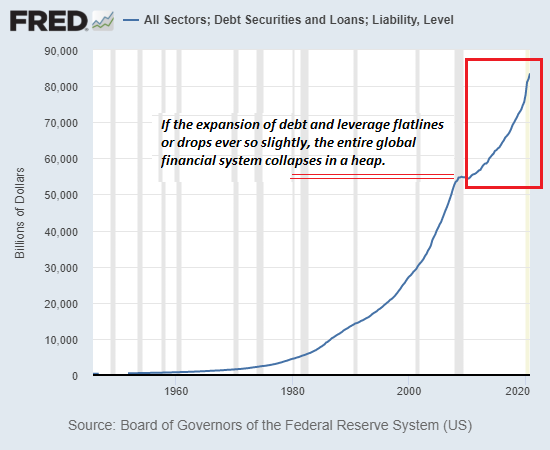

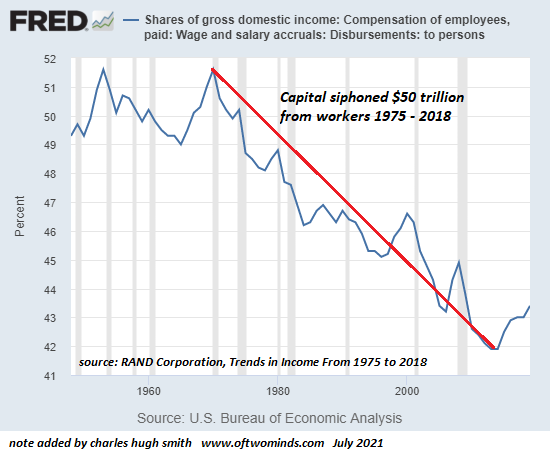

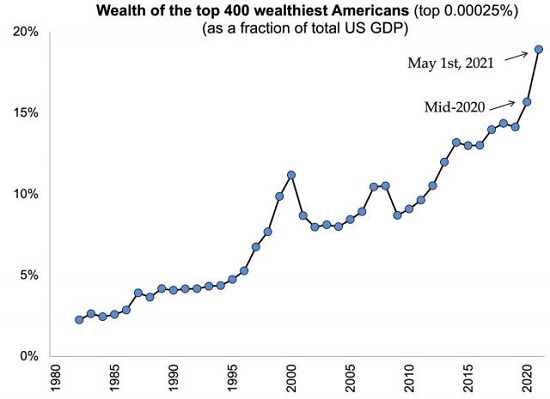

| The Fed is also effectively promising that debt, leverage and wealth/income inequality will also all ascend higher forever. Once again history moots this happy story, as soaring wealth / income / political power asymmetries that serve the interests of the few at the expense of the many inevitably generate revolution or regime collapse. |  |

|

|

|

|

| Dear Fed: is your “plan” to accelerate revolution and collapse? If so, you are insane. Has your hubris reached new extremes in la-la-land or are you so disconnected from reality that you’re closing your eyes and going to your happy place where it all magically works out without the extremes you’ve single-handedly created reverting to the mean? |  |

| So sorry, America, but your central bank is certifiably insane, and it’s not going to magically work out. The speculative bubbles in credit, leverage and assets will pop and the extremes of wealth / income / political power inequality will swing to the opposite extreme. The way of the Tao is reversal and the Fed’s supposedly godlike powers are nothing but the hubris-soaked rantings of the delusionally insane. |  |

Tags: Featured,newsletter